Published in August 30, 2023

Credit Scores and Business Loans in Australia

Building Credit for Your Company

Disclaimer: This content does not constitute financial advice. The article below is for the readers’ information and education only. The writers at Tippla are not financial advisors and are therefore not authorised to offer financial advice. Tippla recommends our readers to always do their research and seek independent advice as needed.

In today’s competitive business world, securing the financial resources necessary for growth and stability can often be a challenge. Whether you’re launching a new business, expanding one, or simply looking to navigate economic fluctuations, access to capital through business loans is frequently essential.

However, in the world of business financing, understanding the nuances of credit is important. In Australia, just as in many other parts of the world, businesses have their own unique credit scores that play a crucial role in their ability to secure loans and financial support. These business credit scores differ significantly from personal credit scores and require a distinct approach to building and maintaining.

In this guide, we will delve into the vital role of business credit scores in obtaining loans in Australia, illuminating the key distinctions between business and personal credit and providing valuable insights into how companies can establish and enhance their creditworthiness to secure the financial backing they need.

Factors That Affect Business Credit Scores

A business’s credit score reflects its financial reliability and responsibility, with late payments adversely impacting it. Lenders and financial institutions rely on this score to decide whether to provide loans or other financial products to a business.

Here are some factors that affect a business credit score:

- Payment History: Just like personal credit scores, late payments, defaults, and bankruptcies can damage a business’s credit score. On-time payments demonstrate financial responsibility.

- Credit Utilisation: Lenders consider how much credit a business uses compared to what’s available. High credit utilization can negatively affect the score.

- Trade Experiences: The number of trade experiences a business has, including its repayment habits, plays a role in determining the credit score.

- Overall Debt: The amount of debt a business carries impacts its creditworthiness. High debt levels can lower the score.

- Credit Enquiries: Frequent credit inquiries or applications for credit can have a negative impact on a business’s credit score.

- Time in Operation: Longer-established businesses may be viewed more favourably by lenders compared to newer ones.

- Public Record Information: Any legal matters or actions taken against the business, such as court judgments, can influence the credit score.

How to Establish Business Credit

Register Your Business

Start by legally establishing your business entity. Register your company with the appropriate government authorities and obtain an Australian Business Number (ABN) or Australian Company Number (ACN), as these identifiers are essential for building credit. You can apply for one through the Australian Business Register (ABR).

Separate Business and Personal Finances

Maintain a clear separation between your personal and business finances. This means having a separate business bank account, using a distinct business address, and keeping separate financial records.

Obtain a Business Credit Profile

Initiate your business credit journey by opening accounts with suppliers, vendors, and service providers who report payment information to credit bureaus. This helps create a credit history for your business.

Apply for a Business Credit Card

Consider applying for a business credit card. Make sure the issuer reports your credit activity to Australian credit bureaus, as this can help build your business credit history over time.

Maintain Consistent Payments

Consistently pay your bills and invoices on time. Timely payments are a cornerstone of building a positive credit history.

Establish Trade References

Develop strong relationships with suppliers and creditors who can provide positive trade references about your business’s payment behaviour.

Nurture Long-Term Relationships

Building solid relationships with suppliers, lenders, and creditors over time can lead to more favourable credit terms and opportunities for growth.

Showcase Financial Stability

Demonstrate your business’s financial stability through transparent financial statements, positive cash flow, and responsible credit management practices.

Leverage Your Business Credit Profile

As your business credit profile improves, leverage it to negotiate better terms on loans, leases, and credit agreements. A strong credit profile can also boost your reputation among partners and investors.

