Published in October 22, 2021

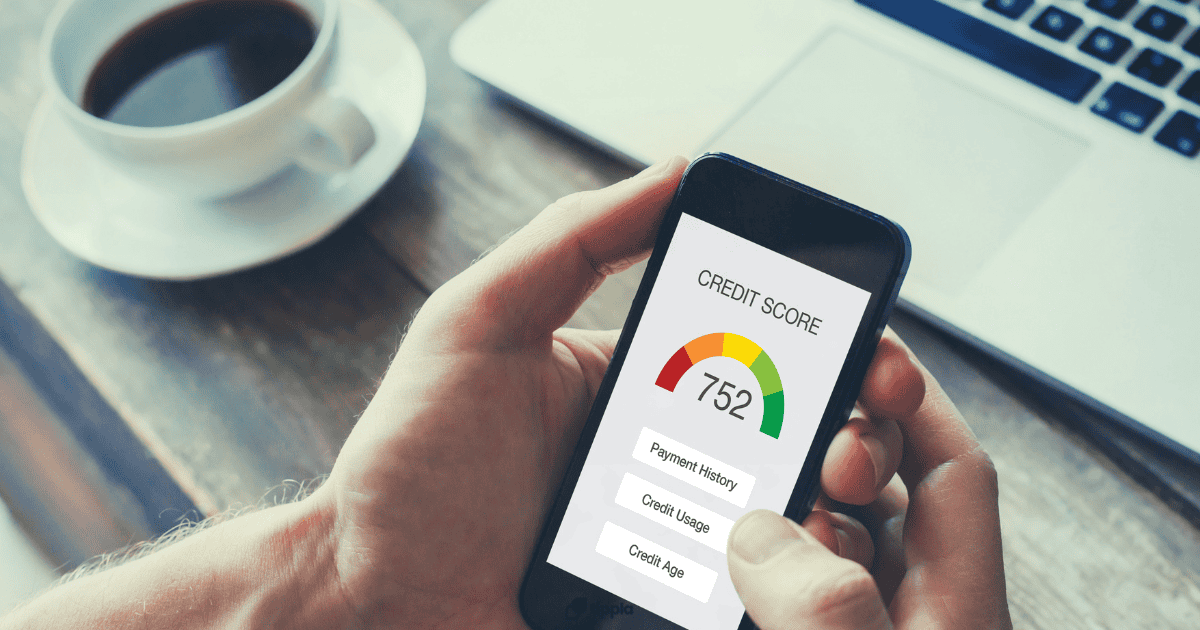

How to Fix Mistakes on Your Credit Report

Mistakes can seriously harm your credit score. That’s why we’ve put together this helpful guide outlining how to fix mistakes on your credit report.

If you have mistakes on your credit report, it could be harming your credit score and could be affecting your credit applications. It is your right to have mistakes on your credit report fixed for no cost at all. That’s why we’ve put together an overview on how to fix mistakes on your credit report.

Why do mistakes on your credit report matter?

Mistakes on your credit report can be quite common – it could be incorrect personal information, defaults, credit enquiries and more listed on your credit report. Your credit score is calculated based on the information contained in your credit report. Oftentimes, mistakes in your report can seriously harm your credit score.

Why does this matter? Your credit score can be the difference between you being accepted or rejected for credit, it can also affect your interest rate and borrowing capacity. Therefore, the higher your credit score, the better.

In Australia, you have the right to fix mistakes on your credit report for free. This process is often referred to as credit repair. We’ve outlined below how.

Most common mistakes on your credit report

Chinelle Wardle, the Director of Wardle Consultancy Services Pty Ltd, outlined the most common mistakes she has seen on credit reports as follows:

- Personal information – incorrect name, outdated address, previous employer, incorrect driver’s licence number;

- Credit enquiries – the incorrect amount that was applied for listed;

- Repayment history – not included at all.

What information can you have fixed on your credit report?

To put it simply, if you have a mistake on your credit report, then you have the right to have it fixed. This can entail having your personal information updated, have negative entries such as defaults and enquiries removed, or have entries updated to contain the correct information.

Here’s a quick overview of what information you can have fixed for no cost at all. This list is not exhaustive:

- Your personal information – name, date of birth, address;

- Duplicate information;

- Credit accounts you don’t recognise (created by mistake or as a result of identity theft);

- Defaults – either listed incorrectly or the amount of debt is wrong.

It’s worth pointing out here that you can’t have just any negative entry removed. It has to be incorrect for you to be able to have it removed from your credit report.

How to fix mistakes on your credit report

Let’s now take a look at how to fix mistakes on your credit report. There are two main ways you can fix mistakes on your credit report – reach out to the relevant credit provider, or reach out to the credit bureaus. Let’s take a look at both of these options.

1. Reaching out to credit providers

If the mistake on your credit report has to do with an entry on your credit reports – such as a default, credit enquiry, credit account, or incorrect repayment information, then you can reach out to the relevant credit provider to resolve the issue.

When you raise a complaint with the creditor, they have 30 days to respond to your complaint. If the complaint isn’t resolved within this time, you can seek for it to be escalated further both internally with their External Dispute Resolution (EDR) scheme, and if necessary, escalate it externally. You can do this with the Office of the Australian Information Commissioner (OAIC), or with the Australian Financial Complaints Authority (AFCA).

If the credit provider agrees that the information on your credit file is incorrect, according to Experian, they are required to forward a request to the credit bureaus within 5 days to make the correction.

Furthermore, Experian highlights: “Any credit provider must investigate any correction request you make. This applies even if the information wasn’t entered correctly by the credit provider. They must demonstrate to you how the information on your credit report is correct if they don’t agree to correct it.”

2. Reaching out to credit bureaus

Instead of reaching out to the relevant credit provider, you can go straight to the credit bureaus. Specifically, you can request for them to contact the credit provider on your behalf to have the information disputed.

In order to get a credit bureau to investigate the issue on your behalf, you will need to provide them with a range of information. Here’s Experian’s correction process and the correction process for Equifax.

While we at Tippla will always do our best to provide you with the information you need to financially thrive, it’s important to note that we’re not debt counsellors, nor do we provide financial advice. Be sure to speak to your financial services professional before making any decisions.

Related articles

Understanding Superannuation in Australia

01/10/2024

Superannuation, commonly known as “super,” is a crucial element...

How To Check My Credit Report For Free

13/09/2021

Your credit report is an important document that gives...

How AI is Changing Credit Score Management

12/03/2025

Managing your credit score has always felt like a...

How Many Personal Loans Can You Have at Once?

25/10/2021

Christmas is just around the corner. December can certainly...

Subscribe to our newsletter

Stay up to date with Tippla's financial blog