Published in January 30, 2024

Understanding the Impact of Utility Debts on Your Credit Score

In Australia, understanding the factors that influence your credit score is important to maintain a healthy financial profile. Credit scores play a big role in determining an individual’s creditworthiness; this can affect their ability to secure cash loans as well as other financial services including acquiring a mortgage or purchasing a car.

While traditional credit providers, such as banks and credit card companies, directly impact credit scores, there is often confusion about the role of utility debts in this equation.

Utility bills, including those from telecommunications and service providers, can affect your credit score if left unpaid for an extended period. Despite utility companies not being licensed credit providers, their ability to report non-payment (defaults) to credit reporting agencies means that overdue bills may negatively impact your creditworthiness, too.

Understanding Utility Debts

Utility debts refer to the amounts owed for essential services provided to households or businesses. In Australia, these typically encompass services like electricity, gas, water, and other essential utilities crucial for daily living.

Reporting of Utility Debts

Utility companies in Australia have the authority to report non-payment of bills to credit reporting agencies. This includes services such as electricity, gas, and water. When a consumer defaults on utility bills, the utility provider may notify credit bureaus about the delinquency, leading to potential negative effects on the individual’s creditworthiness.

Differences Between Utility Debts and Other Types of Debts

- Nature of Debt: Utility debt in Australia arises from missed payments on essential services like gas, energy, and water. Other types of debts can include unsecured debts like ordinary bills or telephone bills.

- Priority Status: Utility bills are considered priority debts in Australia, emphasising the importance of timely payments due to the critical nature of these services.

Duration of Utility Debts on Credit Reports

The duration of utility debts on credit reports varies. Generally, information about late payments or defaults, including utility debts, can stay on a credit report for five to seven years. The exact duration depends on the credit reporting agency’s policies and the severity of the default.

Severity of Impact Compared to Other Debts

While missed payments on any debt can negatively impact your credit score, the severity of the impact may vary depending on the type of debt. Utility debts, such as unpaid bills for services like electricity, gas, or water, do not directly impact your credit score. However, if these debts are referred to a debt collection agency and the agency reports the information to a credit reporting bureau, it may have an impact on your credit score.

Managing Utility Debts

Strategies for Avoiding Late Payments

To avoid late payments on utility bills in Australia, consider implementing the following strategies:

- Implement Automated Payment Reminders: Use automated systems or apps to set up payment reminders for your utility bills. This ensures you are notified before the due date, reducing the risk of overlooking payments.

- Utilise Direct Debits: Set up direct debits with your utility providers to allow automatic withdrawals on the due date. This helps in ensuring timely payments without the need for manual intervention.

- Re-negotiate Payment Terms: If facing financial challenges, consider renegotiating payment terms with your utility providers. Some may offer flexible plans or options during times of difficulty.

Safeguarding Your Credit Score

Budgeting for Utility Expenses

- Develop a Utility Budget: Allocate specific amounts in your budget for utility expenses, considering variations in usage and potential fluctuations in costs.

- Regular Review and Adjustment: Periodically review and adjust your budget to accommodate any changes in utility rates or consumption patterns.

Regular Monitoring of Credit Reports

- Obtain Regular Credit Reports: Obtain credit reports from reputable agencies to monitor your credit history, including utility payment records.

- Promptly Address Inaccuracies: If you identify any inaccuracies related to utility payments, promptly dispute and rectify them with the credit reporting agencies.

Helpful Tip 📢 Did you know that there is an easier way for you to access your credit score? Simply sign up to Tippla and get access to our financial dashboard where you can track your credit score as well as your expenses. The best part? It’s completely free!

Legal and Consumer Rights

Consumer Rights Regarding Utility Debts

- Consumer Guarantees Under Australian Consumer Law (ACL): Consumer Guarantees refer to the automatic rights granted to consumers when purchasing goods or services. These guarantees are established under the Australian Consumer Law (ACL) and are applicable regardless of any manufacturer’s warranty period. Consumer Guarantees apply to utility services, ensuring they meet acceptable quality and are provided with due care and skill.

- Protection Against Unfair Practices: The ACL prohibits unfair practices, providing consumers with rights in case of unjust treatment related to utility debts.

Legal Protections for Consumers in Australia

- Fair and Reasonable Treatment: The Australian Consumer Law and ASIC Act mandate fair and reasonable treatment for consumers in debt situations, ensuring ethical debt collection practices.

- Enforcement of Consumer Rights: Consumer protection laws are enforced by entities such as the Australian Communications and Media Authority (ACMA) and the Australian Securities and Investments Commission (ASIC). Consumers can rely on these regulatory bodies to actively monitor and enforce compliance with consumer protection laws.

Seeking Help from Consumer Protection Agencies

- ACCC and Consumer Protection Agencies: Consumers can seek assistance from the Australian Competition and Consumer Commission (ACCC) and local consumer protection agencies in each state and territory for dispute resolution and guidance.