Monitor Your Business Credit Report

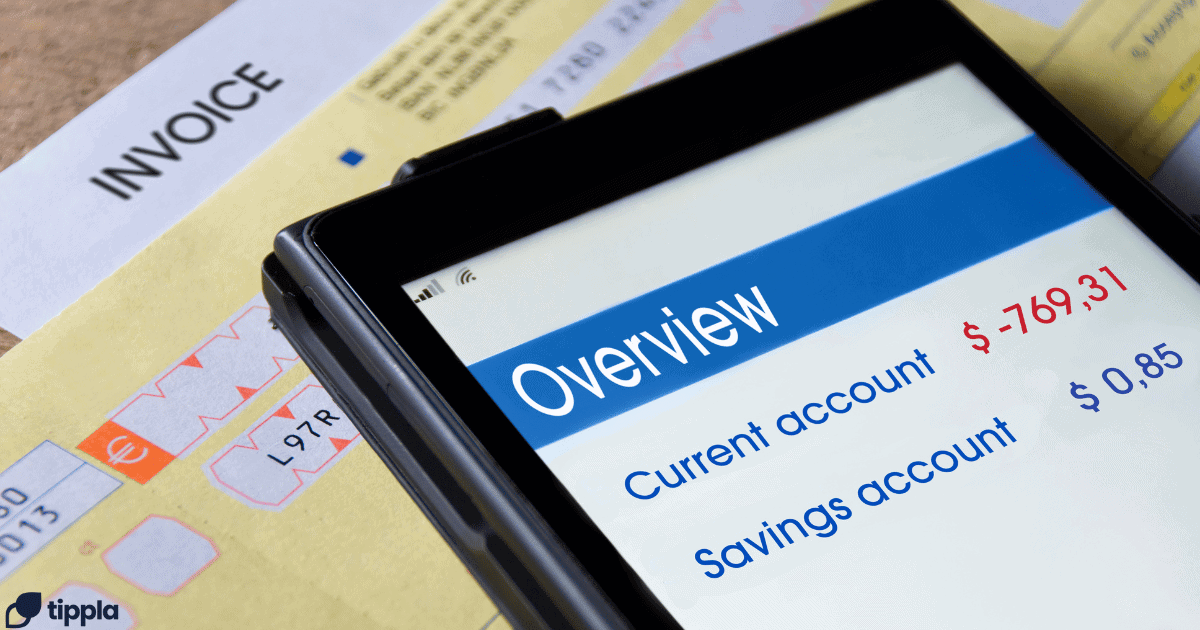

Regularly review your business credit report from Australian credit reporting agencies. Ensure the information is accurate and up-to-date, and address any discrepancies promptly. There are also online platforms like Tippla that make things simpler. They help you keep an eye on your credit score and pick up on any credit checks or changes in your report that you didn’t say yes to. This can help you stay alert about anything unusual happening with your credit.

Understanding Personal Guarantees for Business Loans

When securing a business loan, personal guarantees are a common arrangement that entrepreneurs need to comprehend fully. These guarantees bind business owners to take personal responsibility for repaying the loan if their business is unable to meet its obligations.

Personal guarantees can lead to serious consequences for personal credit in the event of loan default. If the business fails to meet its loan obligations and defaults, the lender may enforce the personal guarantee, requiring the business owner to repay the loan with personal assets. This can include using personal savings, properties, or other valuable possessions to cover the outstanding debt.

Unfortunately, if the business owner is unable to cover the loan obligation through personal assets, this default can be recorded on their credit report. Such negative reporting can significantly impact their credit score, making it more difficult to access personal loans, mortgages, or credit cards in the future.

Weighing the pros and cons of personal guarantees

Personal guarantees come with both advantages and drawbacks. On the positive side, they can enhance the business’s credibility and increase the likelihood of loan approval, particularly for startups and businesses with limited credit history. Personal guarantees can also lead to more favourable loan terms, such as lower interest rates or higher borrowing limits.

However, the downsides are worth considering. The primary drawback is personal financial risk. If the business faces financial difficulties and defaults on the loan, the business owner’s assets are at stake. Additionally, the impact on personal credit in case of default can have long-term consequences that extend beyond the business realm.

Utilising Professional Guidance

When it comes to enhancing your business credit, seeking guidance from seasoned professionals can make a significant impact on your journey towards credit improvement. In Australia, financial advisors and credit experts are valuable resources that can offer strategic insights and tailored solutions to bolster your business credit profile.

Value of Financial Advisors and Credit Experts

Financial advisors and credit experts possess specialised knowledge in the intricate world of business credit. Their expertise can guide you through the complexities of credit management, helping you understand how different financial decisions affect your creditworthiness. These professionals can provide personalised advice on credit-building strategies, debt management, and optimising your credit utilisation ratio. With their guidance, you can make informed decisions that align with your business goals while safeguarding your credit health.

Identifying Professionals with Expertise in Business Credit

In Australia, you can find reputable financial advisors and credit experts who specialise in business credit matters. Look for professionals who hold relevant qualifications or credit industry certifications. Consider seeking recommendations from fellow business owners, industry associations, or reputable financial institutions.

Online platforms and directories, like the Financial Planning Association of Australia (FPA) and the Australian Financial Complaints Authority (AFCA), can help you locate professionals with expertise in business credit management.

Working with the right professionals entails a collaborative effort. Begin by outlining your business credit goals and challenges. Consultation sessions with financial advisors and credit experts can provide you with actionable strategies to enhance your credit profile. They can assist you in identifying areas for improvement, devising customised plans, and navigating through the intricacies of business credit in the Australian context.

Conclusion

For businesses, credit scores are crucial for obtaining loans and maintaining their financial stability. Strong company credit helps you acquire better loan conditions and demonstrates to lenders your dependability and responsibility.

So, business owners need to focus on building and taking care of their business credit. This means consistently following good credit habits, paying bills on time, and keeping an eye on credit reports. By doing this, they create a foundation for seizing growth opportunities, improving their reputation, and having more financial options.

A solid business credit profile doesn’t just help with short-term financing needs; it also brings long-term benefits like better negotiating power, stronger partnerships, and the potential for lasting growth and success in Australia’s ever-changing business landscape.

While we at Tippla will always do our best to provide you with the information you need to financially thrive, it’s important to note that we’re not debt counsellors, nor do we provide financial advice. Be sure to speak to your financial services professional before making any decisions.

Related articles

Should You Pay Off Your Credit Card or Personal Loan First?

07/09/2021

Do you currently have credit card debt as well...

Q&A: Can I Apply For a Personal Loan For Someone Else?

28/07/2021

If you’re wondering if you can apply for a...

Understanding and Managing Overdraft Protection

21/05/2024

What is Overdraft Protection? In banking, an overdraft occurs...

Subscribe to our newsletter

Stay up to date with Tippla's financial blog