Published in July 26, 2021

Credit Score FAQs: You Asked, We Answered

There is a lot of uncertainty surrounding credit scores and your credit report, so we’re shining the light on the situation and answering some of your most frequently asked questions.

Your credit score is an important number that can affect multiple aspects of your life. However, 73% of Australians don’t know their credit scores or why they are important. Because of this, there’s a lot of mystery and uncertainty surrounding credit scores.

It’s time to pull back the curtain and shed some light on credit scores. What is a credit score? What’s the difference between your credit score and credit report? How can you improve your credit rating? All of this and more will be tackled in this article.

What is a credit score?

Let’s start off with the most frequently asked question – what is a credit score? Your credit score, which can also be referred to as a credit rating, is a number ranging from 0 – 1,200.

The role of a credit score is to indicate to credit providers, such as banks, finance companies and utility providers, your creditworthiness. In other words, it reveals how risky of a borrower you are. Your credit rating is based on a five-point scale: excellent, very good, good, average and below average.

A good credit score indicates that you are effective at managing your debt and likely won’t default on your credit. A bad credit score shows that providing you with credit will be more of a risk to the provider. So, the better your credit score, the more likely you will be approved for credit.

One thing that’s important to highlight is that you actually have more than one credit score. In Australia, there are 3 different credit reporting agencies – Equifax, Experian and CheckYourCredit (illion). Each of these have a separate credit score for you.

So, to answer the question, a credit score is a numerical representation of your creditworthiness. Your credit score is likely to change across your lifetime, so it’s important to know what your credit score is and why they change.

You’ve probably heard the saying knowledge is power. When it comes to your credit rating this couldn’t be more true! When you know what your credit score is, and how to improve it, it could help you to negotiate better deals with your existing credit facilities, or when you’re applying for new credit. This brings us to the next commonly asked question…

Why are my Equifax and Experian scores different?

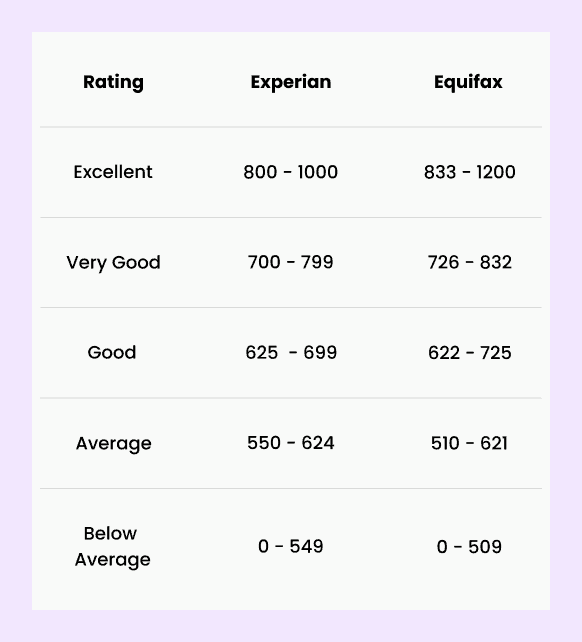

Another common question from Aussies is why are their credit scores different? There’s a number of reasons for this. Firstly, the scale on which the bureaus measure credit scores is different. Experian and illion measure their scores on a scale ranging from 0 – 1,000, whereas Equifax’s scale ranges from 0 – 1,200.

Not all credit providers – whether it be banks, lenders or other credit companies, report to the same credit bureaus. So the bank you have your credit card with might only report to Equifax and not Experian. Therefore, your credit report and credit score would be different between the two.

Not only that, but the algorithms they use to calculate your score vary. Whilst the exact method they use is a well-kept secret, what we do know is that each individual bureau is able to determine what counts the most. Nonetheless, there are a few things you can do that should work to improve your credit score across all of the different bureaus.

What affects your credit score?

Now you know what your credit score is, the next question that follows is, what affects your credit score? Your credit rating is based on the information on your credit report. What’s your credit report? We’ll answer that in a moment!

Your credit rating is influenced by a number of factors. These include your previous repayment history, how many credit accounts you have or have had in the past, and how often you apply for credit.

