Published in October 19, 2021

Common Mistakes on Your Credit Report That Could Be Hurting Your Credit Score

Did you know that mistakes are common on your credit report? We’ve put together this helpful guide to outline the top 3 most common mistakes.

Your credit report is an important document that holds your recent credit history. However, mistakes in your credit report can be quite common. Oftentimes, these mistakes can harm your credit score. Today, we’re going to take you through the 2 most common mistakes on your credit report so you can protect your credit score.

Why is your credit report important?

Your credit report is an overview of your recent credit history. The information on your credit report ranges from the types of credit accounts you have (loans, credit cards, utilities, etc), any credit enquiries you’ve made in the past 5 years, repayment history, personal information and more.

When you apply for any type of credit, such as a loan or credit card, the company you have applied with will typically check your credit report and credit score to get an idea of your creditworthiness (how reliable of a borrower you are).

Whilst your credit report isn’t the only thing they’ll check, it is an important piece of the puzzle. Therefore, your credit report and your credit score can be the difference between you being accepted or rejected for a loan.

Why do mistakes on your credit report matter?

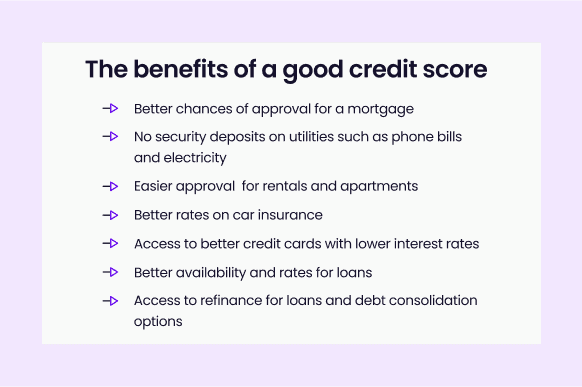

Your credit score is calculated based on the information contained within your credit report. We’ve already mentioned above why your credit report and score matter – but here’s a quick recap of the benefits of a good credit score.

Mistakes on your credit report can harm your credit score. According to Chinelle Wardle, the Director of Wardle Consultancy Services Pty Ltd, mistakes on your credit report can lower your credit score by more than 100 points, depending on the error.

Why are there mistakes on your credit report?

There are two main reasons why there might be a mistake on your credit report – consumer error or creditor error. Let’s take a look at both of these.

1. Consumer error

When you apply for credit, you will need to fill out your personal details on the application. Sometimes people will make mistakes on the application, and regardless of whether the application is accepted or rejected, this incorrect information is reported to the credit bureaus and placed onto your credit report.

If you already have a credit report, and you accidentally provide a creditor with incorrect information, or you make a fresh application with a new address (and you haven’t updated your address with your existing credit providers) the credit bureaus might assume you are a different person, and a new credit report will be made for you.

This can harm your score, because not all of your information is in the same place, and your positive behaviour might not be appearing on one of your credit reports. That’s why it’s important to make sure all of your details are correct when you apply for credit, and that you update your address with your existing credit providers when you move house.

2. Creditor error

Creditors can also make mistakes, which can end up on your credit report. They might input your details incorrectly when they receive your credit application. Or, if you approved for credit, they might record the wrong information. This incorrect data is then passed onto the credit bureaus and can end up on your credit report.

How common are mistakes on your credit report?

In Australia, regulation from the Australian Securities and Investments Commission (ASIC) mandates that when you make a complaint with either a credit bureau or credit provider, they have 30 days to respond to or resolve your complaint.

If a response or resolution is not received within that time, then consumers can raise a complaint with the Australian Financial Complaints Authority (AFCA), who will investigate the complaint at no charge.

