Published in September 28, 2021

How to Remove Negative Entries From Your Credit Report

Negative entries can have a serious impact on your credit score. If you want to know how to remove negative entries from your credit report then we’ve got the breakdown below.

What is a negative entry on your credit report?

A negative entry is some kind of information on your credit report that lowers your credit score. The term negative entry encases any bad financial behaviour that indicates that you haven’t effectively managed your debt.

Examples of negative entries include:

- Late payments on loans or credit cards;

- Delinquent accounts;

- Charge offs;

- Bankruptcies;

- Accounts that have been sent to collection;

- Foreclosures.

Therefore, if you’ve ever defaulted on a repayment for some kind of credit, say your personal loan, then that will be listed on your credit report. This is classified as a negative entry and would have lowered your credit score when it was first added.

How long do negative entries stay on your credit report?

The length of time a negative entry will remain on your credit report depends on what the negative entry is. Here’s an overview:

| What stays on your credit report and for how long | |

| Defaults | If you have defaulted on any credit repayments, it will show on your credit report for 5 years. |

| Court Judgements | If you have received any court judgements, it will appear on your credit report for 5 years. |

| Bankruptcies | If you enter into bankruptcy, it will show on your report for up to 5 years. |

| Serious Credit Infringements | Any serious credit infringements will stay on your report for up to 7 years. |

How do negative entries affect your credit score?

To put it simply, negative entries on your credit report will negatively affect your credit score. When the negative entry is first put on your report, your credit rating will fall. By how much depends on the credit bureau and what kind of negative entry it is. See one of our latest articles for an overview of how your credit score is calculated.

If you show consistent negative credit behaviour, such as continuously defaulting on payments, going into bankruptcy, etc., then your credit score will continue to suffer.

However, if you have only one negative entry on your credit report, and since then, you have only displayed positive behaviour through your credit history and continue to do so, then your score might recover, or only be affected minimally.

According to Equifax, one of the main credit reporting bodies in Australia: “It is unlikely one late payment, depending upon how late the payment was, followed by making your repayments on time, will significantly impact your credit score, however, several late payments could be an indication you are in financial stress and may negatively impact your credit score.”

How to remove negative entries from your credit report?

Now you know what negative entries are, and how long they stay on your credit report, let’s answer the question “how can you remove negative entries from your credit report”.

The answer to this question has a couple of layers, and it all boils down to – is the information correct, or is it incorrect?

If the information is correct

As highlighted by MoneySmart, if the information is correct, even if it is negative and harms your credit score, then you can’t remove it from your report. Instead, you’ll have to wait 5-7 years for the negative information to leave your credit report naturally.

If there has been a mistake

If there has been some kind of mistake then you should be able to remove it. If you notice a negative entry on your credit report that you don’t recognise or is incorrect, the first thing you should do is reach out to the relevant credit provider.

If they find that there has been some kind of error on their side, then they should rectify the mistake with the relevant credit reporting agencies, and it will be removed from your credit report. It’s a good idea to keep a close eye on your report to make sure they do remove the negative entry on your credit report.

Whilst this is the general rule, there are nuances for each negative entry. Let’s take a closer look, and see what requirements need to be met so you can remove negative entries from your credit report.

Defaults on your credit report

A default is when your credit or loan repayment has been overdue for at least 60 days, or the overdue payment is equal to or more than $150. According to the Office of the Australian Information Commissioner (OAIC), for a default to be listed on your credit report, the provider that you owe money to must have sent you a notice to your last known address to inform you of the overdue payment and request payment.

Then, the provider must send you a second notice at least 30 days later to inform you that if you don’t make the payment, then they will disclose it to a credit reporting body.

Once this second notice has been sent, the provider then has to way at least 14 days after issuing the second notice before informing a credit reporting body of your default. Furthermore, the OAIC highlights that the credit provider can’t wait more than 3 months after issuing you with the second notice to list the default.

“If a credit provider mistakenly sent the notices to an old address that was not your last known address then the default listing may not be valid. However, if they sent the notices to an old address because you failed to update your contact details then the credit provider is likely to have met the notice requirements,” the OAIC highlights.

How to remove defaults from your credit report

After a default has been listed on your credit report, it will remain for 5 years. If you pay the overdue amount after your credit provider has listed the default, then the listing will remain on your credit report, but the status will be updated to reflect that the payment was made.

If you want to remove the default from your credit report, the only way you can do that is if the default is not valid. If you can prove that there has been some kind of mistake, or that the credit provider has sent your notices mistakenly to an incorrect address, then the default might not be valid.

However, if the credit provider sent the notices to an old address because you didn’t update your contact details, then according to the OAIC, the credit provider is likely to have met the requirements and the default is valid.

If you can prove that the default is somehow invalid, you can get it removed from your report. If you can’t and the default is valid, then it will remain on your credit report for up to 5 years.

How do defaults affect my credit score?

If you do end up having a default on your credit report, how will it affect your credit score? Equifax outlines that a default on your report will negatively impact your credit score.

“If you have a default on your credit report you can lessen the impact of the default on your score by making repayments on time. This more recent good behaviour can help improve your score.”