It’s important to address here that when we say credit, we’re not just talking about a loan or a credit card. As defined by MoneySmart: “Credit is money you borrow from a bank or financial institution. The amount you borrow is debt. You will need to pay back your debt, usually with interest and fees on top.”

Examples of credit include:

- Credit card;

- Loans – personal (secured and unsecured), car, mortgage, business, student and more;

- Buy Now Pay Later services;

- Mobile phone;

- Internet;

- Electricity or gas;

- Water.

Previously, your credit scores were only based on so-called negative reporting. This meant that if you missed a payment, it would be reported to the credit bureaus and a negative entry would appear on your report.

Whilst this is still true – if you default on a payment it will be reflected on your credit report and your score could be negatively affected. However, from 2018, Australia uses the Comprehensive Credit Reporting (CCR) which now includes positive behaviour being reported to your account for rental agencies and utility providers. While not all rental agencies and utility providers report to credit bureaus just yet, this is looking to be more of a trend in the future.

What is a good credit score?

Having a good credit score could open a world of opportunities. Generally speaking, when you have a good credit rating or higher, you could have access to better credit terms such as lower interest rates and fees.

For example, the average home loan in Australia is $388,100. If you borrow that amount at 5% interest over 25 years, you’ll pay $292,539 in interest over the life of the loan. But if you borrow the same amount at 5.5% instead, you’ll pay an extra $34,344 in interest! The extra half per cent interest doesn’t sound like much, but it has a massive impact.

So what is a good credit score? Well, it varies across the different credit reporting agencies. For Experian, a good credit score starts at 625. Technically, a good credit score is from 625 – 699, anything higher than this is either a very good or excellent credit score. When we refer to a “good” credit score, we’re referring to a score that’s either good or better.

For Equifax, a good credit score starts at 622. You can see an exact breakdown of the different credit scores below. We also did a dedicated article to what is a good credit score, which you can check out here.

Source: Experian and Equifax

What is the difference between a credit score and credit report?

Your credit score is a number that can range from 1 digit to 4, depending on where you fit on the five-point scale. Your credit report, however, contains detailed information on your credit history.

Your credit history includes any interaction you’ve had with credit before, whether you’ve taken out a loan, have a credit card, or rent a place and have to pay for your electricity.

What goes on your credit report?

The specific information that’s included in your report includes your repayment history, which type of accounts you have or have had in the past, how many applications you’ve made for credit, whether you’ve defaulted on a payment and more.

Your credit report contains a mix of information about your previous financial behaviour. This includes:

- Credit Accounts;

- Repayment History;

- Defaults;

- Credit Applications;

- Bankruptcies and Debt Agreements;

- Credit Report Requests.

Each credit bureau uses a slightly different algorithm to base your credit score off. For a full breakdown on what exactly goes into your Equifax and Experian credit reports, head back to school with Tippla’s Credit School – a short online course that will guide you through all the information you need to know about your credit scores, including what exactly goes into your credit report!

What goes on your credit report and how long does it stay there? Here’s an overview:

- Credit accounts – any open credit accounts and accounts that have been closed in the past two years

- Credit enquiries – 5 years

- Repayment history – for 2 years

- Defaults – 5 years

- Court judgements – 5 years

- Bankruptcies – at least 5 years

- Serious credit infringements – 7 years

How can you improve your credit score?

So now you know what a credit score is, and what goes onto your credit report, how can you use this knowledge to improve your credit score?

Fixing your credit score can’t be done overnight – but it definitely can be done! Time and consistent positive behaviour could help you boost your credit score and get access to the VIP credit offers.

Before you can fix or improve your credit score, you need to know where you’re at so you know what you’re working with. The next step would be to understand your credit rating and report and know what affects your score. Luckily for you, you’ve already completed this step!

Now that you know your credit score and what influences your number, you could do the following things to improve your score.

Pay off your current credit debts

Effectively managing your debt is the key to a good credit score. If you’re behind on your payments, one way to improve your credit score could be to get on top of and stay up to date with your debt. Once you’ve achieved this, staying on top of your debt could help maintain any ground that you’ve gained!

