Published in October 12, 2021

How Does Bankruptcy Affect Your Credit Score?

Bankruptcy – it’s a word that you’ve very likely heard before, but you can be forgiven for not knowing much about what bankruptcy actually is. But how does bankruptcy affect your credit score and your ability to apply for credit?

Effectively managing debt is an important issue to discuss, especially here in Australia. In 2016, the average Australian household debt was $168,600, with 29% of households holding more debt than they are able to repay. Financial stress has also been identified as one of the key problems in relationships.

What is bankruptcy?

When debt gets out of control, it can lead to bankruptcy. So what is bankruptcy exactly? As explained by the Australian Financial Security Authority, the government agency that manages bankruptcy for individuals, bankruptcy is the legal process when you’re declared unable to pay your debts.

In Australia, an individual can enter into bankruptcy in two ways. You can enter into voluntary bankruptcy by completing and submitting a Bankruptcy Form. Or, a creditor can petition to have you enter a bankruptcy agreement through court proceedings, referred to as a sequestration order. Bankruptcy normally lasts for 3 years and 1 day. However, it is possible to get out of bankruptcy earlier.

Bankruptcy is a scary term. Most of us haven’t had to go through bankruptcy before, but there are still plenty of people who have had to go through some kind of personal insolvency in Australia.

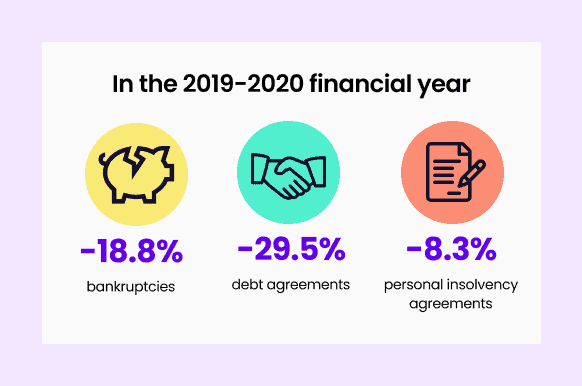

Bankruptcy in Australia

According to figures from the AFSA, in the 2019-2020 financial year, there were 20,762 new personal insolvencies, which refers to people in bankruptcies, debt agreements and personal insolvency agreements. This is lower by 23.3 per cent when compared against the previous financial year.

During this period, there were 12,450 bankruptcies, with Australia recording a drop across all of its states and territories

Bankruptcy vs personal insolvency agreements vs debt agreements

We just threw a lot of technical terms at you: bankruptcy, personal insolvency and debt agreements. So let’s break this down a bit. Personal insolvency and debt agreements are two agreement types you can enter into with your creditors and can be done as a measure to avoid bankruptcy.

A personal insolvency agreement (PIA), also known as a Part X (10) debt agreement, is a legally binding agreement between you and your creditors. It can be used as a way to arrange to settle your debts with creditors without becoming bankrupt.

If you enter into a Part X, a trustee will be appointed to take control of your assets and make an offer to your creditors on your part. This offer might be to pay all or part of your debts either in instalments or a lump sum, depending on your financial situation.

Debt agreements, or Part IX (9) debt agreement, on the other hand, are a legally binding agreement between you and your creditor. This agreement can be a flexible way for you to reach an arrangement with your creditors to settle your debts without becoming bankrupt.

In essence, if you enter into a debt agreement, your appointed debt agreement administrator will negotiate to pay back part of your combined debt – whatever you can afford, over an agreed period of time. Once you complete the payment and the agreement ends, then your creditors can’t recover the rest of the money that you owe.

How does bankruptcy affect your credit score?

Now you know what bankruptcy is, let’s tackle the question “how does bankruptcy affect your credit score”. The exact formula credit bureaus use to calculate your credit score is a well-guarded secret. In saying that, we do know that going into bankruptcy won’t be good for your credit score, as it sends a clear signal that you weren’t able to effectively manage your debt.

Specifically, your report will show your bankruptcy for either:

- 2 years from when your bankruptcy ends or;

- 5 years from the date you became bankrupt (whichever is later).

As highlighted by the AFSA, bankruptcy will remain on your credit report for a maximum of 5 years, assuming your bankruptcy period lasts for 3 years and 1 day. The bankruptcy status will change on your report depending on whether you completed the agreement within the 5 years. If you complete your bankruptcy, the status on your credit report will change to “discharged’. If you complete your bankruptcy agreement before the 3 year and 1 day period, then the bankruptcy will be displayed on your credit report for less than 5 years.

The impact of bankruptcy

Whilst going bankrupt isn’t the end of the world, it can still have a severe impact on numerous aspects of your life, including your ability to borrow credit. Think of bankruptcy as a last resort. There are numerous avenues you could explore first, such as a Part IX or Part X agreement, which should allow you to avoid bankruptcy altogether.

Furthermore, credit providers are required to have hardship policies in place to help you if you are in a bad financial situation. If you are experiencing hardship, it could be worthwhile to reach out to your credit provider first and try to come to an agreement.

In general, once you start the bankruptcy process, your credit score will be negatively adjusted. It will also show on your credit report that you are currently going through bankruptcy. The standard period for completing a bankruptcy agreement is 3 years and 1 day, whereby it will remain on your credit file for an additional two years.

Once you complete the bankruptcy, the status of your bankruptcy will be changed to “discharged” on your report. It will remain this way for an additional two years, before being removed from your report. After completing your bankruptcy agreement, and the status changes on your report, your score might be adjusted positively.

