Are you currently looking for a loan, but you’re not sure where to start? You’re not alone! Here’s a helpful guide on how to pick the right loan for you.

When it comes to the world of finance, you’re not alone if you feel a bit lost. Nowadays there are so many types of loans and finance options. You’re not alone if you’re not sure which loan you should apply for. Today, we’re answering the question: how to pick the right loan for you.

Before you apply for a loan

Before you apply for a loan, one of the most important things you should check is whether you can afford the repayments. Depending on your loan type, this will usually be a fixed weekly, fortnightly or monthly cost. If you’re getting a loan, whatever the purpose, it should not put you in financial strain. If you’re unsure of whether you can afford to take on a loan, you could reach out to a financial counsellor.

Below are some more things you should consider before you apply for a loan or some kind of finance.

Identify your purpose

Before you take on a loan, it’s important to know why you need money. Do you need a loan to cover unexpected expenses, help out with the bills, make a big purchase, study, buy a house, buy a car? The options are endless.

Once you’ve identified why you need a loan, then it can narrow down your search. If you’re wanting to buy a house, then you’re in the market for a home loan. If you want to buy something personal or cover unexpected expenses, then that would be a personal loan.

Know your loan options

In Australia, there are so many different types of loan options. There are also many companies willing to offer Aussies finance. Before you jump in headfirst and apply for a loan, it is worth knowing all your options so you can find the right loan for you.

Here’s a list of some of the different types of loan options:

-

Personal loans

-

Mortgages

-

Car loans

-

Debt consolidation loans

-

Student loans

-

Business loans

-

Home equity loans

Personal Loans

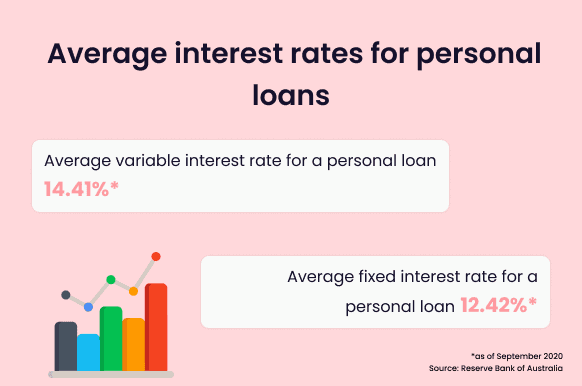

Personal loans come in many forms and are useful for multiple purposes. As the name implies, personal loans are for personal expenses. Personal loans are similar to credit cards and can be used for a range of reasons. You might need to cover unexpected costs, you want to improve your home, the list is endless.

Whilst personal loans are generally easier to get than other loans, you still have to sign a loan agreement. For this loan type, there are two main forms of personal loans – unsecured and secured.

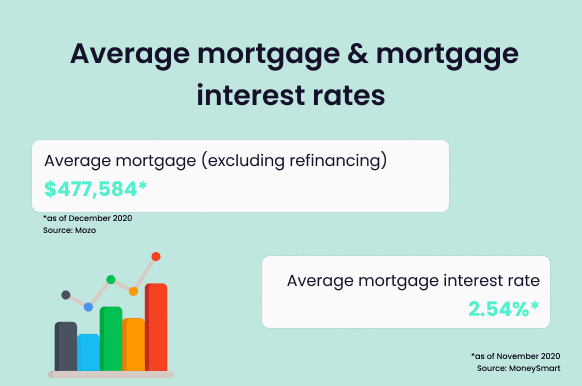

Mortgages

A mortgage is a form of personal loan that is secured against the property you buy with it. A bank or credit union will approve a loan with set repayments plus interest over a longer period of time. Home loans are usually set for 30 years. When you take out a mortgage, you will have to repay your mortgage and any interest that comes with it.

There are two main types of mortgages – a fixed-rate mortgage and a flexible rate mortgage. A fixed-rate mortgage is when the interest rate is fixed for a select period of time, usually 1 year. A flexible rate mortgage means that the interest rate is flexible and will change throughout the lifetime of your mortgage.

Car Loans

Car loans are a specific form of a personal loan to buy a car. Often, this loan isn’t paid out to you. Instead, they are paid to the dealership that you closed your car deal with.

In most cases, a car loan is secured against the car you are purchasing. This can help you to get a lower interest rate and better loan terms. However, if you can’t make your repayments, you are at risk of losing your car.

Debt Consolidation Loan

If you have accumulated debt from multiple sources, you may consider consolidating your debt into one loan. A debt consolidation loan combines all your current debts into one single debt with one interest rate and one repayment date. You may be able to get an overall better interest rate and save some money along the way.

Whether a debt consolidation loan is right for you completely depends on your existing credit terms and conditions. In some instances, consolidating your debt could mean that you are paying higher interest rates, which means you’ll end up paying more in the long-term. You might also incur extra fees (establishment fees, fees for paying off your other debt early, etc). This is something to watch out for.

Student Loans

Student loans often come with low-interest rates and can be considered an investment in your future. They often come with long loan terms and smaller repayment amounts over a longer duration.

Business Loans

A business loan is a form of loan given to help with business operations. This could be linked to a specific purchase or to provide cash flow in the first years of operation until the business is making a profit. Business loans are often big amounts of money linked to a business plan. They may be secured against assets or your business itself.

Home Equity Loans

Even while you are still paying for your home, you can make use of its value by taking on a so-called equity loan. The value of your property that you have already repaid can be used to take on new credit. Because it is secured against your property, home equity loans come with lower interest rates and provide good security to creditors.

Compare loans

Now that you know why you want a loan, and what’s available, it’s a good idea to compare all your options so you can find the right loan for you. If you’re looking for a personal loan, then you could look at several options and try and find the one with the best terms for your situation.

If you want to limit the negative impact on your credit score, then you should try and not apply for too many loans. This is because, when you apply for a loan, the lender will take a look at your credit score, to see how risky of a borrower you are. This check is recorded on your credit report as a hard enquiry and it will usually impact your credit score.

As outlined by Equifax, “Hard inquiries serve as a timeline of when you have applied for new credit and may stay on your credit report for two years, although they typically only affect your credit scores for one year.”

Because of this, you could protect your credit score by doing your research first and compare loans to find the best one for you.

Know your credit score

As a follow on, it’s important to know what your credit score is. If you have a good credit score, then you could get access to better loan terms, such as lower interest rates, as your credit score indicates to lenders that you are a low-risk borrower and likely to make your repayments.

If you know your credit score isn’t good, then it might be worth taking the time to improve your credit score before applying for a loan. Not only could a good credit score be the difference between being rejected or accepted for a loan, but it could save you money in the long run.

One of the first things you should do if you want to improve your credit score is to check your credit report for any mistakes. 1 in 5 credit reports in Australia have some kind of mistake on them, and that mistake could be hurting your credit score!

As we highlighted in a recent article, there are numerous ways you can repair your credit report and fix your credit score. Want to hear some good news? Fixing your credit score is free, and you can do it yourself.

How to pick the right loan for you

With so many loan options out there, it can be hard to know how to apply for the right loan for you. If you can identify why you’re getting a loan and compare your options before applying for a loan, then you could be setting yourself up for a more successful experience, and save your credit score and bank account from unnecessary harm.