Published in July 28, 2021

How Are Credit Scores Calculated in Australia?

There’s a lot of uncertainty when it comes to credit scores. There’s one question, in particular, that has a lot of mystery surrounding it – how are credit scores calculated in Australia? We’re here to pull back the curtain and give you all the information you need.

Credit scores in Australia

Before diving into how are credit scores calculated, you first need to understand what your credit score is. In Australia, three credit bureaus calculate your credit score – Equifax, Experian and illion. Your credit score sits somewhere on a scale ranging from 0 to 1,200. The higher your score, the better.

Your credit score is a number that represents how trustworthy of a borrower you are – i.e. how likely you are to make your repayments if you take on some kind of credit. There are many things that constitute as credit.

Examples of credit

The following are examples of different types of credit in Australia:

- Credit card;

- Loans – personal loans (secured and unsecured), car loans, home loans (mortgage), business loans, student loans and more;

- Buy Now Pay Later services;

- Mobile phone;

- Internet;

- Electricity or gas;

- Water.

Your credit score is based on many factors. These include your credit history – do you always make your repayments on time, have you applied for credit recently, and if so, how many applications did you make? Other factors include more serious credit infringements – have you gone through bankruptcy, have you entered into default?

What is a good credit score?

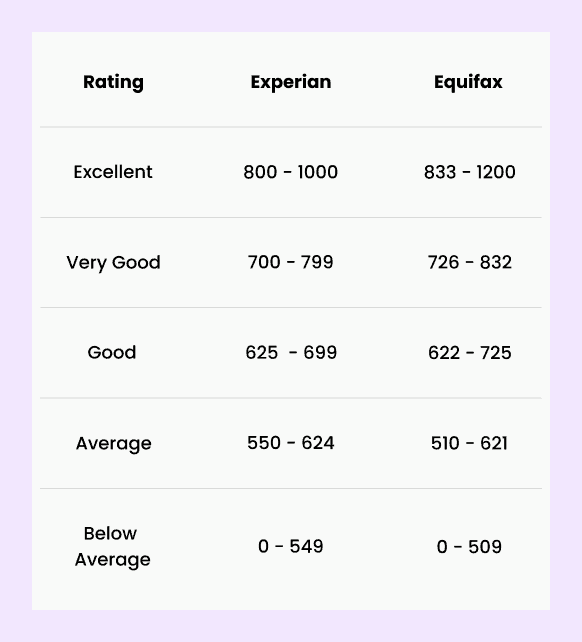

Your credit score generally falls on a five-point scale – below average, average, good, very good and excellent. The higher your credit rating, the better it is. Not only does having a good credit score feel nice, but it could also unlock many financial benefits for you.

These include lower interest rates when you take on some kind of credit, a larger variety of credit options, and better terms. All of these benefits could save you money, and all it takes is a good, or even excellent credit score.

So what is a good credit score? A good credit score differs between each of the bureaus. Here’s how Experian and Equifax categorise credit scores in Australia.

Source: Experian and Equifax

Understanding the difference between your credit score and credit report

What is the difference between your credit score and credit report? Simply put – your credit score is a number, ranging from 1 to 4 digits. This number gives lenders and credit providers insight into how reliable of a borrower you are.

Your credit report is also referred to as a credit file, however, is what determines your credit score. Your credit report contains detailed information on your credit history. It outlines your credit accounts, credit enquiries (otherwise referred to as credit applications), defaults, judgements and details your credit history.

If the information contained within your credit report demonstrates good credit behaviour, then you’re likely to have a credit score falling somewhere between good to excellent. If your credit report shows too many credit applications, defaults and serious credit infringements, then you’re likely to have a score ranging from below average to average.

