Published in July 29, 2021

The Five Biggest Factors That Affect Your Credit

Want to know what are the biggest factors that affect credit scores? We’ve provided an easy breakdown below.

Credit scores – you might want to improve yours. Why? Because with a good credit score, we’re not only able to borrow more but we generally will get better interest rates.

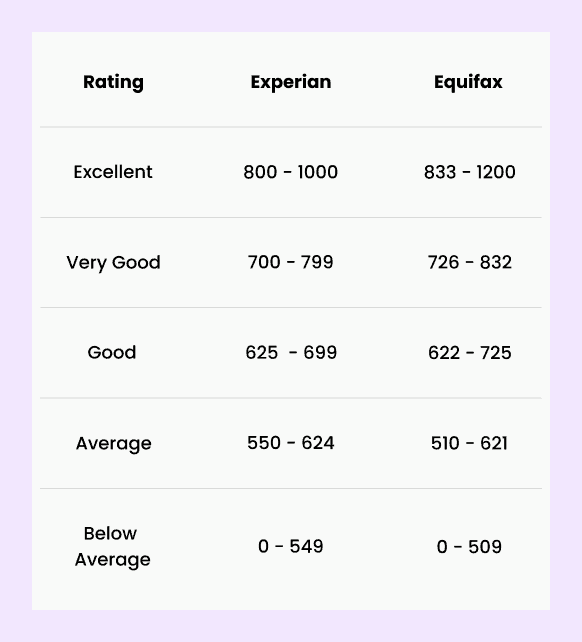

What is a good credit score? Here’s how Equifax and Experian categorise their credit scores:

Source: Experian and Equifax

Few of us can go through life without using credit at some point, so it always makes financial sense for us to improve our credit score wherever possible. But where do you start?

A number of elements affect your credit score, but there are five things that credit reporting agencies will take into account the most. These include your bill payment history, your level of debt, your credit history age, the number of enquiries that have been made on your account, and the types of credit on your report. So, let’s jump in and take a closer look at these factors in greater detail.

1. Payment history

How well do you manage your finances? A lender can get a pretty good idea just by looking at your payment history. If you think about it from their perspective, someone regularly paying their bills is a good indication of whether they could handle future loan repayments.

If you have a credit account, it will be in your payment history. This includes credit lines, personal loans, and mortgages. Recurring payments like apartment rentals, electricity bills, or office maintenance aren’t typically recorded on your payment history. Yet, when you fail to pay those bills and they are turned over to collection agencies – this will usually be recorded, hurting your credit rating.

Late repayments

Even the best of us forget to make a payment from time to time. A one-off missed payment might not mean much in the grand scheme of things. Yet, a lot of overdue payments will definitely be a red flag for potential lenders. Your payment history is a potent number: It makes around 35% of your credit score. So, fail to keep on top of your debts and your rating will definitely suffer the consequences.

If you’re wondering how much a late payment might have cost you, the effect a late payment has on credit rating depends on a number of factors:

- How late did you make a payment? A late payment that was unpaid for months is considered worse than one that is repaid within 30 days.

- Number of late payments that you made

- How much do you owe?

- How long has it been since you last had a late payment? Years-old late payments are less concerning to credit agencies than recent issues.

Late payments can be reported to the credit reporting agencies after 30 days. In practice, this is often left to much later, so you might have gotten away with it if you’ve forgotten a bill here or there.

Positive credit reporting

New rules introduced in July 2018 mean that some of your good financial habits may also be reported to credit agencies now. So, there are even more incentives to keep up with your good financial habits!

2. Debt level

Feel like you’re running a lot of debt? You’re not alone. Australians have one of the highest debt-to-income levels in the world. Debt plays a big part in modern life. It not only affects our ability to spend but with the amount of debt we have making up around 30% of our personal credit score, it also controls how much we’re able to borrow. These are some things to keep in mind when it comes to managing how your debt levels impact your credit score:

Credit utilisation

Credit utilisation is the ratio of how much credit you have against how much money you borrowed. You might have a high credit limit, but if your utilisation of that credit is high, your credit score suffers.

Things get particularly bad when you over-utilise credit by maxing out a credit card or going over the limit. On the flip side, paying off a loan early will lower your credit utilisation and improve your credit score.

Debt-to-income ratio

Another factor to consider is how much debt you have in comparison to your income. While this doesn’t typically affect your official credit score, banks and lending establishments will certainly take it into account when considering whether to offer you a loan. Again, high levels of debt will affect your ability to borrow more. So make sure you’re not overdoing it!

