Published in July 29, 2021

Relationships And Money: When Should I Ask My Partner About Their Credit Score?

Money talk: Why the question “should I ask my partner about their credit score” is important

Do you regularly set aside time to talk about money with your partner? If not, you are not alone. In a recent survey by Relationship Australia, only 37% of Australians have stated that they fully discussed their financial situation with their partner. If you are wondering how you should handle the financial side of your relationship, or you find yourself asking “should I ask my partner about their credit score”, then we’ve got some conversation starters for you.

Time for some real talk: For many Australians, finances are a taboo topic with friends and even with their partners. However, if you are planning a future together, it is important to know where you both stand financially and if you have the same goals. So, you’re likely wondering, “when should I ask my partner about their credit score?”

It’s never too early to talk about finances. Relationships Australia states financial stress as the number one reason for relationships to break down. While money still seems to be a tricky topic for most people, it can make your relationship flourish. Of course, it may not be the best topic to start with on your Tinder date, but knowing each others’ credit score and financial situation is important for any serious relationship.

Benefits of knowing your partners’ financial situation

- Making informed decisions as a team

- Helping and supporting each other with financial distress

- Knowing your combined borrowing power will help you make better future decisions

- Setting joint financial goals

Why financial intimacy matters

While Relationships Australia has found that 73% of Australians think their partner’s financial situation doesn’t matter at all or very little to them, it can have a significant impact on your future. Imagine you only find out that your partner has debt or a bad credit score when you are trying to apply for a mortgage or a joint loan. If you have this conversation early on, you both can be more comfortable and confident with your joint financial situation and tackle potential problems early on. A healthy relationship means honesty in all areas, including your finances.

Money problems, especially debt, are a big stressor in many relationships. If you are serious about your commitment, then the answer to the question “should I ask my partner about their credit score” is yes. You should ask your partner about their credit score and financial situation. Of course, this will only be effective if you are equally open about your own situation.

Relationships and credit scores

Your credit scores tell future creditors if you normally pay your bills on time and how high the risk is that you may miss a payment. When you ask your partner about their credit score, you can find out much more about their financial habits and their relationship with money. Having a low credit score doesn’t mean someone is a bad person. However, it may be an indication that personal finances are not their strong suit and that is something you can work on together.

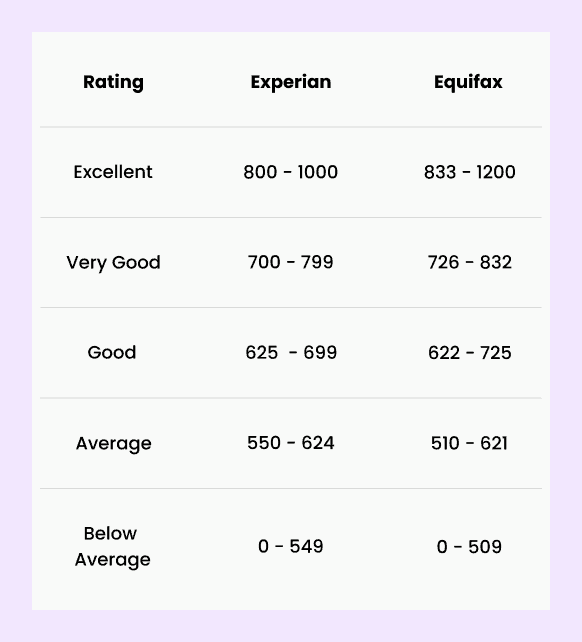

In Australia, you actually have more than one credit score. Experian and Equifax are the two major credit bureaus that collect data about your previous and current credit history. Their scores range from 0 to 1,200/1,000 and, as a rule of thumb, a score above 800 is considered a good credit score.

When should I ask my partner about their credit score?

Another question we get a lot here at Tippla isn’t just should I ask my partner about their credit score, but when. Talking about money doesn’t come easily to everyone. However, if you want to plan a future with your current partner, it is important to know where you are standing and what your joint goals are. There is no right or wrong time to ask your partner about their credit score. However, this chat is definitely due once you start thinking about merging finances together. Joint bank accounts or credit cards mean joint responsibility and it’s only fair for both of you to know where you are standing.

In the future, you may consider bigger financial commitments such as personal loans or even a mortgage. It’s best to know each other and your spending habits well before signing off on anything big.