Here’s an overview of what goes on your credit report and how long it stays there:

| Activity | Average length on your credit report |

| Credit Accounts | Any open credit accounts and accounts that have been closed in the past two years will appear on your credit report. |

| Credit Enquiries | Any application you have made for some type of credit, whether it be a loan or credit card, will appear on your credit report for 5 years. It will appear on your report regardless of whether you went ahead with the credit, and if you were approved or rejected. |

| Repayment History | Your repayment history over the past 2 years will appear on your credit report. |

| Defaults | Your credit report will show if you have defaulted on any repayments in the last 5 years. |

| Court Judgements | Same with defaults, if you have received any court judgements in the last 5 years, then it will appear on your account. |

| Bankruptcies | If you enter into bankruptcy, it will remain on your report for 5 years. |

| Serious Credit Infringements | Any serious credit infringements will stay on your report for up to 7 years. |

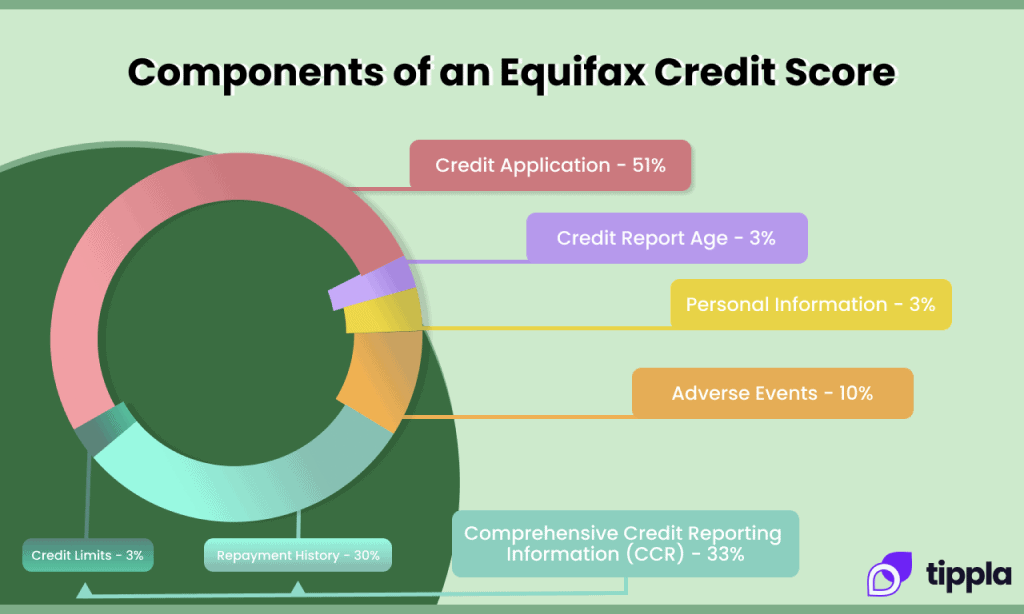

How does Equifax calculate my credit score?

Credit bureaus like to keep the exact algorithm they use to calculate your credit score close to their chest. Nonetheless, they have revealed certain information about how they calculate your credit score.

According to Equifax, the general factors considered in credit score calculations are as follows:

-

- The number of accounts you have;

- The types of accounts;

- The length of your credit history;

- Your payment history.

Equifax has also outlined the below information as its standard Credit Score model used in its assessment. Of course, this is only a general overview and it is subject to change. Nonetheless, it provides a good picture of what the credit bureau deems as the most important.

Source: Equifax

How does Experian calculate my credit score?

Now you have a better understanding of how Equifax calculates your credit score, let’s take a look at how Experian calculates your credit score.

As highlighted by the bureau itself: “Your Experian Credit Score is calculated applying a statistical algorithm that uses past events to predict future behaviour. Each credit bureau uses a slightly different algorithm and does not disclose in detail how this is calculated.”

Experian does go on to outline some key attributes that are used to generate your credit score. This includes:

- Type of credit providers that have made enquiries on your report;

- The type of credit you have applied for;

- Your repayment history;

- The credit limit of each other credit products;

- Negative entries;

- The number of credit enquiries (credit applications) you have made.

Whilst we don’t know how much each of these items weighs when it comes to calculating your score, you can assume that the above factors will have some influence on your rating. Therefore, if you want to have a good credit score or higher, then you could ensure that you employ positive credit behaviour regarding the above items.

How does illion calculate my credit score?

Last but not least, let’s take a look at how illion calculates your credit score. On its website, illion says that it determines your credit rating by looking at whether you’re reliable with paying your bills.