- Financial Rights Legal Centre: The Financial Rights Legal Centre provides resources and assistance for consumers facing financial stress, including issues with utility debts.

Responsible management is the key to ensuring that your credit score does not get affected negatively by your utility dues. Keep in mind that unpaid bills may only affect credit reports if they go to collections, so communicating with your providers during times of financial distress can also help safeguard your credit profile.

While we at Tippla will always do our best to provide you with the information you need to financially thrive, it’s important to note that we’re not debt counsellors, nor do we provide financial advice. Be sure to speak to your financial services professional before making any decisions.

Related articles

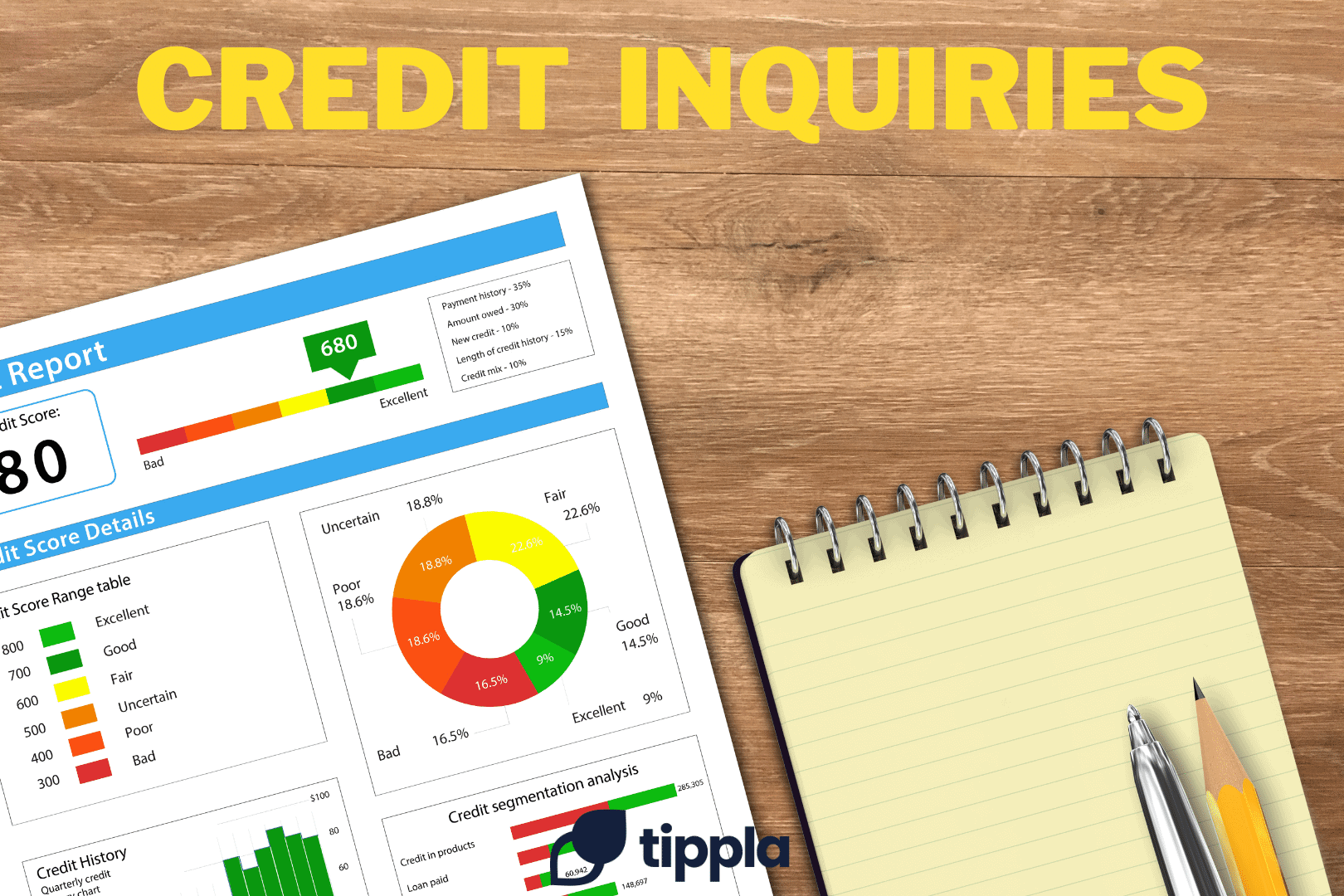

The Difference Between Hard and Soft Credit Inquiries

14/07/2023

Understanding all the factors that can affect your creditworthiness...

Has Your Credit Report Been Updated? Here’s What to Check

28/07/2021

Every three months, your Equifax and Experian credit reports...

The Role of Credit Scores in Renting a Property in Australia

09/12/2024

Renting a property in Australia is a significant milestone,...

Subscribe to our newsletter

Stay up to date with Tippla's financial blog