Published in July 26, 2021

5 Achievable Credit Score Goals for 2021

We’re all about setting realistic credit score goals. We’ve compiled a list of achievable credit score goals to help you improve your credit score and enter the New Year on the right footing.

2021 is just around the corner. We are so close to officially saying goodbye to 2020 and hello to a new year, which will hopefully be a lot better than this year (we’ve set a low bar, we know)!

One way we can make next year better than the last, regardless of COVID-19, is by getting on top of our credit score and working to improve our rating. Although it will take time and effort on your part, it’s actually a lot easier than you think!

But what if you’re not a goal setter? Or do you find it hard to stick to goals? We’ve all been there. We get a surge of motivation and create these grand plans to change our life. Whether it’s actually going to the gym more, eating healthier, or cutting back on expenses – whatever it is, in the moment it feels totally achievable. But then reality sets in, we lose our motivation, and we find ourselves falling back into our bad habits. So how can we actually set achievable credit score goals?

Setting SMART credit score goals

If this has been you, you’re definitely not alone. The goal is admirable, but it falls apart at the execution. So what’s going to be different this time around? We’re going to be SMART about it.

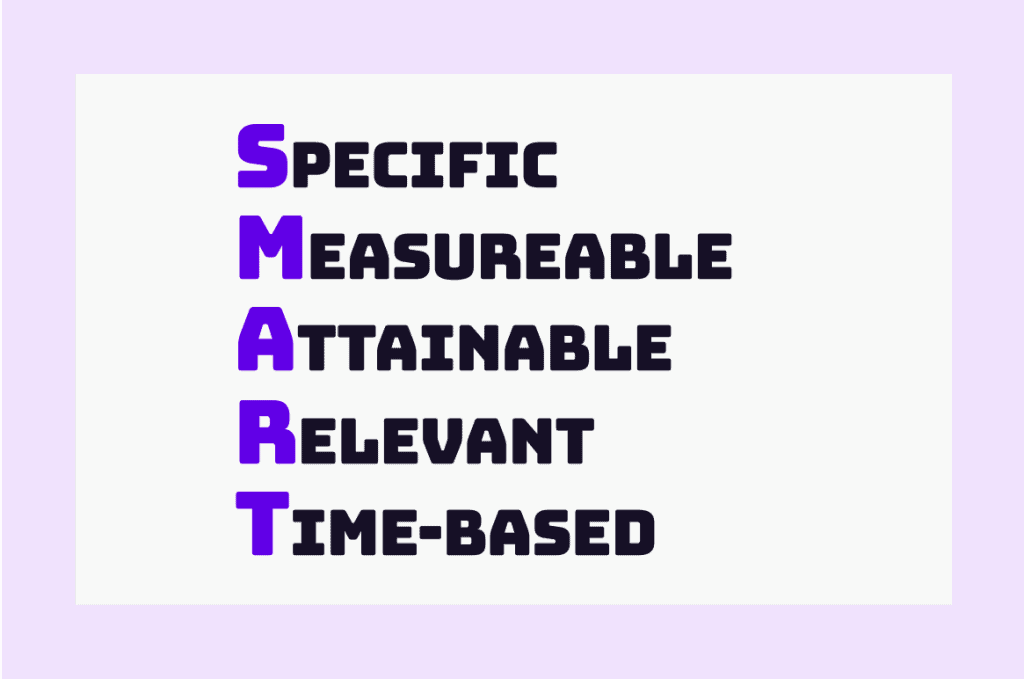

By SMART, we don’t just mean setting intelligent goals but setting goals that are clear and tangible. Specifically, SMART stands for:

Look at it like this – “getting rich” is not easy to achieve. “Having $500,000 on my savings account by the time I’m 50” sounds more tangible but still makes it hard to know what to do. A SMART goal would be something frequent and time-restricted such as “saving $1,000 each month”. This type of goal gives you a direction of what to do and an appropriate time frame you can work with.

Setting arbitrary goals such as “I want to go to the gym more” or “I want to eat less junk food”, whilst well-intentioned, are arbitrary goals. This makes them hard to commit to and you may struggle to feel a sense of achievement. The more specific your goals are, the easier it is to measure your success and to keep yourself motivated and accountable.

It’s also easier to break down your ultimate goal. In this case, your ultimate goal is to improve your credit score. But that doesn’t just happen on its own. So you can create multiple SMART credit score goals that will help you reach your ultimate goal.

With this in mind, what are some SMART credit score goals you can set?

Check your credit score on a regular basis

Let’s start off with an easily achievable goal – checking your credit score on a regular basis. On Tippla, your credit scores update on a quarterly basis. This means every three months your credit score might rise or fall. If you have opened new credit accounts during this period, then these will appear on your credit report, and any adverse or positive credit behaviour will be shown on your report and reflected in your rating.

As we highlighted in a recent article, checking your credit score frequently will help you see exactly what influences your score – both good and bad. If you see your credit scores drop, then you could take steps to rectify the situation in a swift manner, reducing the duration of the impact on your rating.

Look out for mistakes

Not only that but if you check your credit score, you’re more likely to catch any mistakes on your report early. 1 in 5 credit reports have some kind of mistake on them. Wrongly listed information could cost you valuable points. That’s why it’s important to check your information frequently to catch mistakes early on.

So how could you make this a SMART goal? Instead of just saying, “I’m going to look at my credit score whenever I remember”, you could instead clearly outline your goal. An example of this could be: throughout 2021, starting from the 1st of January, “I am going to check my credit score every quarter as my report updates”. Now that’s some credit score goals!

