Published in August 18, 2023

Why do credit checks lower a credit score?

No clue about credit enquiries? Join the club

If you’re wondering why do credit checks lower credit scores, you’re not alone.

According to a survey conducted by Finder in 2022, a large portion of Australians, about 73%, which is equivalent to around 14.6 million people, are unaware of their credit scores.

Also according to Finder, the survey also found that about 48% have never taken the step to check their credit scores. Additionally, 7% feel too apprehensive to do so, while 6% are unfamiliar with the concept of a credit score.

At a time when worries about personal information security are at their peak following the Optus data breach, Australians are being advised to pay attention to signs such as an unexpected decrease in their credit score or credit applications being declined. These indicators could suggest that their personal data has been compromised. However, according to the research, almost 3 out of 4 Australians remain unaware of their own credit scores.

Does checking your credit score hurt your file?

No! Checking your own credit score will not hurt your credit file or credit score. It’s a common misconception that checking your credit score will have a negative impact, but this is not the case.

When you personally check your credit score, it’s considered a “soft” inquiry, which does not affect your credit score. Soft inquiries provide an overview of your financial status and are not visible to potential lenders. However, if third parties like lenders conduct credit checks as part of a loan application, it could result in a “hard” inquiry, which may leave a minor impact on your credit file. This distinction is important in understanding why credit checks don’t typically lower your credit score when done by you.

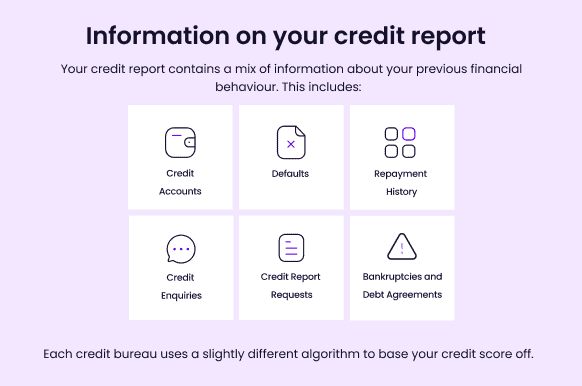

What is a credit score made up of?

Several factors make up your credit score, each weighted differently depending on their significance. To put it simply, your credit score is calculated using the information on your credit report.

The next step in getting to know your credit score is uncovering what makes it tick. The key to maintaining a healthy credit score is understanding how different financial decisions impact your score.

Here’s what information goes onto your credit report:

Take a look at the 5 factors that affect your credit score:

Bill payment history

Weighing in at number 1 is bill payment history. The quality of your payment history determines 35% of your credit score. So, what does it mean to have a pristine payment history? Mostly, it’s the little stuff. Such as paying bills on time and making timely repayments on credit cards and loans. The biggest favour you can do your credit score is making your payments on time each month. It’s a win-win – avoid nasty late fees and keep your credit score fresh! Your future self will probably thank you.

Amount of debt

Debt level attributes to 30% of your credit score. Credit score agencies, such as Equifax and Experian, analyse particular factors of your debt to calculate your credit score. These include, but are not limited to, your total debt amount, the ratio of credit card balances to your credit limit (also known as credit utilisation) and the correlation of a loan balance to the original loan amount.

As a general rule, it’s good practice to maintain credit utilisation at 30% or less. In other words, only charge up to 30% of any available credit on your card. Much like bill payment history, losing control of debt can significantly damage your credit score. The good news? It works both ways. If you work to pay off your debt, you can drastically improve the health of your score. What a bonus!

The age of your credit history

When it comes to credit checks, age matters. The age of your credit history accounts for 15% of your credit score. Age demonstrates experience. Therefore, the older your credit history, the stronger your credit score. Don’t shy away from the odd wrinkle or frown line, as it highlights how you handle credit. Opening and closing accounts can alter your average credit age, so keep accounts open, even if you no longer use them – provided they’re paid for, of course.

Diversity of history

Age without diversity holds little purpose. So, while your credit history ages, it’s important to remember to diversify your credit. Your credit history should show two basic types of credit accounts: revolving accounts and instalment loans. A revolving account is an account that can incur debt where the borrower is not obligated to repay the outstanding balance each month. An instalment loan is a loan that you must repay over a set period, such as a car loan or mortgage.

To really hit peak diversity on your credit file, you could take out different loans for a variety of assets, such as a car or a home, as well as credit cards and personal loans. Credit diversity only accounts for 10% of your score, so it’s more beneficial to focus on bill payments and to repay lingering debt.

Number of credit inquiries

Credit enquiries make up 10% of your credit score. Conducting your own credit check won’t reflect negatively on your credit score. However, if you submit a loan application, you will incur an enquiry on your credit report. This enquiry simply demonstrates that you’ve made a credit-based application.

The average Australian will typically have a few credit enquiries on their report – it’s expected, especially given how we all shop around to find the best possible rates and offers. However, several enquiries, especially during a short period, will negatively impact the health of your score. So, keep that in mind when you’re looking to borrow money, or take out a new credit card.

Hard enquiries vs soft enquiries

Your credit score contains a variety of intricacies and different types of enquiries have varying levels of impact. Credit enquiries are classified into two categories; hard enquiries and soft enquiries. The critical difference is that a soft enquiry does not negatively affect your credit score health; however, a hard enquiry certainly will. For example, if you decide to take out a personal loan the lender will conduct a credit check, leaving a hard enquiry on your credit report.