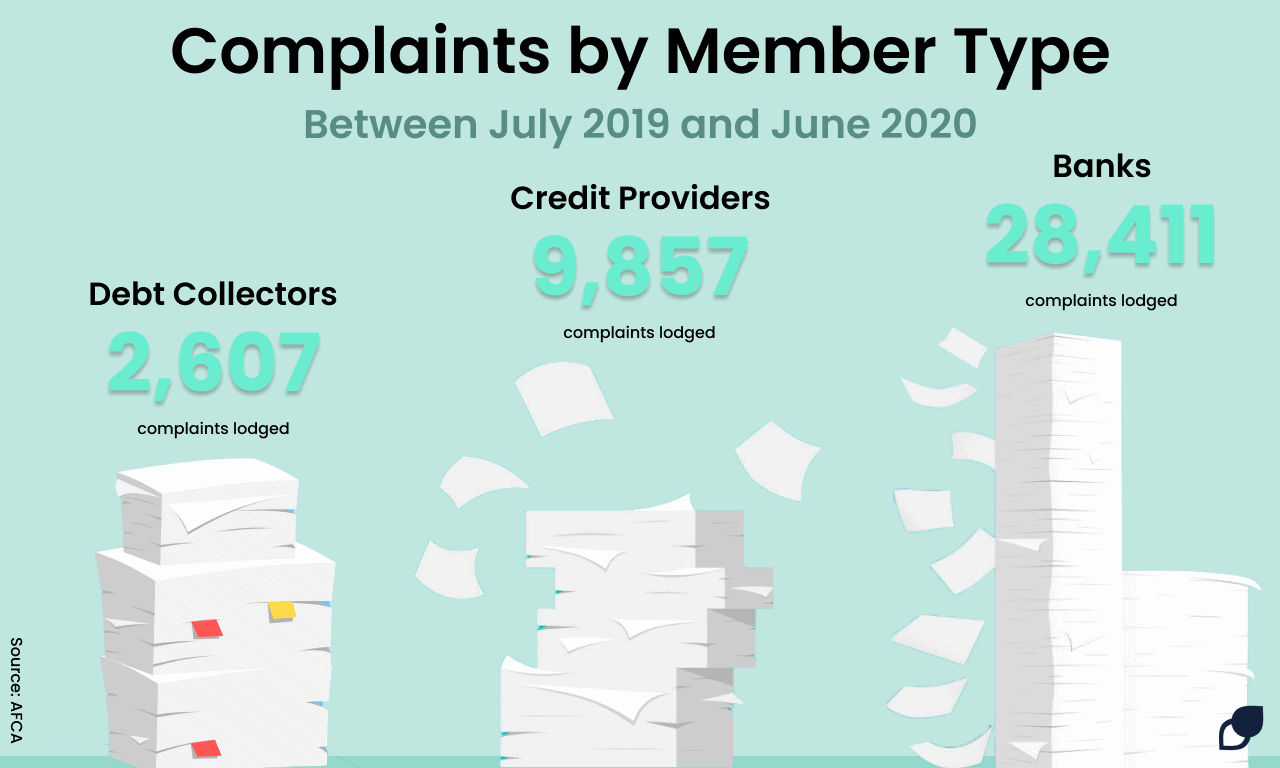

AFCA released statistics on the number of complaints it received from individuals in its 2019-20 annual review. The report clearly highlights just how prevalent complaints are within the credit space.

During the 2019-2020 financial year, AFCA’s report showed that credit providers received 9,857 complaints. Debt collectors or buyers received 2,607 complaints during the period. Credit reporting topped the list for complaints received by issue. Specifically, 6,381 complaints were lodged.

What are the most common mistakes on your credit report?

According to Wardle, whose company specialises in helping Australian consumers and/or their representatives to improve their credit scores themselves, there are three mistakes that are quite common on your credit report.

1. Personal information

The personal information on your credit report includes the following:

- Your full name;

- Current address or your last known address, as well as your previous two addresses;

- Your current or last known employer;

- Driver’s licence number.

According to Wardle, it is very common for one of these to be wrong – whether your full name has been listed incorrectly, wrong or outdated address and employer. Sometimes, your driver’s licence number can also be incorrect.

2. Credit enquiries

Every time you apply for credit, regardless of whether your application is accepted or rejected, this is known as a credit enquiry and it will appear on your credit report. Specifically, the type of credit you’re applying for (loan, credit card, etc) will be listed, as well as the amount you applied for.

According to Wardle, it can be quite common for credit enquiries to list the incorrect amount that was applied for. Furthermore, she explains that a lot of Australians don’t realise that when they apply for credit, it will appear on their credit report and harm their score.

3. Repayment history

With the introduction of Comprehensive Credit Reporting (CCR) in 2018, banks now have to report both positive and negative credit behaviour. This includes your repayment history. If you take out a loan and you consistently make your repayments, this will appear on your credit report and boost your credit score.

However, Wardle outlined to Tippla that despite the regulation, repayment history is often left out of an individual’s credit reports. That means they could be missing out on important information which could boost their credit score.

How to fix mistakes on your credit report

If you have identified a mistake on your credit report or missing information – how can you fix the common mistakes on your credit report? According to Wardle, the first step you should take is to reach out to the relevant credit provider to resolve the issue.

Specifically, she advises consumers to raise a complaint with their creditor about the incorrect information. If the complaint isn’t resolved within the required 30 days, Wardle suggests you seek for it to be escalated further both internally within the creditor’s complaints area, and if necessary, escalate it externally with an ombudsman such as AFCA.

While we at Tippla will always do our best to provide you with the information you need to financially thrive, it’s important to note that we’re not debt counsellors, nor do we provide financial advice. Be sure to speak to your financial services professional before making any decisions.

Related articles

How to Fix Mistakes on Your Credit Report

22/10/2021

If you have mistakes on your credit report, it...

The Benefits of Setting Up Automatic Savings Plans

12/09/2024

Automatic savings plans are a practical tool that helps...

Bankruptcy: A Financial Recovery Guide

06/04/2024

For many Australians, the weight of unmanageable debt can...

Subscribe to our newsletter

Stay up to date with Tippla's financial blog