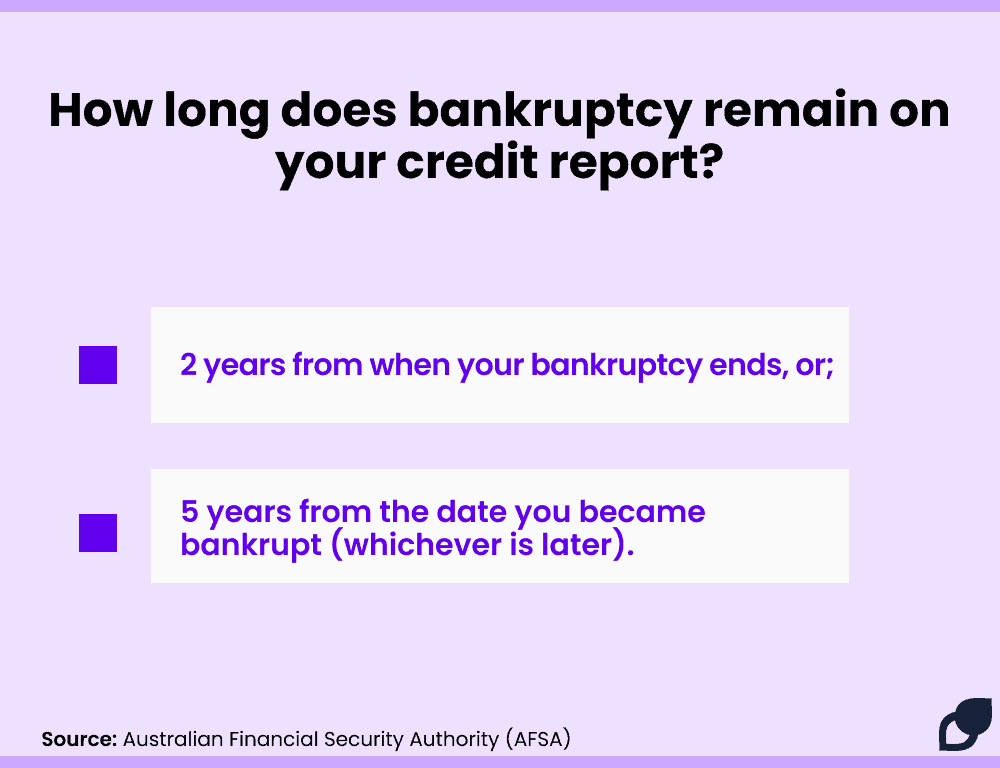

Bankruptcies and court judgements

In Australia, bankruptcy normally lasts for 3 years and 1 day, although it is possible to get out of bankruptcy earlier. As highlighted by the Australian Financial Security Authority (AFSA) your credit report will continue to show your bankruptcy for either:

The Consumer Action Law Centre, an advocacy organisation, outlines that for a bankruptcy or court judgement to be removed from your credit report, then you would need to have the public record details changed to have the listing removed from your credit report.

“Credit reporting agencies obtain court judgment and bankruptcy information directly from the Courts and the Australian Financial Security Authority records. This might involve having the court judgment set aside,” the organisation states.

As was the same with defaults, you can only have bankruptcies and court judgements removed from your credit report if they are inaccurate.

How does bankruptcy affect your credit score?

Like all negative entries, the question of how does bankruptcy affect your credit score is complicated. This is because the exact formula credit bureaus use to calculate your credit score varies between each of them, and only some information is public knowledge.

However, what we do know is that going into bankruptcy will harm your credit score. This is because it sends a clear signal to credit providers that you couldn’t effectively manage your debt and you have a high risk of defaulting on your repayments.

Protect your credit score

As the saying goes, prevention is better than cure. If you want to avoid having negative entries on your credit report, then the best thing you can do is avoid defaulting on payments, serious credit infringements, court judgements and bankruptcies.

In some cases, this is easier said than done. Sometimes life can throw you a curveball. Because of that, here are some things you could try to help you stay on the right path:

- Create a budget and limit your spending to only what you can afford;

- Set up an emergency fund to cover unexpected expenses;

- Only borrow what you can afford;

- Set up automatic payments so you don’t miss any repayments;

- Make sure your contact information, including your email and address, is updated with any companies that you have a loan or credit card with.

Keep an eye on your credit report

Another thing you can do to protect your credit score is to keep an eye on your credit report. 1 in 5 credit reports has some kind of mistake on it. These mistakes can often harm your credit report.

If you regularly check your credit report, then you might be able to spot a mistake straight away and have it removed from your credit report. The quicker you notice and remove the mistake, the less damage it can do to your credit score and financial wellbeing.

While we at Tippla will always do our best to provide you with the information you need to financially thrive, it’s important to note that we’re not debt counsellors, nor do we provide financial advice. Be sure to speak to your financial services professional before making any decisions.

Related articles

How to Report Credit Card Fraud: Protect Yourself and Your Credit Score

26/07/2021

Fraudsters are adopting more sophisticated methods to steal your...

What’s the Most Efficient Way of Building Your Credit Score?

28/07/2021

Building good credit: Where to start Good credit can...

Managing Multiple Credit Accounts

08/02/2024

Managing multiple credit accounts is a common financial strategy...

Subscribe to our newsletter

Stay up to date with Tippla's financial blog