Published in October 25, 2021

Does Your Personal Information Affect Your Credit Score?

If you’ve seen your credit report, you might have noticed that it contains some of your personal information. Can that information affect your credit score? Find out in this article - the answer might surprise you!

Your credit score is an important number – it can be the difference between you being accepted or rejected for a loan. Your credit score is calculated based on the information contained in your credit report, which includes both your financial and personal information. We know that your financial information affects your credit score, but does your personal information affect your credit score? Let’s find out.

What is personal information?

Personal information is any information related to an identifiable person. Broadly speaking, personal information can include the basics, such as your name, date of birth, address and employment, all the way to the more abstract such as correspondence, audio recordings, images and more.

What personal information appears on your credit report?

Your credit report contains a mixture of your financial information, as well as your personal information. What personal information can appear on your credit report is determined by the Privacy Act, as credit bureaus can only hold data of individuals permitted by the Act.

Part IIIA of the Privacy Act 1988 (the Act) regulates consumer credit reporting in Australia. The Act aims to facilitate an efficient credit reporting system whilst at the same time, protecting the privacy of individuals.

So what personal information is on your credit report? Here’s a breakdown:

- Your full name;

- Current address or your last known address, as well as your previous two addresses;

- Your current or last known employer;

- Driver’s licence number.

Here’s what personal information is not included in your credit report:

- Race/religion;

- Dependents;

- Salary;

- Superannuation;

- Savings;

- Assets (such as cars, houses and jewellery).

The importance of your personal information on your credit report

You might not realise it, but the personal information on your credit report is important. As we mentioned above, your credit score is calculated based on the information on your credit report.

A lot of people might think that only extends to the financial information on your credit report – but your personal information can also affect your credit score. In fact, having wrong or outdated personal information on your credit report can harm your credit score quite significantly.

According to Chinelle Wardle, the Director of Wardle Consultancy Services Pty Ltd, which specialises in helping Australian consumers and/or their representatives to improve their credit scores themselves, having incorrect personal information on your credit report can reduce your overall score and in some instances result in rejected applications.

Speaking to Tippla, Wardle said: “A lot of people don’t realise the significance of incorrect personal information on their credit reports. I have many clients who have been rejected for loans because of incorrect personal information, which was harming their credit score by more than 100 points. All it took was fixing their information to boost their score and get approved for the loan.”

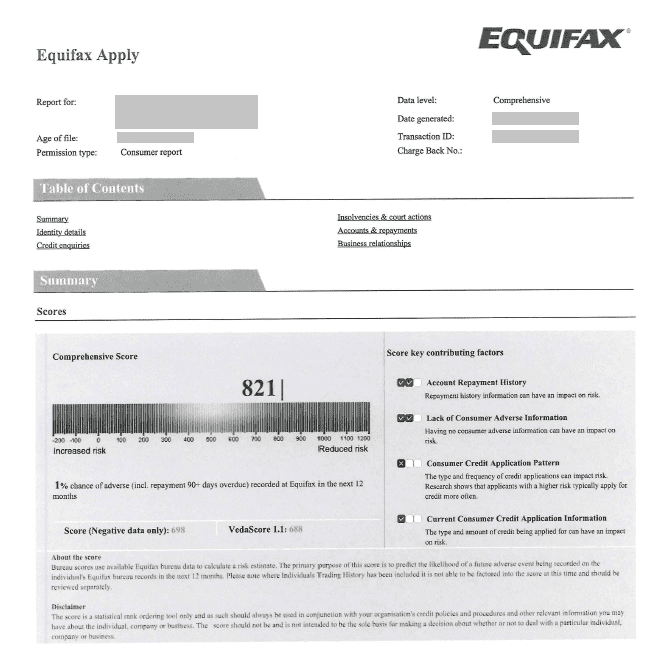

In the below image, Wardle’s client had a credit score of 821. Despite the high number, her client was rejected for a loan due to a mismatch in their credit information.

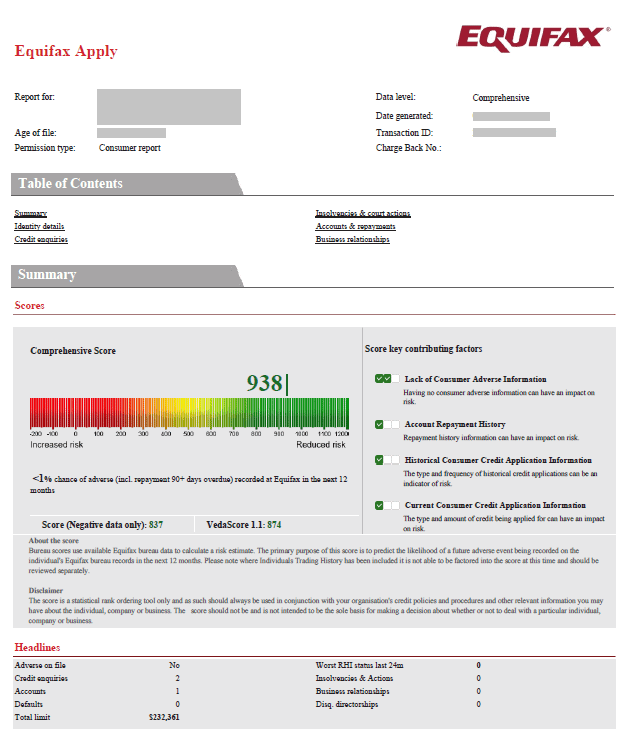

Upon seeking Wardle’s services, she was able to see that her client’s driver’s licence and address on their credit report was incorrect. Once the personal information on her client’s credit report was updated, the customer’s credit score increased by more than 100 points, and their loan application was accepted.

