Published in September 7, 2021

New Year, New Credit Score: Take Control of Your Credit

The new year is upon us. It’s time to embrace the #newyearnewme motto and take control of your credit score and improve your credit score.

2020 will definitely go down as an interesting year in history, especially here in Australia. We started off the year with bushfires, then COVID-19 swept in, forcing us all into lockdown, and just so we could experience the full spectrum – we closed the year with floods in some parts.

Although COVID-19 is still with us, 2021 can still serve as a fresh start – especially for our credit scores. So, how can we use the new year to get on top of our credit scores, and ultimately, improve our financial situation? We here at Tippla have put together a few ideas.

Check your credit score

Before we can even begin to improve our credit scores, you need to first know what your credit score is. A lot of people ask us, “how can I check my credit score?”. Unfortunately, there’s not a lot of education in Australia on what your credit score is, and how you can check your credit score. That’s why Tippla is here to help!

When you sign up to Tippla, you can see what two of your credit scores are – one from Equifax and the other from Experian. It’s important to know where you’re at before you start trying to make changes.

You can also contact the credit reporting agencies in Australia directly for a copy of your credit report. In Australia, there are three reporting agencies – Equifax, Ilion (CheckYourCredit), and Experian.

What is a good credit score?

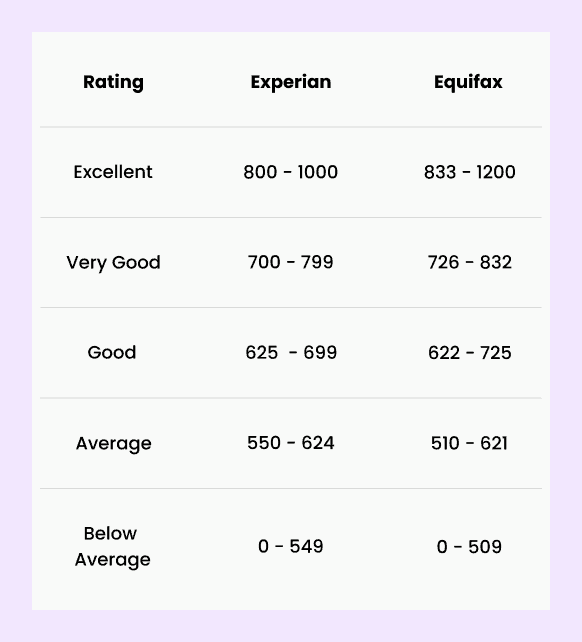

Once you log into Tippla, you’ll see two separate numbers ranging from 0 to 1,200 – these are your credit scores. Your credit scores are categorised on a five-point scale, ranging from below average, all the way to excellent.

So, how can you know if you have a good credit score? Here’s how Equifax and Experian rank your credit scores.

Source: Experian and Equifax

Understand your credit report

After you’ve checked your credit score, it’s important to understand why you have achieved your given ratings. Whether you’ve received a below-average rating, all the way up to excellent, there is a reason as to why.

If you have a below-average rating, firstly, never fear – there are many ways you can improve your credit score. In fact, Tippla recently put together a quick guide on how you can fix your credit score.

There are a number of things that can damage your credit report – defaults on your credit repayments, too many credit applications, too many loans, and more.

How long does it take to improve your credit score?

Unfortunately, you can’t improve your credit score overnight – but it definitely can be done! The main ingredient that can help you improve your credit score is time. Mix in some consistent positive credit behaviour and you have the perfect recipe for a better credit score.

But how much time are we talking about here? Well, there’s no set time limit for how long it will take. It completely depends on each individual situation and if there are any significant negative entries.

The good news is that even significant negative entries will age over time and get progressively less powerful. However, for most of them, it takes up to 7 years until they fully disappear.

Here’s what stays on your credit report and for how long:

- Credit accounts – any open credit accounts and accounts that have been closed in the past two years

- Credit enquiries – 5 years

- Repayment history – for 2 years

- Defaults – 5 years

- Court judgements – 5 years

- Bankruptcies – at least 5 years

- Serious credit infringements – 7 years

To help you fix your credit score, here’s a helpful article Tippla put together outlining the dos and don’ts of credit.

Identify your bad habits

Now it’s time to identify your bad credit habits. A bad credit score can have numerous consequences, such as your loan application being rejected, higher interest rates and premiums, and a number of other implications.

Before you can improve your credit score, you need to identify your bad habits. We’ve put together a list of the most common offenders below.

Defaults

A default is when you don’t make one of your repayments – whether that’s for a loan, a credit card, or even your electricity bill. A default is generally when you haven’t made the repayment within a timely manner and you haven’t made arrangements with your credit provider to defer the payment or set up some kind of payment plan.

As outlined by the Office of the Australian Information Commissioner, a credit provider can list a default on your credit report if:

- the payment has been overdue for at least 60 days;

- the overdue payment is equal to or more than $150;

- a notice has been sent to your last known address to let you know about the overdue payment and requesting payment;

- a second notice was sent at least 30 days later to let you know that if you don’t make a payment the credit provider intends to disclose the information to a credit reporting body;

- the credit provider must wait at least 14 days after issuing the second notice before listing the default.

