Published in July 28, 2021

Has Your Credit Report Been Updated? Here’s What to Check

Every three months, your Equifax and Experian credit reports will be updated on Tippla. We’ve put together a helpful guide to allow you to understand what might have changed.

How often is your credit report updated on Tippla?

From when you log into Tippla, your Equifax and Experian credit reports will be updated on a quarterly basis (every 90 days). You will receive an email letting you know when your credit reports have been updated.

Why does it matter that your report has been updated?

What does it mean when your credit report gets updated? Generally, it can mean a couple of things – namely, your credit score might have increased or decreased since the last update. Whether your credit score goes up or down or remains the same, will depend on your credit activity.

Why is this important? We recently put together an informative article on why your credit score matters. To sum it up – your credit score could be the difference between you being accepted or rejected for a loan or other types of credit.

Furthermore, every time your credit report updates, it gives you the opportunity to check all of the information on your credit reports is accurate. This is important for several reasons, below we’ve listed just a few:

- New information can help you understand what goes onto your credit report and what affects your credit score;

- You can identify any mistakes in your report. If you spot a mistake early on, you can have it removed quickly and limit the damage to your credit score and credit applications;

- You can detect if you’ve been a victim of identity theft early on.

What changes can I expect on my credit report?

You’ve just received an email from Tippla that your credit report has been updated. But what changes should you be looking out for?

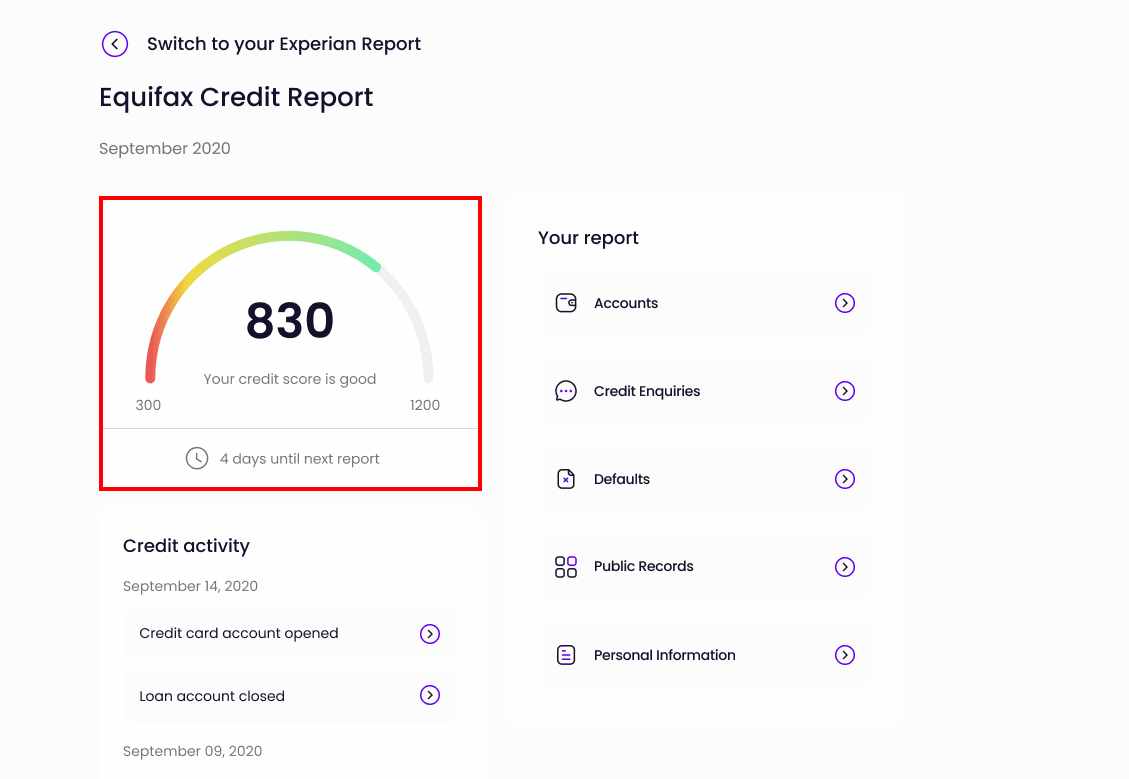

1. Your credit score

When your credit report is updated, new information might be added to your report, or older information might expire and be removed from your report. Because of this, your credit score can change when your report is updated.