Furthermore, the credit reporting agency also outlines that the following events could harm your credit score:

- Not paying your bills on time, or failing to pay them at all;

- Applying for credit too often;

- If someone else defaults on a joint debt.

With this in mind, we can assume that paying your bills on time and spacing out your credit applications could have a positive impact on your credit score.

Credit score calculator

Unfortunately, there’s no such thing as a credit score calculator. However, there are several ways you can check your credit rating. If you’re just wanting to know your credit score, then there are many free online sites you can use. Similar to Tippla, you can sign up in minutes, and you’ll usually need to provide some kind of identification, like your driver’s licence.

However, if you also want to see your credit report, where all the important information is, then some of the online sites won’t be able to help you. This is where Tippla can help!

With Tippla, not only can you check your credit score, but you can also see your full credit report for both Equifax and Experian. This provides you with a more thorough overview of your credit situation. The sign-up process takes just minutes and it is completely free.

Alternatively, you can get your report directly from each of the credit bureaus. However, you will have to wait 10 days to get your report. If you want your credit report within 10 days, then you might have to pay for it. You might also incur a fee if you ask for a copy of your credit report more than once a year.

How to improve my credit score

There are many ways you can improve your credit score. We recently put together a helpful guide on how to improve your credit score. Here’s a breakdown:

Space out your credit applications

One way you can improve your credit score, or at least, limit the damage to your credit score, is by spacing out your credit applications. When you apply for any type of credit, the lender will look at your credit report. This registers as a hard enquiry on your report and harms your credit score for a time.

The more applications you make in a short period, the more damage it will do. If you space out your credit applications, then you can limit the damage to your credit score.

Not only that but multiple applications in quick succession can indicate to lenders and credit providers viewing your report that you are in financial distress. Regardless of whether this is the case or not, it could lead to you being rejected for a loan.

Make your repayments on time

As outlined by the three credit bureaus, your repayment history is factored into your credit score. For some, it is the most important ingredient. That’s why ensuring that you make your repayments on time is important if you want to have a good credit score.

Keep your credit accounts open

Whilst having too many lines of credit open can be bad for your credit score, it can also be good to keep your credit accounts open, even if you’re not using them. Confused? It does sound contradictory. Here’s how it works.

The age of your credit account matters, and it can contribute positively to your credit score. The older the account, the better it is for your rating. That’s because it demonstrates that you can consistently handle a line of credit.

Check your credit report frequently

If you want to stay on top of your credit score, then it’s a good idea to check your credit report frequently. Your report can change often, sometimes even multiple times a day. You can never be too careful.

If you become familiar with your report and score, then you can see if it drops or increases. Then you can take a look at your report and see what’s changed. This can give you a good insight into what’s good and bad for your score.

Keep an eye out for mistakes on your credit report

1 in 5 credit reports will contain some kind of mistake on them. Not only can mistakes harm your credit score, but they could also be an indicator that you’ve been subject to credit card fraud. That’s why it’s important to check your report and score often.

How Are Credit Scores Calculated in Australia?

Unfortunately, there is no clear answer to the question “how are credit scores calculated in Australia”. This is because the credit bureaus won’t reveal their exact formula for calculating credit scores. Nonetheless, if you do these following things, then it could be the difference between having a good and bad credit score:

- Make your repayments on time;

- Pay your bills;

- Don’t make too many credit applications in a short period;

- Check your credit report frequently;

- Don’t take on too much credit.

Want to know more about your credit score? Head to Tippla’s blog where you can find many informative articles and guides on your credit score. If you want to view your free credit report, you can sign up to Tippla and have your credit score and report within minutes.

While we at Tippla will always do our best to provide you with the information you need to financially thrive, it’s important to note that we’re not debt counsellors, nor do we provide financial advice. Be sure to speak to your financial services professional before making any decisions.

Related articles

How To Pick The Right Loan For You: A Quick Guide

29/07/2021

Are you currently looking for a loan, but you’re...

Understanding and Using Line of Credit Loans

23/07/2024

In Australia, the financial landscape offers a variety of...

A Guide to Preventing Unauthorised Credit Enquiries

14/08/2024

In today’s digital age, safeguarding your financial identity is...

Subscribe to our newsletter

Stay up to date with Tippla's financial blog