To make sure you stay on track, you can put alerts on your calendar, phone, or find some way to remind yourself of your goal (post-it notes throughout the house also work!). You’ll be able to measure your progress based on whether you have checked your credit score and report in March, June, September and December, as an example.

Implement a budget

If you’re like us, then you’ve probably tried to set a budget numerous times. Whilst you started off strong, once the motivation wore out, you strayed from your budget more and more until you were back to your bad habits (snacks are life).

Unfortunately, it’s often the little things that add up. Ask yourself, do you know what you spend your money on? You may be getting $80 worth of snacks every month without even noticing (we’re guilty of this!)

This is where a budget comes in handy, as it helps you dictate where your money should go instead of spending without thinking. Specifically, a budget can help you reach your financial goals, ensure you have enough money to pay your bills, keep track of your debt repayments, and help you save money for your future self.

What is a budget?

So, what is a budget? A budget is a plan for your finances that spans across a defined period of time such as weekly, monthly, or even yearly. Your budget takes into account your incoming and outgoing expenses.

Your incoming funds can range from your salary, interest from investments, money from your side hustle, or any other way that you make money. Your outgoing expenses is what you spend money on, which can be divided into three separate categories – fixed expenses, variable costs, and savings. Assets, liabilities, and a range of other things can also be included in your budget, depending on how detailed you want to get.

Making your budget SMART

How can you actually stick to your budget and make it into a SMART goal? Firstly, you need to have a defined goal for your budget. Do you want to save a certain amount of money, reduce your spending in one area, such as cutting back the number of coffees you buy each week, or build an emergency fund?

All of these are great reasons, and there’s plenty of other ones out there. Once you know why you are setting a budget and what you want to achieve, then it’s much easier to stick to. Remember your goal needs to be specific. So maybe your ultimate goal is to have an emergency fund of $1,000, then your SMART goal is to set aside $100 each week after paying off all your fixed expenses. This budget would then last for 10 weeks, and at the end, if you stick to it, you’ll have met your goal!

Limit your hard enquiries

When it comes to your credit report, there are two types of enquiries made – soft and hard. A soft enquiry does not impact your credit score and generally occurs when you check your own credit score or when a promotional credit offer is provided to you.

Hard enquiries, on the other hand, are done when you apply for some form of credit, such as a loan or credit card. Your chosen credit provider will take a look at your application and, in order to assess how risky of a borrower you are, will look at your credit score.

Therefore, a hard enquiry on your credit report indicates that you have recently applied for credit. They serve as a timeline to show when you’ve applied for credit and could stay on your report for two years. Typically, however, they only affect your credit score for one year.

If you have multiple hard enquiries on your credit report in quick succession, then a potential lender or credit provider might think you’re in a bad financial situation in desperate need for finance, regardless of whether this is the case. This could lead to them rejecting your application, as they might feel you’re too risky of a borrower. This is why it’s important to limit your hard enquiries.

Keep old accounts open

Another goal you could have for 2021 to help your credit score is keeping your credit accounts open, even if you’re not using them. This is because accounts that have been open for longer may have a higher weight because they showcase your credit behaviour over a more significant period of time.

It seems contradictory at first to keep too many open credit accounts. However, the age of an account can contribute positively to your credit score. Paying your credit bills of a specific account consistently showcases that you have been capable of dealing with this credit account for a long time already – a good indication for a future credit provider that you are likely to handle credit well.

Not only is this goal quite easy to achieve, but it could be beneficial for your credit score. This is a win-win situation for us!

Develop good credit habits

One goal that could be super beneficial for your credit score is to develop good credit habits. However, this isn’t a SMART goal, as it doesn’t meet the criteria. In order to maximise your success, let’s break this down a bit.

Firstly, let’s go over what some good credit habits could be. There are so many things you could do that could be beneficial for your credit score, such as paying your bills on time, only taking on credit you can afford, budgeting, spacing out your credit applications and more.

So now we have a list of ideas, how can these be made into SMART goals? Perhaps instead of selecting “paying your bills on time”, your goal could be to know what all your outgoing fixed expenses are – such as rent, groceries, utilities, etc, and knowing exactly how much you need to cover these expenses.

Say your total fixed expenses total $600 a week, as an example, your SMART goal could be: when you get paid, make sure $600 is set aside each week to go towards these costs. Alternatively, you could set yourself a goal to automate all of your payments or change them all to direct debits, on top of ensuring you have enough money in your account each week.

Be SMART in 2021, set achievable credit score goals

There are a number of things you can do to start 2021 off on the right footing when it comes to your credit score. You could try and set SMART achievable credit score goals, such as creating a budget, checking your credit report every 3 months, keep old credit accounts open, and develop healthy credit habits.

All of these and more could be just what you need to make 2021 your year (surely it can’t be worse than 2020 – right?). So, what are you waiting for? Sign up to Tippla and take control of your financial situation and set achievable credit score goals!

While we at Tippla will always do our best to provide you with the information you need to financially thrive, it’s important to note that we’re not debt counsellors, nor do we provide financial advice. Be sure to speak to your financial services professional before making any decisions.

Related articles

6 Ways To Enhance Your Property’s Valuation

29/10/2024

Every property owner should strive to improve their commercial...

How To Reduce The Interest On Your Personal Loan

19/10/2021

A lot of people don’t realise just how much...

The Dos And Don’ts Of Credit: Protect Your Credit Score

12/09/2024

Taking out credit, whether it be a credit card,...

Subscribe to our newsletter

Stay up to date with Tippla's financial blog