Published in September 13, 2021

Does a Personal Loan Harm My Credit Score?

There are many reasons you might want to take on a personal loan – an unexpected expense, an upcoming holiday, or even to cover a medical bill. But if you’re wondering “does a personal loan harm my credit score?”, Tippla has done the legwork for you! Below you’ll find the information you need to know.

What is a personal loan?

A personal loan is a type of credit that allows you to make big purchases or consolidate your debts. These types of loans are repaid with interest over a fixed term, ranging from months to years. You can apply for a personal loan from a bank, credit union, or online lender.

The reason for taking out a personal loan can vary. Here are some examples:

- Consolidating debt;

- Big purchases: car, holiday, wedding, renovations, medical, etc;

- To cover unexpected expenses.

If you decide to apply for a personal loan, it can be overwhelming to see how many options are out there. It can be difficult to understand what’s the best loan for you. Here are some key factors to keep an eye out for when comparing loans:

- Interest rate;

- Repayment terms;

- Borrowing limits (minimum and maximum amounts);

- Fees;

- Collateral requirements.

Types of personal loans

There are many options for personal loans. That’s why it’s important to understand your personal and financial situation so you can choose the best option for you. Here’s a breakdown of the two most common types of personal loans:

Secured loan: a secured personal loan is a loan guaranteed by an asset, such as a car, motorbike, or something similar. The asset acts as security and if you default on your loan, then you’re at risk of losing the asset.

Because of the extra security, secured personal loans are generally easier to obtain from a reputable lender. They typically come with lower interest rates and fees as there is less risk for the lender.

Unsecured loan: as the name suggests, an unsecured personal loan has no asset attached to the loan. Because of this, the lender is taking on more risk which means you’ll generally be charged higher fees and interest rates than a secured loan. This type of loan is good if you don’t have an asset, though you may have to convince the lender that you’re able to make the repayments through proof of income, and if this is your first loan, you may require a guarantor for security.

What is a credit score?

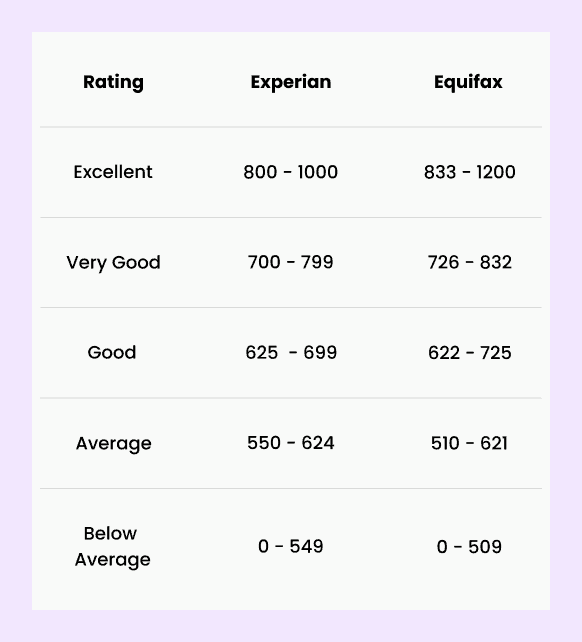

Before moving straight into discussing the question “does a personal loan harm my credit score”, let’s take a moment to talk about credit scores. Let’s start with the most important question – what is a credit score? A credit score is a number that ranges from 0 – 1,200.

A lot of people don’t know how credit scores are calculated. To put it simply, your rating is based on the information contained in your credit report. Your report considers factors such as your repayment history, your credit accounts and even how many times you have applied for credit.

A good credit score indicates to lenders that you have a high level of creditworthiness. The better your score, the more likely you will be approved for a loan and reap the benefits of a higher loan amount and/or lower rates. Your score falls somewhere on a five-point scale ranging from below average up to excellent.

Source: Experian and Equifax

Does a personal loan harm my credit score?

Unfortunately, there isn’t a simple answer to “does a personal loan harm my credit score”. Like any form of credit, a personal loan will affect your credit score. But how it affects your score depends on how you handle the personal loan.

When you first make an application for the loan, your credit score will be lowered. Whilst your credit rating will take a hit when applying for the loan, after this point, a personal loan can be beneficial for your score. When used responsibly, your credit score can improve when you take out a personal loan.

Let’s take a closer look at this.

Applications

When searching for the right personal loan you should try and minimise the number of applications you make. Why is this? When you apply for a personal loan, you are giving the company you’re applying to permission to check your credit report. When they check your credit report this is referred to as a hard enquiry. Hard enquiries harm your credit score, regardless of whether you are approved.

A large number of applications within a short period of time are not viewed positively. Not only will the multiple applications harm your credit score further, but future lenders may also assess your application and deem this proof of you being rejected previously, thus making you a risky borrower.

Instead, you could consider researching your options further and only make one application for the loan which best matches your criteria.

Repayments

If you fail to repay the loan, it will appear on your credit report as a default. This will negatively impact your credit score. Not only will this stay on your credit report for five years, but you may also lose the asset you used to secure the loan (if applicable) or run the risk of having to deal with debt collectors.

What to consider before taking on a personal loan

So we’ve covered the question of does a personal loan harm my credit score, but what about the factors you should consider before taking out a personal loan? Here are some things you should consider before applying for a loan.

Do you meet the loan requirements?

The first thing you can consider is whether you meet the requirements for a personal loan. The basic requirements of any loan are that you are over the age of 18, have a regular income, be a permanent Australian resident (or hold an acceptable non-resident visa), and can provide an overview of your current financial situation.

Check the terms and conditions

The next step you could take is to look into the finer details of your loan. The interest rate is the amount that the financial institution charges in addition to the money you’ve borrowed. Aiming to find the lowest interest rate means that you can focus on paying off your loan rather than extra interest.

On top of interest rates, you may also have fees associated with your loan. All loans have different associated fees; some to look out for include establishment, servicing, early repayment, early exit, insurance, and withdrawal fees.

How long is your loan term?

Another factor worth considering is the term of the loan. The length of your personal loan will determine the amount of interest you are charged over its life. Typically, the longer the loan, the lower the monthly repayments.

How will you pay off the loan?

When taking on a loan, it is important to know beforehand how you will pay off the loan. Whether you choose to opt for weekly, fortnightly, or monthly repayments – or even want to pay it off sooner than the term. Such elements are great starting points to consider before making any personal loan applications.

Effectively manage debt

As we’ve addressed in this article, the question “does a personal loan harm my credit score” isn’t a straightforward one. But if you can effectively manage your personal loan and your debt, then you could actually make your loan work for you.

Here are some easy steps you could take to effectively manage your debt:

- Consistently make your repayments;

- Don’t borrow more money than you can afford;

- Consolidate your debt;

- Take the time to look for the loan that offers the best value instead of creating multiple applications;

- Consider making extra repayments if you can;

- Seek expert advice if you encounter trouble.

While we at Tippla will always do our best to provide you with the information you need to financially thrive, it’s important to note that we’re not debt counsellors, nor do we provide financial advice. Be sure to speak to your financial services professional before making any decisions.

Related articles

Credit Enquiries for Auto Loans

24/11/2023

Undergoing the Car Financing Process Without Harming Your Credit...

Credit Scores and Mortgage Applications: What Australians Need to Know

15/09/2023

Many Australians dream of owning their own home, but...

Can You Get a Personal Loan After Bankruptcy?

12/10/2021

There are many reasons why someone might have to...

What is a Good Credit Score? Getting Your Credit to Work For You

28/07/2021

You may not realise it, but credit scores play...

Subscribe to our newsletter

Stay up to date with Tippla's financial blog