Reduce your debts

If you are struggling with managing your debts, you could look at trying to reduce your debts. There are two main methods – the snowball system and the avalanche system. The snowball method is when you organise your debts from largest to smallest amount, and focus on paying more towards the smallest debt whilst still making the minimum payments towards your other obligations.

The avalanche method is when you organise your debts by interest rates and put more resources towards paying off your debts with the highest interest rates first. The avalanche method might take you longer, but it could help you save more money in the long run.

Another way to reduce your debts could be debt consolidation. If you have accumulated debt from multiple sources, you may be able to consolidate them into one loan. This may save you money as you only pay interest on one loan and could make it easier to manage your repayments. Instead of remembering multiple dates, you only need to keep track of one.

Pay your bills on time

Similar to the above, paying your bills on time could help you improve your credit rating. If you can consistently show that you’re able to pay your bills on time, it indicates that you’re responsible with your finances – which is what credit providers care about! There are a number of ways you could make this easier for yourself. Some examples include setting up a budget, streamlining your payments so they all come out at the same time, setting yourself reminders, setting up a direct debit for your bills and more!

Find the best interest rates

Interest rates can make a big difference when it comes to how much money you will have to pay over the duration of your credit. As we highlighted before, even a 0.5% difference in an interest rate can cost you thousands over the course of a year.

Because of this, when applying for credit, you might want to aim for credit with the lowest interest rates and fees. If you’re not sure what’s the best option for you, you can seek the advice of a financial advisor, who can help you make the best decision for you!

Diversify your credit

Having more than one type of credit shows to credit providers that you are capable of handling multiple credit accounts perfectly fine. Repaying your debt on time might not only improve your credit score but signal to credit providers that you are good at managing your finances.

Space out your credit applications

When you apply for credit, your creditor will assess your application and how big the risk is that you may miss a repayment or won’t be able to pay back your loan at all. Your credit report is one of the elements used to assess if you are a high or low-risk candidate.

When a credit provider does this, it is called a hard enquiry. Too many hard enquiries in close succession could damage your credit rating as it implies that you’re in a bad financial situation and in need of extra money.

To avoid this, it could work out better to space out your credit applications over a few months and let your score recover in between. This could help you get better interest rates and protect your credit score in the long run.

Check your report for mistakes

Last but not least, one way you could improve your credit rating is by frequently checking your credit reports for mistakes. 1 in 5 credit reports have some kind of error on them, which can damage your rating. So it’s best to keep an eye on your reports and check to make sure you’re rating isn’t damaged because of a mistake!

Don’t have a credit score? No problem! We’ve already put together a guide on how to build your credit score from scratch.

What do credit providers see when they look at your credit report?

What you see on your credit report and what providers see when they check your report are two different things. So what can creditors see when they look at your report? For example, when you request to see your credit report, for security reasons only you can see who has accessed your report and when. Potential lenders and credit providers can’t see this when they make a hard enquiry on your report.

Aside from that, creditors can see your personal information, repayment history, your current credit accounts and more.

What are the consequences of bad credit?

If you’ve taken a look at your credit score and it’s not quite what you’re hoping for, never fear! It is possible to improve your credit score. But if you’re wondering if it’s even worth the effort, here are some of the consequences of bad credit.

- Credit applications might be rejected;

- Potentially higher interest rates;

- Insurance premiums could be more costly;

- It might make starting a business more difficult;

- Might cause obstacles to getting a phone contract.

Want to learn more?

If you’re hungry for more information and ready to embrace your inner finance geek, then head back to school! Learn what they didn’t teach you at school with Tippla’s Credit School – a free online short course that will guide you through the ins and outs of your credit score.

While we at Tippla will always do our best to provide you with the information you need to financially thrive, it’s important to note that we’re not debt counsellors, nor do we provide financial advice. Be sure to speak to your financial services professional before making any decisions.

Related articles

Understanding The Differences: Credit Scores in Australia vs The US

19/06/2024

If you understand your credit score, then you can...

The New Way Of Spending: Buy Now Pay Later And Your Credit Score

07/09/2021

If you did online shopping during the lockdown, chances...

How to Choose the Best Australian Centralised Exchange

15/04/2025

If you’re new to the world of digital currency,...

Subscribe to our newsletter

Stay up to date with Tippla's financial blog