As an individual, you may not be penalised for conducting your own ‘credit check’. Submitting a request to review your credit score registers as a soft enquiry and has no effect on your score. Soft enquiries are only visible to you on your personal credit report. It’s perfectly normal to see several soft enquiries on your credit report. In fact, it’s good to become familiar with the notes on your report so you can see what does and doesn’t affect your credit score.

When we venture into hard enquiries, things become a little more grey. A hard enquiry will occur when you authorise a third party, such as a lender or credit card issuer, to review your credit report. The penalty for a hard enquiry varies, however, according to FICO you may only incur a 5 to 10 point drop per enquiry. Even though hard enquiries are pinned to your credit report for 2 years, they may only impact your score for a few months.

Examples of hard vs soft enquiries

The essential difference between a hard and soft enquiry lies in whether you give the lender permission to check your credit. To help you identify hard and soft enquiries on your credit report, here are a few examples.

Common hard enquiries

- Mortgage applications

- Car loan applications

- Credit card applications

- Student loan applications

- Personal loan applications

- Apartment rental applications

Common soft enquiries

- Checking your credit score with Tippla!

- ‘Pre-qualified’ credit card offers

- ‘Pre-qualified’ insurance quotes

- Employment verification (e.g. background check)

Other types of credit checks may be classified as either a hard or soft enquiry, including an insurance company enquiry, or a credit check conducted by your cable or internet providers.

Why do credit checks lower credit scores?

So why do credit checks lower credit scores? When you apply for finance, it is signalling to potential lenders and credit providers that you’re in need of finance. Whilst a single application shouldn’t do too much harm to your credit rating, multiple hard enquiries on your report can do some real damage. Why is this? Because it indicated to credit providers that you are in financial distress and desperately trying to get extra finance. This is the message it sends to lenders regardless of whether it’s the truth.

If you have too many credit applications on your report in close succession, this could also lead to lenders rejecting your loan application, which could further harm your score. That’s why it’s a good idea to space out your credit applications, so lenders and credit providers don’t get the impression that you’re in a bad financial situation.

How to minimise the impact of hard enquiries

Borrowing money for that first family home, or your dream car is a part of life. Don’t shy away from applying for finance you need just to avoid a hard enquiry on your credit report. There are a few ways you could minimise the impact of hard enquiries.

Firstly, don’t let the fear of a hard enquiry stop you from browsing interest rates when shopping for a home or car loan. Some credit score providers, such as FICO, allow for a 30-day cooling-off period before specific loan enquiries are reflected on your credit score. Credit providers may also combine similar loan enquiries into a single enquiry on your credit report. This will lessen its effect on your score, as long as they were made within a certain window.

So, when hunting down the best loan, don’t settle for the first one you see. Set a designated window to shop without the worry of it severely affecting your credit score.

Now you know the answer to “why do credit checks lower credit scores”, and you have the tools to limit the damage, you can go forth and use this information for the good of your credit rating.

What is a bad credit score?

A credit score demonstrates to lenders your ability to repay your loan and can also reveal the likelihood of incurring an adverse event in the following months. A bad credit score is typically anything below 509.

An Equifax or Experian score is the most common way to measure your credit score. The score ranges from 0 to 1200, 0 being the worst and 1200 is perfect. So, you’ve requested your credit score, and now you have your number, but what does it actually mean? Good question. Below is a handy breakdown of what your score indicates:

| Score | What it means |

| Below average to average (0-509) | It’s more likely that you may incur an adverse event, such as a default, bankruptcy or court judgement in the following 12 months |

| Average (510-621) | You may likely incur an adverse event, such as a default, bankruptcy or court judgement in the following 12 months |

| Good (622-725) | It’s less likely that you may incur an adverse event that could damage your credit file in the following 12 months |

| Very good (726-832) | It’s unlikely that you may incur an adverse event that could damage your credit file in the following 12 months |

| Excellent (833-1200) | It’s highly unlikely that you could incur an adverse event that could damage your credit file in the following 12 months |

Can I check my credit score for free?

By jumping online and submitting a few details, you can generally check your credit score for free. There is a myriad of sites that will deliver a bog-standard credit score calculation from a single credit reporting agency.

Credit scores are vital for understanding your overall financial health and assessing your suitability for credit approval. So, we think you deserve the big picture, not just a single frame. We believe it’s time you meet Tippla.

Meet Tippla

Do you want to check, monitor and improve your credit score? What if we said it didn’t have to cost you anything? That’s what you get when you sign up to Tippla!

If you want access to more resources similar to this article “why do credit checks lower credit scores”, then Tippla is just the place for you!

Sign up to Tippla and let us help you reach your financial goals with our smart monitoring and insights. We compare your score from multiple reporting agencies to give you the best understanding of your credit.

Tippla – for smarter credit checks.

While we at Tippla will always do our best to provide you with the information you need to financially thrive, it’s important to note that we’re not debt counsellors, nor do we provide financial advice. Be sure to speak to your financial services professional before making any decisions.

Related articles

Understanding the Impact of Utility Debts on Your Credit Score

30/01/2024

In Australia, understanding the factors that influence your credit...

Does renters insurance cover power surge damage

29/07/2021

Covering power surge damage Insurance providers either reimburse or...

Understanding Superannuation in Australia

01/10/2024

Superannuation, commonly known as “super,” is a crucial element...

Should I get a student bank account?

28/07/2021

Student bank accounts are essentially the same as any...

Subscribe to our newsletter

Stay up to date with Tippla's financial blog