Published in July 29, 2021

How Long Does Bankruptcy Stay On Credit Report?

There are a number of reasons why someone might have to enter into bankruptcy. But how can bankruptcy affect your credit score and how long does bankruptcy stay on credit report? We’ve put together a helpful guide to give you all the facts.

What is bankruptcy?

Bankruptcy is the legal process when someone is declared unable to repay their debts. The point of bankruptcy is to allow the individual to be released from most of their debts, allowing them to make a fresh start.

As highlighted by the Australian Financial Security Authority (AFSA): “You can enter into voluntary bankruptcy. To do this you need to complete and submit a Bankruptcy Form. It’s also possible that someone you owe money to (a creditor) can make you bankrupt through a court process. We refer to this as a sequestration order.”

Bankruptcy normally lasts for 3 years and 1 day. However, it is possible to end your bankruptcy earlier if you repay your debts faster.

Different types of bankruptcy

In Australia, if you get into debt and you’re unable to repay it, then there are three formal options available for you – bankruptcy, personal insolvency agreements and debt agreements. We’ve already outlined what bankruptcy is, so let’s cover personal insolvency and debt agreements.

Personal insolvency agreements

A personal insolvency agreement, also known as Part X (10), is a step you can take to avoid declaring bankruptcy. It’s a legally binding agreement between yourself and your creditors and can be used as a way to settle your debts with creditors without going into bankruptcy.

When you enter into a Part X agreement, a trustee will be appointed to manage your finances and make an offer to the creditors you owe money to on your behalf. As part of this agreement, you might have to pay all or part of your debt in either a lump sum or in instalments – depending on what you can afford.

Debt agreements

Debt agreements are similar to personal insolvencies in that it is a way to avoid bankruptcy. Also referred to as a Part IX (9) debt agreement, this type of agreement allows you to reach an arrangement with the creditors you owe money to so you can settle your debts without having to resort to bankruptcy.

Here’s how it works. When you enter into a debt agreement, you’ll be appointed an administrator, who will negotiate with creditors to pay back part of your combined debt. This will be as much as you can afford based on your current financial situation across an agreed period of time.

When you have completed your debt agreement, then you won’t have to pay back the remaining debt that you owe.

Bankruptcy in Australia

As we highlighted in a previous article, during the 2019 – 2020 financial year, figures from the AFSA highlighted that the number of new personal insolvency agreements, bankruptcies and debt agreements entered was lower year on year.

In Australia, you are able to apply for bankruptcy if you meet the following two requirements:

- You’re unable to pay your debts when they are due (insolvent) and;

- You’re present in Australia or have a residential or business connection to Australia.

There’s no cost for entering bankruptcy and, according to the AFSA, there’s no minimum or maximum amount of debt or income needed to be eligible.

How does bankruptcy affect your credit score?

A lot of people want to know how bankruptcy affects their credit score. Unfortunately, there’s no precise answer, as the credit bureaus like to keep the exact algorithms they use to calculate your credit score a well-guarded secret.

However, we do know that if you’re declared bankrupt, it won’t be good for your credit score. This is because it sends a clear signal to creditors that you aren’t able to effectively manage your debt.

Therefore, you can expect that if you go into bankruptcy your credit score will take a significant hit. It will likely take years for your score to recover.

How long does bankruptcy stay on credit report?

So let’s answer the main question of this article – how long does bankruptcy stay on credit report?