Defaults can leave a big mark on your credit report and generally take 5 years to disappear from your credit report. This means, any time you apply for a loan or some kind of credit, the provider can see that you previously defaulted on your repayment. This could lead to them rejecting your application, as you’re deemed too high of a risk.

If you have been rejected for a loan, Tippla recently put together a step-by-step guide on what you can do next and how you can harness your credit score for good.

If there are any defaults on your credit report, then it might be worth reflecting on why you defaulted on your repayment.

Preparing for life’s curveballs

Life throws us curveballs, and sometimes, this can put us under financial strain. It doesn’t make you a bad person if you are in financial hardship. But one way to protect yourself from defaulting on payments could be an emergency fund.

Having an emergency fund in place could be a good way to protect yourself from life’s unexpected challenges. It’s totally up to you how large your emergency fund is. The general rule of thumb is to have enough money set aside that could support you for a three month period.

It’s OK if you don’t have that money available now. You don’t have to rush. You could set up a savings account and slowly save towards your goal. If you want to take it easy, you could start with the goal of saving one month of income as a safety buffer. Once that is achieved, you could then save your way towards three months.

Too many credit applications

When you apply for credit, whether it’s a loan, credit card, or another type of credit, it will show on your credit report as a hard enquiry. When it comes to your credit report, there are two types of enquiries made – soft and hard.

A soft enquiry does not impact your credit score and generally occurs when you check your own credit score or when a promotional credit offer is provided to you.

Hard enquiries, on the other hand, are done when you apply for some form of credit, such as a loan or credit card. Your chosen credit provider will take a look at your application and, in order to assess how risky of a borrower you are, will look at your credit score.

Therefore, a hard enquiry on your credit report indicates that you have recently applied for credit. They serve as a timeline to show when you’ve applied for credit and could stay on your report for two years. Typically, however, they only affect your credit score for one year.

If you have multiple hard enquiries on your credit report in quick succession, then a potential lender or credit provider might think you’re in a bad financial situation in desperate need of finance, regardless of whether this is the case. This could lead to them rejecting your application, as they might feel you’re too risky of a borrower. This is why it’s important to limit your hard enquiries.

Too many types of credit

The subtleties of your credit score can be confusing and keeping your score healthy can be a delicate balance. Whilst you need to have had some kind of credit in your life in order to have a credit history and credit score, having too much, however, can work against you.

Similar to having too many hard enquiries on your credit report, having too many lines of credit can make it appear as if you are in financial distress. If you have multiple loans or multiple credit cards, it could give off the impression that you are struggling financially, or you’re not able to effectively manage your finances.

This could make a lender or credit provider deem you as a higher risk and make them less likely to lend you money or increase your interest rates to hedge against the perceived risk. One way you could counteract this is by only taking on finance when you need it, and if you are already repaying off one loan, to not take out a second, for example.

If you’re unsure what’s the best course of action for you, you can reach out to a financial counsellor. They can help you make informed financial decisions that are the most suitable for your current circumstances.

Consolidate your debt

If you have multiple loans or debts from different sources, you may be able to consolidate them into one loan. This could save you money as you only pay interest on one loan and will make it easier to manage your repayments. Instead of remembering multiple dates, you only need to keep track of one.

The benefits of debt consolidation are numerous, such as simplifying your repayments, reducing your cost to maintain your debts, and having more control over when you can become debt-free.

However, before consolidating your debt, there are a number of things you should consider and check first. Whilst there are numerous benefits to consolidating your debts, sometimes, it may cost you more if you end up with a higher interest rate or have to pay fees.

You should compare the interest rate of the new loan, and find out whether there are any fees or additional costs, against your current loans. If the new consolidated loan ends up being more expensive than your current loans, then it might not be worth it and better to keep things as they are!

Some fees you should keep an eye out for include: penalties for paying off your original loans early, application fees, legal fees, valuation fees, and stamp duty.

Another thing to watch out for is switching to a loan with a longer-term. Although the interest rate might be lower than what you’re currently paying, if you have a longer repayment period, then you might end up paying more in interest and fees in the long run!

New Year, New Me: make 2021 your year

A new year can give you the perfect opportunity to reset and start anew. Make 2021 the year that you look after your credit score, and take control of your financial future. It’s never too late to start, and your friends here at Tippla are here to help you!

While we at Tippla will always do our best to provide you with the information you need to financially thrive, it’s important to note that we’re not debt counsellors, nor do we provide financial advice. Be sure to speak to your financial services professional before making any decisions.

Related articles

Can You Buy a House Without a Credit Score?

24/08/2021

Australia’s property market is hot right now, with lots...

Credit Scores for International Students in Australia: Building Credit History

06/09/2023

In Australia, as in many other countries, a good...

Frugal Hacks for 2021 | Prepare For The End Of JobSeeker

30/07/2021

Make saving money fun with these frugal hacks for...

Subscribe to our newsletter

Stay up to date with Tippla's financial blog