Published in October 19, 2021

What is Credit Repair? How to Fix Your Credit Score

Mistakes on your credit report are common. Learn how to identify mistakes and repair your credit report so they don’t harm your credit score.

Mistakes on your credit reports can be quite common. Whether it’s consumer error when filling out credit applications or errors made by the credit providers, mistakes on your credit report can be damaging to your credit score. Tippla has put together this helpful guide on credit repair, so you know how to fix your credit score, should you need to.

What is Credit Repair?

Let’s start first with taking a look at credit repair – what is it, and why would you need to repair your credit report. To put it simply, credit repair is a term that’s used to describe the process of improving an individual’s credit report.

Credit repair involves reviewing your credit report, ensuring that all the personal information is correct and up to date, and investigating any negative entries that might be harming your credit score.

Once the review is complete, a process is undertaken to update or fix any mistakes on the credit report, trying to remove negative listings when applicable.

Why would you need to repair your credit report?

There’s a couple of reasons why. Namely, your credit score indicates your creditworthiness (how reliable of a borrower you are). The higher your score, the more reliable you are deemed to be.

Your credit score is calculated based on the information contained in your credit report. If there are mistakes on your report or negative entries, then this can harm your credit score.

Your credit score and report are some of the factors lenders and credit providers use when determining whether to accept or reject your credit applications. The higher your credit score, the better your chances of getting approved.

Furthermore, your credit score can influence a few things when it comes to credit, such as the interest rate you’re offered, the options available to you and more. Once again, the higher your credit rating, the better chance you have of getting lower interest rates and better terms.

Therefore, credit repair is one way you can make sure your credit score remains healthy, or as high as it can be.

How common are mistakes on your credit report?

Unfortunately, mistakes are quite common on your credit report. 1 in 5 credit reports have some kind of mistake on them. In Australia, if you want to dispute information on your credit report, you can lodge a complaint with the relevant credit provider, or one of the credit bureaus.

According to regulation from the Australian Securities and Investments Commission (ASIC), when you make a complaint with either a credit bureau or credit provider, they have 30 days to respond to or resolve your complaint.