When you get a notification from Tippla that your credit reports have been updated, log into your Tippla account, and check whether your credit score has changed. You can see your credit scores straight away when you log into your Tippla account.

Your credit score can either increase, decrease or stay the same. If you previously didn’t have a credit score, but you have since taken on some form of credit, then you might find that you now have a credit score.

My credit score has dropped, what can I do?

If you log into your Tippla account and discover that your credit score has dropped, you might be wondering what went wrong. There are a number of things that can lower your credit score:

- When you apply for a loan or type of credit, the company you’ve applied to will check your credit report. This is referred to as a hard enquiry and it lowers your credit score;

- Have you recently defaulted on one of your credit repayments? This can harm your credit score;

- Have you recently entered into bankruptcy or made any serious credit infringements? This can harm your credit score.

For a full breakdown of what affects your credit score, check out Tippla’s article here. You can also find a helpful guide on how to improve your credit score on our financial blog.

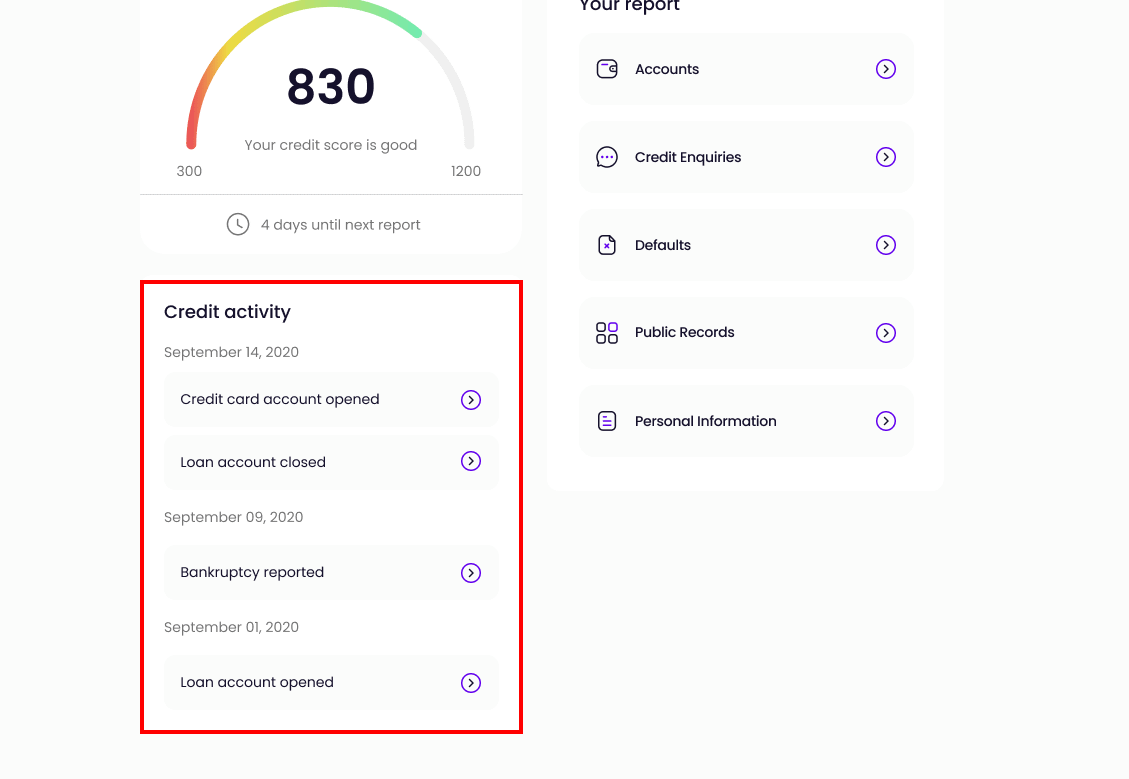

2. New credit activity and accounts

When your credit report is updated, your credit activity will also be updated, if applicable. If you have taken on a new line of credit, such as a credit card or personal loan, then this will appear in your credit activity.

If you have closed any accounts, such as you’ve repaid a loan, or you have cancelled your credit card, these accounts will still remain on your credit report for two years, however, the status of these accounts will be changed to ‘closed’. After two years, these closed accounts will be removed from your report.

Below, we have highlighted where you can find your credit activity on Tippla.