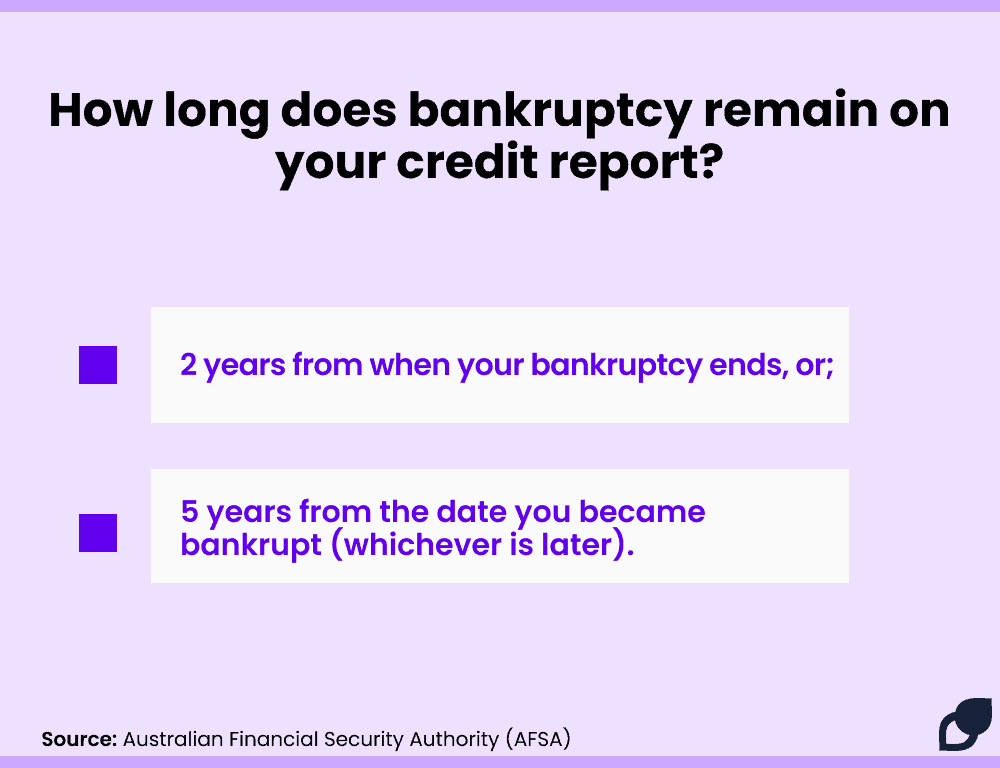

According to the AFSA, your credit report will show your bankruptcy for either:

The AFSA further outlines that bankruptcy will remain on your credit file for a maximum of 5 years if your bankruptcy period lasts for 3 years and 1 day. When you have completed your bankruptcy, the status will change on your report to “discharged”. Although the status will change, the bankruptcy will still remain on your report for a further 2 years.

How to avoid bankruptcy

Now that you have a better idea of the impact of bankruptcy, let’s see how you could avoid filing for bankruptcy in the first place.

Know where you’re at

Before you can take steps to reduce your debt, you need to first know where you’re at. MoneySmart recommends that you make a list of all your debts and show how much each debt is and the minimum monthly repayment if applicable.

Specifically, the financial education website advises individuals to include credit cards, loan repayments, unpaid bills, fines and any other money you owe. Once you have created the list, add up all the debt that you owe. Once you’ve done this, you’ll have a clearer idea of how much debt you’re in.

Pay what you can

Once you have an idea of how much you owe, the next step is to figure out how much you can repay. You could do this by creating a budget that outlines your monthly expenses, and determine how much money you have left over after all of your bills are paid. With what’s leftover, you can dedicate some of that to paying your bills.

Extra tip: reduce your spending

When you take a look at all of your bills, you could try and see what things you could cut. Say you have multiple subscriptions to streaming services, you could reduce that to just one server. Are you eating out a lot? Why not cook at home? There are many things you could do to reduce your spending.

Reduce your debt

When you’re paying back your debts, you could try to reduce your debt at the same time. There are two common methods you could use to achieve this – the avalanche and snowball methods.

The snowball system is when you make the minimum payments to all of your debts, except for your smallest, which increases your payments above the minimum requirement. The goal of the snowball system is to pay off your smallest debt as quickly as possible. Once that’s paid off, you move onto the next smallest debt, and so the cycle continues.

The avalanche system has a slightly different approach. Instead of focusing on the smallest debt, you instead focus on the debt with the highest interest rate. Your aim is to dedicate more funds to your debt with the highest interest rate to try and pay it off faster, whilst making the minimum repayments on your other debts.

Once you’ve paid off this debt, then you focus on the next debt that has the highest interest rate. Like the snowball system, you continue with this method until you’ve paid off all of your debt.

Reach out for help when you first notice the problem

To stop your debt from getting out of hand, when you first notice a problem, you should reach out for help. In Australia, you can reach out to a financial counsellor for free, and they can offer you independent and confidential services to help you get back on track.

If you are currently struggling with debt, you can speak with a financial counsellor through the National Debt Hotline on 1800 007 007. Alternatively, you can head to the National Debt Helpline website for more tools and resources.

Check your credit report

Another way you can help avoid having to declare bankruptcy is by frequently checking your credit report to examine your credit history. With Tippla, you can clearly see all of your credit, including your limits, listed on your credit report. This can provide you with an easy overview of your credit situation.

How long does bankruptcy stay on credit report?

To answer the question of how long does bankruptcy stay on credit report, the answer is around 5 years if you complete your bankruptcy in the standard 3 years and 1-day timeframe. If you complete your bankruptcy earlier, then it’s 2 years after you’ve finished.

Although bankruptcy won’t stay on your credit report forever, it is worth highlighting that you will be put on the public register called the NPII. Your name will appear on the NPII permanently. It shows details of insolvency proceedings such as bankruptcy in the country.

While we at Tippla will always do our best to provide you with the information you need to financially thrive, it’s important to note that we’re not debt counsellors, nor do we provide financial advice. Be sure to speak to your financial services professional before making any decisions.

Related articles

Are Term Deposit accounts worth it?

28/07/2021

Although a term deposit account tends to earn high...

Can You Buy a House Without a Credit Score?

24/08/2021

Australia’s property market is hot right now, with lots...

How to understand your Equifax score

18/07/2023

What does my Equifax score mean? Ah, your Equifax...

Subscribe to our newsletter

Stay up to date with Tippla's financial blog