Published in September 13, 2021

How To Check My Credit Report For Free

Your credit report is an important document that gives you a clear overview of your credit history and current standing. It’s no wonder a lot of people ask us “how to check my credit report for free”. Tippla has the breakdown for you below.

What is a credit report?

Your credit report is a document that outlines your credit history. It is a summary of how you have handled your credit accounts and managed your debt. If you have a personal loan, home loan, credit card, or your name is on a utility bill, then you will have a credit report.

In Australia, you have a credit report with three credit bureaus – Equifax, Experian, and illion. Each month, your creditors and lenders will report your credit information – such as your repayment activity and history, to one of these three bureaus. The information reported by these financial institutions is what makes up your credit report.

The information on your credit report is what’s used to determine your credit score – a number ranging from 0 -1,200. It provides an indication of how reliable of a borrower you are. If you have positive information on your credit report – such as a reliable repayment history, then you will likely have a good credit score.

However, if your credit report is filled with negative entries, such as defaults, bankruptcy, etc, then you will likely have an average to below-average credit score. That’s why it’s a good idea to know what’s on your credit report and know how to check my credit report for free.

What goes onto your credit report?

There are many things that go onto your credit report, as outlined by Equifax, your credit report contains the following types of information:

| Personal information | Your credit report will contain certain information about your identity, such as your name, address and date of birth. It won’t include information such as your marital status, salary, etc. |

| Credit account information | Listed on your credit report will be your credit account information. This includes the type of accounts you have, such as a credit card or loan, the date it was open and your credit limit. |

| Repayment history | Your repayment history for your credit accounts will be listed on your credit report. |

| Credit applications | Your credit report will list all of the enquiries that have been made on your report. There are two types of enquiries – hard or soft. Hard enquiries are when a lender or creditor looks at your report when you apply for a loan or type of credit.

Hard enquiries affect your credit score. A soft enquiry does not affect your credit score, and ranges from you checking your own report or if a company checks your report for a pre-approved offer. If you have applied for credit, then it will show on your report. |

| Bankruptcies and defaults | Your credit report contains negative entries, if applicable. This can include bankruptcies and defaults. Bankruptcy will stay on your credit report for up to 5 years. If you have defaulted on any of your credit repayments in the past 5 years, then it will appear on your credit report. |

How long do items stay on your credit report?

Let’s get stuck into how long items stay on your credit report. Here’s a breakdown:

- Credit accounts – all of your current accounts, and any that you have closed in the past 2 years;

- Credit applications – any application you have made for some time of credit will remain on your report for 5 years;

- Repayment history – your repayment history over the past 2 years will appear on your credit report;

- Defaults – if you have defaulted on any repayments in the last 5 years then it will appear on your report;

- Court judgements and bankruptcies – 5 years;

- Serious credit infringements – these can stay on your credit report for up to 5 years.

Why does my credit report matter?

There are many reasons why your credit report matters, but we’ll take you through a few. One of the main reasons why it’s important to check your credit report and keep it, and your credit score healthy, is because it affects your ability to borrow.

If you have a lot of negative entries on your credit report, such as numerous defaults, then you will be perceived as a riskier borrower. Because of this, you might find it much harder to be approved for credit.

Not only that, but the credit or loans you are approved for will likely come with higher interest rates, more fees and smaller borrowing limits. If you don’t take care of your credit report and credit score, then it can limit your finances, and as a result, your life.

If you move into a new house or apartment and you need to sign up for your utilities, such as electricity and water, if you have a bad credit report and a low credit rating, then you might also be rejected by providers because you’re deemed too high of a risk. You could also struggle to get a phone contract.

Your credit report can also be valuable in helping you detect identity theft. If you check your credit report and see that something that doesn’t add up, such as a credit account you don’t recognise, then this could either be a mistake or an indication that someone has stolen your identity and is using it to open credit accounts. That’s why it’s important to check your credit report frequently.

How to check my credit report for free?

Now that you understand what your credit report is and its importance, let’s answer the question “how to check my credit report for free”. There are a few ways you can do this, and it depends on how long you’re willing to wait.

Request your report from the credit bureaus

If you would like to view your credit report for free, you can request a free copy from each of the bureaus – Equifax, Experian, and illion. However, it is important to highlight that you will have to wait approximately 10 days if you want to get a free copy.