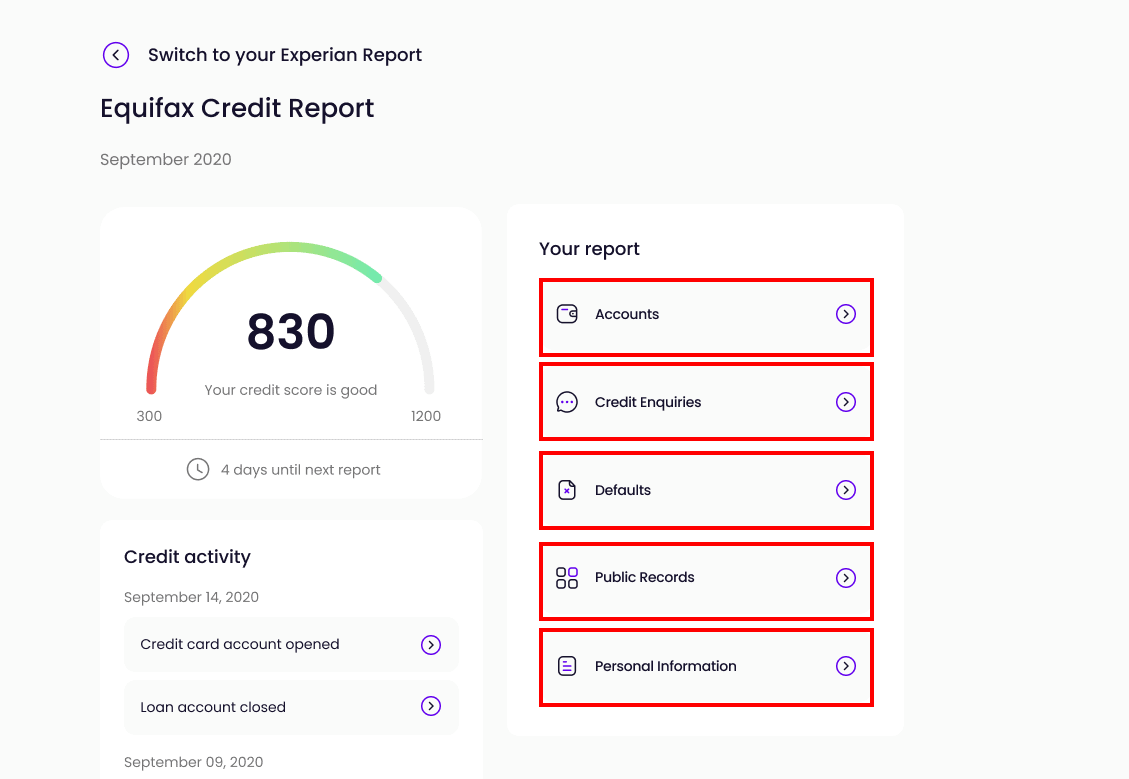

3. New credit enquiries

If you have made any new credit enquiries – ie. applied for a loan or credit card, as an example, then these will also appear on your credit report. Credit enquiries will appear on your report regardless of whether you were approved for the loan.

4. Negative entries

Negative entries are events on your credit report which will lower your credit score. “Negative entry” refers to any negative financial behaviour that indicates that you haven’t effectively managed your debt.

Examples of negative entries include:

- Late payments on loans or credit cards;

- Delinquent accounts;

- Charge offs;

- Bankruptcies;

- Accounts that have been sent to collection;

- Foreclosures.

When your credit report updates, if any of the above is applicable to you, say you were late with a loan repayment or you have entered into bankruptcy, then this will appear in your updated credit report.

4. Personal information

When your credit report is updated, your personal information can also be changed. If you have moved to a new place, recently changed your name, or changed your employment, and you’ve let a lender or credit provider know, then your personal information could change.

It’s important to keep your personal information up to date and ensure it’s accurate. Having inaccurate personal information on your credit report can lead to multiple credit files in your name.

On Tippla, you can check for new credit accounts, enquiries, public records, court judgements and your personal information here:

Related articles

When Do Banks Do a Credit Check For Personal Loans?

19/10/2021

If you’re in the market for a personal loan,...

Understanding Chattel Mortgages: A Guide for Australian Business Owners

29/10/2024

When running a business, it’s common for owners to...

How to Reduce the Interest on Your Home Loan

29/07/2021

When you take out a loan, you’re not only...

Subscribe to our newsletter

Stay up to date with Tippla's financial blog