Published in August 24, 2021

Can You Buy a House Without a Credit Score?

Australia’s property market is hot right now, with lots of people flocking to the real estate market. But can you buy a house without a credit score? Tippla has provided you with everything you need to know below.

Buying a house in Australia

Many Australians are currently entering the property market, either to buy their first home, a new home or investment property. With household savings peaking during COVID-19, and the Australian Government providing a range of stimulus packages for the property market, many Aussies feel like now is the time to buy.

When you’re looking to buy a house, many people need to do so with the help of a mortgage – a loan that is provided by the bank or a similar financial institution. According to the Australia Bureau of Statistics (ABS), as of October 2020, the average mortgage in Australia was $453,133.

Unsurprisingly, residents of New South Wales on average have the largest mortgages on average. Following NSW is Victoria and then South Australia.

Where can you apply for a mortgage?

You might be surprised to learn that it’s not just banks that offer home loans. In Australia, there are three main types of financial institutions where you can apply for a mortgage. The first of these three, is, of course, banks.

However, you can also apply for a home loan with mutuals, otherwise known as “member-owned” lenders. These range from building societies, credit unions and member-owned banks.

Furthermore, you can also apply for mortgages with non-bank lenders, which are privately owned institutions. This type of lender is neither a bank nor mutuals, as they don’t hold a banking licence.

What do lenders consider when you apply for a mortgage?

When applying for a mortgage, financial institutions will take a number of factors into consideration. This includes your credit score, salary, length of employment, spending habits and more.

Here are some of the most common home loan requirements:

- Credit score (the higher the better);

- Deposit (at least 5%);

- A stable income;

- Personal ID, such as Driver’s Licence, Passport and similar documents;

- Stable financial position;

- Bank statements and payslips.

All of these factors and more give the institution you’re applying to a good overview of your financial situation. It allows them to judge how risky of a borrower you are, and make their decision accordingly.

Why do you need a credit score for buying a house?

Your credit score is a numerical representation of your creditworthiness, AKA, how reliable of a borrower you are. Typically, if you have a high credit score, then you are perceived to be less of a risk. Therefore, you’re more likely to be approved for finance.

Your credit score is based on your credit report. Your credit report provides an overview of your credit history. It allows lenders to see how responsible you have been with your debt.

Because of this, not having a credit score and credit report could be viewed as a red flag by lenders. It gives them one less measurement to determine how big of a risk you are.

As a result, you might be charged a higher interest rate, which can cost you in the long run, or your application could be rejected. Having a good credit score could improve your chances of being approved for a mortgage.

How to buy a house without a credit score

Whilst having a credit score, especially a good credit score, can help your home loan application, you can still get a mortgage without a credit score. There are a number of things you can do to overcome this obstacle.

However, it is worth pointing out that if you are applying for a mortgage without a credit score, you might have access to fewer loan options, only be offered loans with higher interest rates, and less desirable conditions. Furthermore, because of responsible lending standards, you might only be able to apply for a smaller loan amount.

Prove you’re in a strong financial position

One of the main focuses for lenders is checking whether potential borrowers are in a strong financial position. If you can prove that you’re in a strong financial position, then this could go a long way in helping your application.

So how can you do this? If you can show that you have a full-time stable job, a strong income, you can save money on a monthly basis, and show that you don’t have a history of dishonour fees and defaults, then these can all help your case.

Nonetheless, it is important to keep in mind that if you don’t have a credit score, then you’re starting at a disadvantage.

Here is a quick overview of some of the potential downsides of buying a house without a credit score:

- Limited choices of lenders;

- Higher interest rates;

- Smaller borrowing limit;

- Stricter loan terms and conditions.

How to build a credit history from scratch

If you’re thinking about buying a house but you don’t have a credit score, you could consider trying to build a credit history before applying for a mortgage. We’ve put together a few tips on how to build a credit history from scratch.

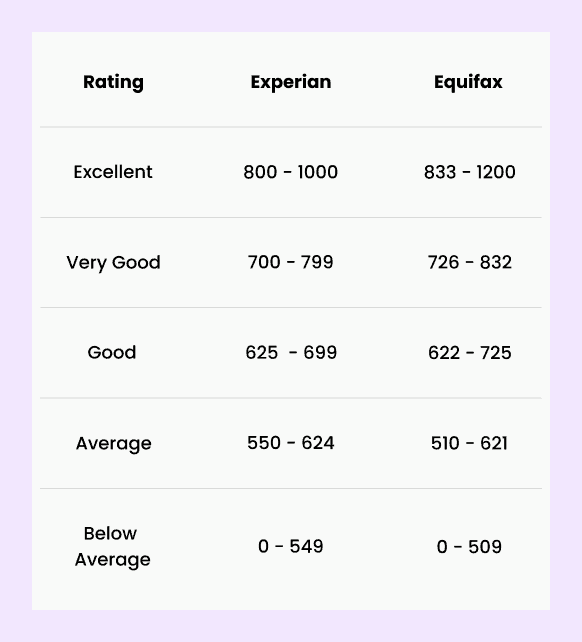

Source: Experian and Equifax

Open an Australian bank account

If you don’t already have your own bank account, then this could be a good place to start. Having a bank account could help you apply for credit later on. So whilst opening a bank account won’t immediately help you create a credit history, it is a good first step.

Bank accounts are also important when applying for finance. This allows lenders to see your spending habits and how you manage your money. If you are responsible with your spending, then this could go a long way for your application.

Add your name to your utilities

If you are living out of home and your name isn’t on your utility bills, it might be time to change that. Your utility bills are a form of credit. If your name is on the bill, then each payment you make on your bill goes towards building your credit score.

Apply for a credit card

One way you can build your credit history is by applying for a credit card. If you don’t have a credit history, your choices are more limited than if you did have a credit score. Nonetheless, there are options, as banks and financial institutions will take other factors into account.

If you are a tertiary student studying at either university, TAFE, VET or an apprenticeship, then you could be eligible for a student credit card without a credit history. However, it’s a good idea to compare your options beforehand.

If you’re not a student, there are still other options. You could, for instance, apply for a secured credit card. Similar to a secured personal loan, a secured credit card is when you have a cash deposit in your bank account that is the same amount as your credit limit. That way, it is guaranteed to be paid.

Proactively provide information to credit bureaus

If you don’t have any credit, then credit bureaus won’t have any information on you. One way you can overcome this is by reaching out to provide your information. This could be in the form of sending a document to prove your identity and address. However, it’s important to update your information when necessary – such as your address, so that you don’t end up with multiple files with different credit information.

Can I buy a house without a credit score?

To sum it all up, simply put, whilst you can buy a house without a credit score, it’s not necessarily your best option. If you don’t have a credit score, you might have access to fewer loan options. Not only that but the loans that you are offered might not be as good, as you are deemed a riskier borrower. This could mean higher interest rates, lower borrowing limit, and other fees.

While we at Tippla will always do our best to provide you with the information you need to financially thrive, it’s important to note that we’re not debt counsellors, nor do we provide financial advice. Be sure to speak to your financial services professional before making any decisions.

Related articles

Credit Scores vs Credit Reports: Understanding the Difference in Australia

23/10/2023

Understanding the nuances of credit scores and credit reports...

Can You Get a Personal Loan After Bankruptcy?

12/10/2021

There are many reasons why someone might have to...

What is a savings account?

28/07/2021

Grow your money faster with savings accounts Unlike everyday...

Subscribe to our newsletter

Stay up to date with Tippla's financial blog