Generally, the bureaus will only allow you to see your credit report free once a year. You may have to pay for a copy of your report from the bureaus if you request a copy more than once a year, and if you want to receive it faster than 10 days.

Sign up to a platform like Tippla

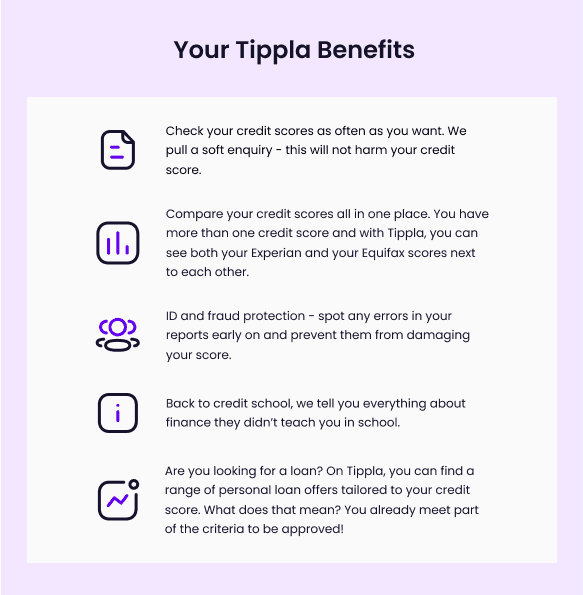

This is where platforms like Tippla come in handy! With Tippla you can view your credit reports and credit scores from the two largest credit bureaus in the world – Equifax and Experian. On Tippla you can access your free personal Equifax credit report and your free personal Experian credit report.

Signing up to Tippla is completely free and you can view your credit report and score as often as you want – it won’t hurt your score. Your report is updated every 90 days, so you can see how you’re tracking throughout the year.

Does checking my credit report hurt my credit score?

No, it doesn’t! You can check your own credit report as often as you like, it won’t hurt your credit score or reflect badly on your report. This is because when you look at your own report, it is registered as a soft enquiry. Soft enquiries don’t affect your credit score.

The damage is done when you apply for a loan or type of credit, like a credit card. This is because when a lender or creditor views your report to see if you are a reliable borrower, this registers as a hard enquiry. Hard enquiries initially harm your credit score and will remain on your report for up to 5 years.

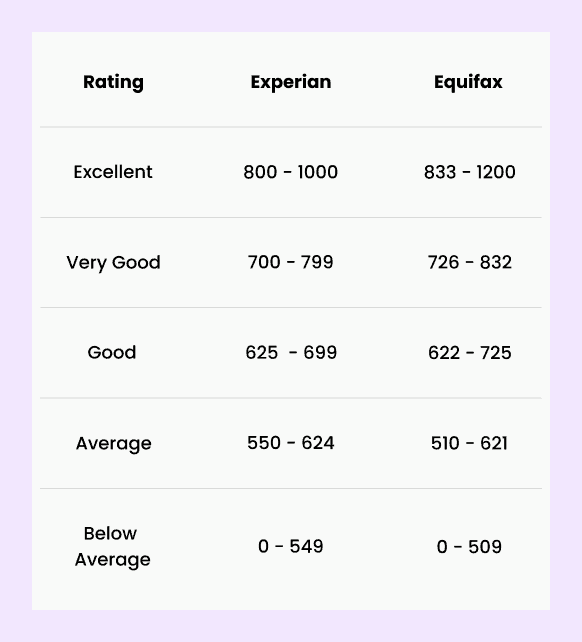

Want to know what a good credit score is? Here’s how Equifax and Experian categorise their credit scores.

Source: Experian and Equifax

For more information on what affects your credit score and report, head to Tippla’s financial blog to find everything you need to know and more.

While we at Tippla will always do our best to provide you with the information you need to financially thrive, it’s important to note that we’re not debt counsellors, nor do we provide financial advice. Be sure to speak to your financial services professional before making any decisions.

Related articles

Get the Lowdown on Renters Insurance Premium

29/07/2021

What is a renters insurance premium? Insurance companies typically...

Types of savings accounts

28/07/2021

What Are the different types of savings accounts? Generally,...

Introducing Tippla’s Latest Feature: Spending Habits

25/10/2021

Tippla is expanding. We recently launched a new feature...

Subscribe to our newsletter

Stay up to date with Tippla's financial blog