However, it is important to highlight here that although bankruptcy will last on your report for a maximum of 5 years, once you enter into bankruptcy, you will be added to the National Personal Insolvency Index (NPII). The NPII shows details of insolvency proceedings such as bankruptcy in the country.

Applying for credit during and after bankruptcy

Can you still apply for credit when you’re bankrupt? Technically you can still apply for credit even during the bankruptcy process, however, it is completely up to the credit provider as to whether they will give you a loan.

Bankruptcy indicates to them that you are not able to effectively manage your debt and you are a high-risk borrower. If you have entered into some kind of debt agreement, there might be a condition of your agreement that states you can’t apply for additional credit. If this is the case, then you can’t apply for credit until the debt agreement has been completed.

In Australia, for anything above $5,788, you must disclose that you are bankrupt or in a debt agreement before you can buy goods or services on credit, unless there are specific clauses in your contract that state otherwise. After your bankruptcy has ended, all restrictions on applying for loans or credit are lifted. Then, it’s up to the credit provider to decide if they will take you on as a customer.

Getting approved for credit

So what might help you get approved for credit after bankruptcy? Again, this is completely dependent on the type of credit you are trying to get approved for, and the provider’s internal policies.

If you can show that your financial situation has changed and you are now able to effectively manage your debt and have overcome your bad habits, this could go a long way for a creditor. Good banking habits, such as no dishonours and no overdrawn accounts, could also go a long way.

It is worth pointing out here that if you have applied for bankruptcy or are in the process of establishing a debt agreement, but it has not yet been accepted or finalised, you can’t apply for credit. Applying for finance during this period could be construed as fraud.

Bankruptcy and COVID

The impact of COVID-19 has been felt around the world, with the global pandemic affecting almost every aspect of our lives. This extends to bankruptcies. In the wake of coronavirus, the Australian government implemented temporary debt relief measures on the 25th of March 2020 to support individuals and businesses.

The temporary debt relief measures include:

- Six-month temporary debt protection;

- Changes to bankruptcy notices;

- Impacts on people who are currently bankrupt.

You can see all the information on the temporary relief measures on the AFSA’s website. To summarise the main points, the temporary debt protection period for people in financial difficulty has been increased from 21 days to 6 months. During this 6 month period, unsecured creditors are prevented from taking recovery action.

The protection period allows individuals and businesses to seek advice from a free financial counsellor, negotiate a payment plan with creditors, or consider if any formal insolvency options are the right course of action.

As part of the relief measures, there have also been changes to bankruptcy notices. As part of this, the debt threshold required for creditors to apply for a bankruptcy notice against a debtor has increased from $5,000 up to $20,000.

The debtor, AKA the person in debt, then has 6 months to respond to the bankruptcy notice, as opposed to the normal 21 day period.

Am I eligible for bankruptcy?

If you are in significant financial hardship, you might be wondering “am I eligible for bankruptcy?” There are two requirements you need to meet in order to apply for bankruptcy:

- You’re unable to pay your debts when they are due (insolvent) and;

- You’re present in Australia or have a residential or business connection to Australia.

In Australia, there is no fee to apply for bankruptcy and there is no minimum or maximum amount of debt or income needed to be eligible.

Before entering into bankruptcy, you should speak with a free financial counsellor via the National Debt Helpline on 1800 007 007. The AFSA has also put together a list of support services for you to access before entering into bankruptcy here.

Who will know you’re bankrupt?

Not everything goes to plan in life. If bankruptcy is unavoidable, then who will be able to see that you’ve gone bankrupt? Unfortunately, your name will permanently appear on a public register called the NPII. The NPII shows details of insolvency proceedings such as bankruptcy in the country.

Generally, the information available on the register will include:

- Your name, date of birth, residential address and occupation that you disclose on the bankruptcy application;

- Previous names and aliases, if known and applicable;

- The type of proceeding, the start date and your AFSA administration number;

- The name and contact details of the appointed trustee or administrator;

- The current status of the proceeding, such as whether you have been discharged from bankruptcy.

You can request your details to be hidden from the NPII if you have been the victim of domestic violence or apprehended violence and have been granted an order to protect you, or if you are in a witness protection programme. It is up to the AFSA as to whether your details will be hidden.

Managing debt

One of the ways to avoid bankruptcy is to effectively manage your debt. There are numerous ways you can stay on top and effectively manage your debt. First things first – it’s important to know your financial situation. Being across how much you owe, when your repayments go out and how much of your income is spent on debt repayments could be the difference between financial wellbeing and financial strain.

Once you’re on top of your situation, other ways to help yourself effectively manage debt could include setting up a budget and thoroughly doing your research before taking on any credit to ensure you will be able to make the repayments. Cancelling non-essential services, such as your multiple streaming services, could help increase your available discretionary income.

You could also establish an emergency fund should an unexpected expense or event occur that leaves you without a consistent income or a big bill to pay.

Check your credit scores frequently to make sure you know where you’re at. It’s also a good idea to keep an eye out for any mistakes, and make sure any statuses on defaults and bankruptcy are correct. Once you start repaying your debt, you may see them rise over time. Don’t forget to celebrate your small successes!

Want to learn more?

Unfortunately, they don’t teach you about your credit score in school. But it’s never too late to learn! Sign up to Tippla’s free Credit School, where you can learn all the ins and outs of your credit score, including how to improve your rating. Embrace your inner finance geek and go back to school!

While we at Tippla will always do our best to provide you with the information you need to financially thrive, it’s important to note that we’re not debt counsellors, nor do we provide financial advice. Be sure to speak to your financial services professional before making any decisions.

Subscribe to our newsletter

Stay up to date with Tippla's financial blog