This is a clear example of how incorrect personal information can not only harm your credit score but also result in you being rejected for a loan or other type of credit. It’s important to outline that having a high credit score doesn’t mean that you can’t be rejected for credit. Checking your personal details are up to date and correct is critical to potentially avoid being rejected for finance in the future.

Why does your personal information affect your credit score?

A lot of people might be confused as to why your personal information can harm your credit score. It’s not your credit history – so why does it affect your rating? As Wardle explains, having incorrect personal information can lead to multiple credit reports being generated for one individual.

These credit reports won’t have the full picture of your credit history, and as a result, you will likely have a lower credit score as your report may not contain accurate information with respect to your current and updated financial obligations.

In some cases, having incorrect personal information can result in you not having a credit report and score at all. If you don’t have a credit score, then it can be harder to be accepted for credit, and drastically reduce your finance options.

What personal information is most likely to be incorrect?

Mistakes on your credit report are common. In fact, 1 in 5 credit reports have some kind of mistake on them. It is quite common for the personal information on credit reports to either be incorrect or outdated.

As outlined by Wardle, the personal information most likely to be incorrect are:

- Full name – it is quite common for your credit report to have your incorrect name. Sometimes, someone else’s name might appear on your report, or your name may have been spelt incorrectly. Often, the incorrect middle initial can appear on your report.

- Employment – your credit report might have an old employer listed as your current employer on your credit report, or your employer might be completely incorrect.

- Contact information – your credit report might show incorrect or outdated contact information, such as your phone number and address;

- Licence number – it is common for credit reports to feature an outdated or incorrect driver’s licence number.

Common reasons for incorrect personal information on your credit report

So now you know what’s likely to be incorrect, let’s get into why that information is more likely to be wrong. Like many things in life, there’s not just one reason, but a multitude of reasons why your personal information on your credit report might be incorrect.

The personal information on your credit report is collected by the credit bureaus in Australia from credit providers – such as banks. Each time you apply for credit, take on credit, and more, that information is stored and reported to the credit bureaus. This information then appears on your credit report.

As highlighted by Wardle, there are two main reasons why personal information on credit reports can be incorrect – consumer error, or creditor error. Let’s break these two down.

1. Consumer error

When you apply for credit, you will need to fill out your personal details on the application. Sometimes, people make mistakes on the application – they might spell their name wrong, or submit incorrect licence details, for example.

Regardless of whether the application is approved or rejected, the credit enquiry is sent to the credit bureaus with the incorrect information, which can then end up on your credit report.

Furthermore, if you move address, and you don’t update your driver’s licence or inform your credit providers, then your outdated address will remain on your credit report. That’s why it’s important to ensure you update your address across all channels when you move house.

2. Creditor error

Similar to consumer error, creditors can also make mistakes. When they receive your application, they might input your details incorrectly – such as your name, address, date of birth, employment details, driver’s licence number and more. This incorrect information is then passed onto the credit bureaus, which can inevitably end up on your credit report or generate a new report. This is sometimes known as a possible match or a cross-reference.

How to update your personal information on your credit reports

If you can see there is a mistake with your personal information on your credit report, or the information is outdated, how can you fix this? There are two main courses of action – you can reach out directly to each of the credit bureaus to have your personal information updated or corrected.

You can also reach out directly to your credit providers to ensure they have all of your correct personal information. If they don’t, then you can request that they update the details they have on file and request they update these details with the credit bureaus they are connected with. Your credit report will then be updated the next time they send your information over to the credit bureaus if they agree with your request.

Going forward, if you move house, or you change employment, you can provide that updated information to your creditors so the most up to date information remains on your credit report.

While we at Tippla will always do our best to provide you with the information you need to financially thrive, it’s important to note that we’re not debt counsellors, nor do we provide financial advice. Be sure to speak to your financial services professional before making any decisions.

Related articles

The Effects of Multiple Credit Enquiries on Your Credit Score

28/07/2023

Credit scores play a crucial role in determining an...

Loan Forgiveness Programs in Australia

23/01/2025

Loan forgiveness, also known as debt forgiveness, is a...

Why You Need a Mortgage Broker to Buy Property in Sydney

29/10/2024

Remember that crazy days when over 200 interested parties...

What is usage-based car insurance?

28/07/2021

With usage-based car insurance, you could save a lot...

Subscribe to our newsletter

Stay up to date with Tippla's financial blog