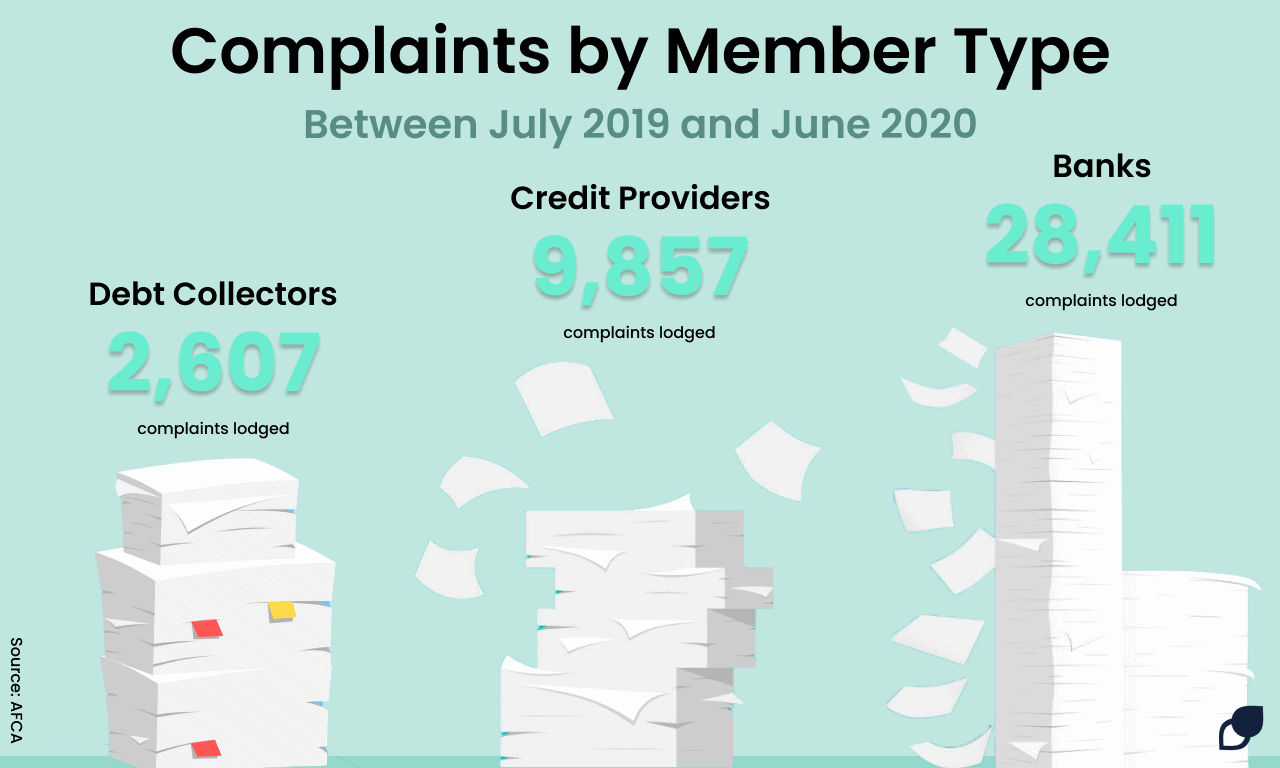

If the complaint is not resolved within this time, then you can raise a complaint with the Australian Financial Complaints Authority (AFCA). Recent data from AFCA’s 2019-20 annual review highlights just how prevalent complaints are within the credit space.

Between the 1st of July 2019 and the 30th of June 2020 credit providers received 9,857 complaints, according to the annual review, whereas debt collectors or buyers received 2,607 complaints during the period.

When it comes to complaints received by issue, credit reporting topped the list, with 6,381 complaints lodged. Credit reporting complaints topped other issues such as service quality, unauthorised transactions and incorrect fees/costs.

When it comes to credit complaints, credit cards were the most complained about product. Specifically, 11,628 complaints were received during the period.

AFCA highlighted in its report: “There was also an increase in the average number of complaints received per month about credit reporting (up 34%), unauthorised transactions (up 14%) and responsible lending (up 14%). An increase in credit reporting complaints was partly driven by a rise in consumer awareness about credit scores and increased refinancing activity towards the end of the year.”

AFCA’s report clearly highlights just how prevalent mistakes on Australian credit reports are.

Most common mistakes on your credit report

Now you know just how common mistakes can be on your credit report, let’s cover the most common mistakes on your credit report. To help us answer this question, Tippla spoke with Chinelle Wardle, the Director of Wardle Consultancy Services Pty Ltd.

According to Wardle, here are some of the most common mistakes on credit reports:

- Personal information – incorrect name, wrong or outdated address, and issues with the driver’s licence number are common offenders;

- Credit enquiries – incorrect amount or wrong product listed are some of the most frequent issues;

- Repayment history – not included on the report at all.

How to repair mistakes on your credit report

Now you know what is credit repair, let’s get stuck into how you can repair your credit report. The first thing you should do when you notice a mistake or want to dispute a negative entry is to reach out to the credit provider to resolve the issue.

Wardle advises consumers to raise a complaint with their creditor about the incorrect information. If the complaint isn’t resolved within the required 30 days, Wardle suggests you seek for it to be escalated further both internally within the creditor’s complaints area, and if necessary, escalate it externally with an ombudsman such as AFCA.

For a more thorough overview of credit repair, you can check out Tippla’s Credit School, where we provide a thorough overview of credit repair. Specifically, we take a deep dive into credit repair, the importance of personal information, how to fix your credit score, and how to prevent mistakes on your credit report.

While we at Tippla will always do our best to provide you with the information you need to financially thrive, it’s important to note that we’re not debt counsellors, nor do we provide financial advice. Be sure to speak to your financial services professional before making any decisions.

Subscribe to our newsletter

Stay up to date with Tippla's financial blog