3. Credit history age

Credit rating agencies only have a few figures to work with when calculating whether you are a credit risk or not. The longer you’ve held good credit, the more likely it is that you’re able to handle it sensibly.

As a result, it can sometimes make financial sense to keep an account alive but dormant even if you don’t use it. It’ll remain on your credit report as an example of how many years you’ve been able to keep your credit in good standing. It pays to check whether there are any dormant account fees though, as this might end up only adding to your troubles down the line.

4. Number of inquiries on the report

One of the biggest factors that affect credit scores is an interesting one – the number of hard enquires you have on your account. Credit enquiries can remain on a report for two years. However, it is the most recent credit enquiries that can temporarily cause your score to drop.

Every time you apply for credit, you’re essentially saying that you don’t have enough money for something you want to buy. Everyone’s in the same boat, but if you make too many of these enquiries in short succession, it can signal to the lending agencies that you’re in some kind of financial bind. This causes them to lower your credit score.

This system is also used to help mitigate the potential problem of someone applying for a lot of credit from multiple lenders at the same time.

You’re savvy if you get quotes from multiple providers. But if you like to shop around for deals you should be particularly wary that multiple enquiries could mess up your credit score for up to a year.

Soft enquiries vs. hard enquiries

It’s important to note that not all enquiries into your credit report have the same impact on your actual score. There are two types of enquiries a lender can perform on your credit – a soft enquiry and a hard enquiry.

A soft enquiry is used to get a high-level idea of your financial status. So, while they can be on your credit file, they won’t affect your credit rating.

A hard enquiry, on the other hand, is when a lender pulls your complete credit report. Such enquiries will definitely reflect in your credit report. So, it’s best you avoid hard enquiries where you think a lender might reject your application. After all, a long list of rejections doesn’t look too great on a credit report either.

5. Types of credit on the report

Having a number of different types of credit can positively affect your credit score. It has a small positive effect because it shows you are capable of managing a number of different credit accounts.

This is more of a factor when you’re just starting out financially and looking to build credit. A completely clear credit report that doesn’t show any kind of credit activity makes us a bit of an unknown to lenders, which represents a bigger risk to them. They are unlikely to offer us a large amount of credit. Opening a few different lines of credit and managing them efficiently improves a credit score quickly.

Key takeaways

In a nutshell, the biggest factors that affect credit scores include the most are your current debt levels and your bill payment history. How long you’ve held credit, the number of different types of financial products you’ve used, and the number of recent inquiries on your report also play a smaller role in determining your credit score and how much you’re able to borrow.

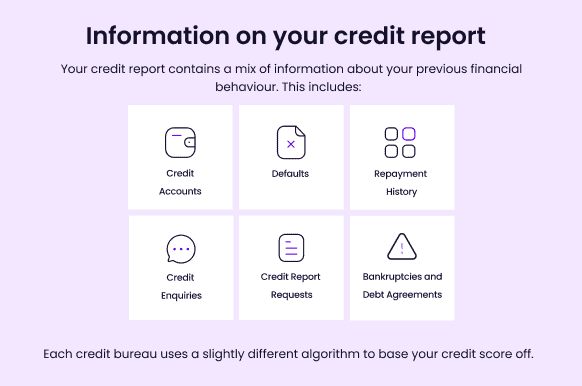

Nonetheless, it’s important to pay attention to all the information on your credit report. Here’s a breakdown:

Tippla, for smarter credit checks

Looking to get the most out of your credit score? What if we said it didn’t have to cost you anything? That’s what you get when you sign up to Tippla!

Sign up to Tippla and let us help you reach your financial goals with our smart monitoring and insights. We compare your score from multiple reporting agencies to give you the best understanding of your credit.

Get your financial well being on track, sign up to Tippla today.

While we at Tippla will always do our best to provide you with the information you need to financially thrive, it’s important to note that we’re not debt counsellors, nor do we provide financial advice. Be sure to speak to your financial services professional before making any decisions.

Related articles

Relationships And Money: When Should I Ask My Partner About Their Credit Score?

29/07/2021

Money talk: Why the question “should I ask my...

Credit Scores and Financial Planning: Leveraging Good Credit for a Secure Future

26/09/2023

Credit scores have a big impact on our financial...

Subscribe to our newsletter

Stay up to date with Tippla's financial blog

WARNING: Do you really need a loan today?*

WARNING: Do you really need a loan today?*