Setting financial goals together

Even if you don’t plan to buy a house just yet, talking about financial priorities and where your money should go is an important step in any relationship.

Joint bank accounts

There may be a point in your relationship where you consider opening a joint bank account. They are an easy way to pay for joint expenses for living and on holidays. However, you should be aware that you are both equally responsible to pay for any expenses on it. To keep your relationship happy and healthy, you should have a chat first to see who’s responsible to pay for what and what would happen with money on the account if you were to split up in the future.

Joint credit cards

It is even more important to have this conversation before activating a joint credit card. Both of you are legally responsible for paying off any credit card debt no matter who takes out the money. Joint accounts will affect both your credit scores and, therefore, you should know your partner will use it responsibly.

Loans and mortgages

Taking out a loan or a mortgage together is a huge responsibility. You should ask your partner for their credit score months before you seriously consider applying. If there are any issues, you may have enough time to fix them so that you can get better interest rates and loan terms. Otherwise, it may be sensible to wait until your scores have improved.

See where you’re both at

While it may feel like a difficult discussion to have at first, it doesn’t have to be! Skip the blame game. Talking about finances simply means to know where you are at. Remember the last time you felt bad because you felt obligated to pay for an overpriced dinner? If you and your partner had talked about your financial situation prior to that, you would have known about each other’s financial priorities and budgets.

Important topics to talk about include

- income

- regular expenses

- assets, including your house and car

- super and investments

- debts and loans

It’s important to know your credit score situation first, before taking a look at your partner. Tippla helps you compare and monitor your credit scores for no cost whatsoever.

What if my partner has bad credit?

If you ask your partner about their credit score and the outcome is not great, don’t be frustrated. A bad credit score is not the end of the world and doesn’t have to negatively impact your relationship. Mistakes happen, and unfortunately, some of them stay on your credit report for up to 7 years.

The good news is that your partner can build up their credit score over time, the earlier you start the better. Teaching each other good financial habits can be wholesome and nourishing for your relationship as long as it happens in a caring way. Try to understand where your partner is coming from and what their struggles are.

- A first step could be to sit together and get an overview of their financial situation. How much are they earning, what financial commitments do they have?

- Thoroughly go through their credit report and check if everything is correctly listed. A mistake on a credit report can make them lose valuable points.

- Develop strategies together to repay debt. A lower debt to credit ratio can already improve your credit score immensely.

- There are two ways to approach personal debt: You can start by making the minimum payment on all debts. Pick the smallest one and use spare cash to pay it off as quickly as possible. Then use the new spare cash to tackle the next debt, one at a time. This is called the snowball method. Alternatively, you can focus on the debt with the highest interest rate first. This will save you money over time but take a little longer until you have your first success.

- Work out a realistic budget together. Some people may struggle to cap their spendings by setting up budgets for certain areas. However, it is important to have an eye on your spendings to help you save money and get your finances under control.

What is a good credit score? Here’s how Equifax and Experian categorise your credit scores:

Source: Experian and Equifax

Where to get help if your partner is bad with their finances

If you already joined forces together but you are unhappy with the way your partner is managing their finances, you can get help.

Talking to your partner about money and finances is difficult? If you don’t know how to ask your partner about their credit score, you may want to look for a relationship counsellor to help. You can find resources on

If you and your partner struggle with personal debt, seeing a free financial counsellor may help.

Should I ask my partner about their credit score?

To summarise, in answer to the question – should I ask my partner about their credit score, the answer is yes. In a committed and open relationship, you should be willing to share this information. It’s also so important to know your financial position before you make any big decisions.

Sources: Relationships Australia Survey 2019

While we at Tippla will always do our best to provide you with the information you need to financially thrive, it’s important to note that we’re not debt counsellors, nor do we provide financial advice. Be sure to speak to your financial services professional before making any decisions.

Related articles

Credit Scores for Small Business Owners in Australia

20/09/2023

If you’re a small business owner, you probably know...

Do Investments affect your credit score?

22/01/2025

Whether in property, the stock market, cryptocurrency, or a...

Answering Australians’ Top Questions About Credit Enquiries

22/11/2023

In a nutshell, credit enquiries occur when you apply...

Subscribe to our newsletter

Stay up to date with Tippla's financial blog