Published in October 19, 2021

How To Reduce The Interest On Your Personal Loan

A lot of people don’t realise just how much interest can cost you when you take out a personal loan. That’s why we’ve put together this helpful guide on how to reduce the interest on your personal loan.

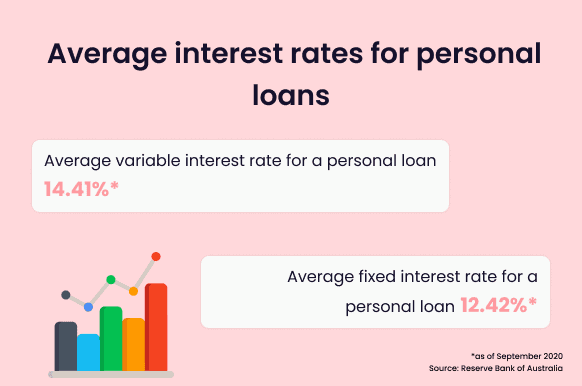

The average personal loan in Australia

A lot of Aussies rely on personal loans. According to data from the Reserve Bank of Australia (RBA), the total amount of outstanding personal loans in Australia was more than $145.5 billion as of September 2020.

In Australia, there are two main types of personal loans – secured personal loans and unsecured personal loans. Let’s get stuck into how to reduce interest on personal loans.

How to reduce interest on personal loans – compare your options

There is a range of different personal loans available in Australia – short-term, long-term, secured, unsecured, fixed-rate and variable rate – the list goes on and on.

Tippla recently put together a guide on how to reduce the interest on home loans. As was the case with home loans, if you want to reduce the interest on your personal loan, then you could compare all of the different options available to you. MoneySmart recommends comparing these features:

| Comparison rate |

|

| Interest rate |

|

| Application fee |

|

| Other fees |

|

| Extra repayments |

|

| Loan use |

|

| Loan term |

|

Source: MoneySmart

In Australia, you can also get a low-interest loan and a no-interest loan. They can also come with no fees and fast approval.

Pay off your personal loan quickly

When you take out your personal loan, you will be charged a set amount of interest each month which will be factored into your repayment amount. Therefore, the quicker you pay off the loan, the less interest you will pay. Say you take on a loan of $2,000 with a 14% interest rate p.a., with a loan term of one year, you’ll pay about $23.80 each month in interest (for a month with 31 days). Now say you pay off that loan in 6 months instead of 12, then you have saved yourself from having to pay about $140 in interest. If you imagine this on a larger scale you could really save yourself a lot of money.

We’ve put together a number of ways you could pay off your personal loan faster.

Round up your repayments

A simple way you could repay your loan faster and save yourself from having to pay all of the interest is by rounding up your repayments. Say your monthly loan repayment is $235 a month. If you instead repaid $250 a month, then you’ll reach the end of your loan faster. Depending on the loan term, you could be saving yourself months worth of interest by doing this.

Before you start making these extra repayments, check if there’s an early exit fee or any other fees that you might be charged.

Pay fortnightly, instead of monthly

Similar to rounding up your repayments, if you change the schedule of how you repay your loan, you could save yourself in interest. But how does switching your repayments to fortnightly from monthly make a difference?

Let’s say your loan repayment is $200 a month, over a 2-year period. Instead of paying that amount each month, you could pay $100 each fortnight. This way, you’ll end up paying more in the long run, as there are 26 fortnights each year (you’ll pay $2,600 instead of $2,400). This way, you could repay your loan months ahead of schedule, and save on interest.

Make additional repayments

Another way you could repay your loan faster is by making additional repayments when you can. By doing this, you could keep to your normal repayment schedule, but make impromptu repayments as and when you can afford them. The amount is up to you – any additional repayments will bring the end of your loan quicker, and that could save you a lot in interest.

Long-term loans aren’t always best

A lot of people might be tempted into getting longer-term loans with lower interest rates, thinking it will save them more money in the long run. However, this isn’t always the case.

As an example, say you borrow $1,000. If you take out a short-term loan with a 3-month repayment period and a 14% interest rate p.a. Throughout the loan, you’ve paid $35.7 in interest (assuming every month is 31 days).

On the other side, imagine you take out a longer-term loan of the same amount, with a 2% interest rate over 2 years.

That 2% interest rate is dramatically smaller than 14%. However, over the 2 years, you’ll end up paying $40 worth of interest, which is more than the higher-interest short-term loan.

Refinance your personal loan

If you’re trying to reduce the interest rate on your personal loan, there is also the option of refinancing your personal loan. This is when you take on a new loan to pay off your existing one. There are a number of reasons why people decide to refinance their loans:

- To get a lower interest rate;

- To get a shorter, or longer loan term;

- To consolidate their debt.

Why refinance your personal loan?

When you refinance your loan, you might be able to get a better deal than your existing one. This is especially true if your credit score has improved since you took out the initial loan. Generally speaking, the better your credit score, the better the interest rates and conditions available to you will be. Therefore, if your score has improved, then you might be able to get access to better deals compared to your initial loan term and that could save you money.

Debt consolidation

Refinancing your personal loan could allow you to consolidate your debt. If you have debt from multiple sources, such as numerous personal loans, then you might be able to combine this into one debt consolidation loan. A debt consolidation loan combines all your current debts into one single debt with one interest rate and one repayment date.

The benefits of doing this include ease. You will only have to worry about one loan. That means one loan, one interest rate and one repayment schedule. By going down this road you might be able to get a better interest rate overall and save money.

However, there are some things to consider. You’re not guaranteed a lower interest rate when you take on a debt consolidation loan. In some instances, consolidating your debt could mean that you are paying higher interest rates, which means you’ll end up paying more in the long-term.

On top of this, you might be charged extra fees by your provider, such as establishment fees, fees for paying off your other debt early, etc. These extra fees could outweigh the benefits of the lower interest rate. That’s why it’s a good idea to carefully weigh up your options and read the terms and conditions.

Access to more finance

If you refinance your loan, you might be able to get access to a higher credit limit. This could be good if you’re in need of extra finance. Perhaps your situation has changed, your family has expanded – the list goes on and on.

Refinancing your loan could be an easy way to accommodate this. However, taking on a higher credit limit means you’ll have more to repay. It’s important to ensure you can make the repayments before taking on a higher limit.

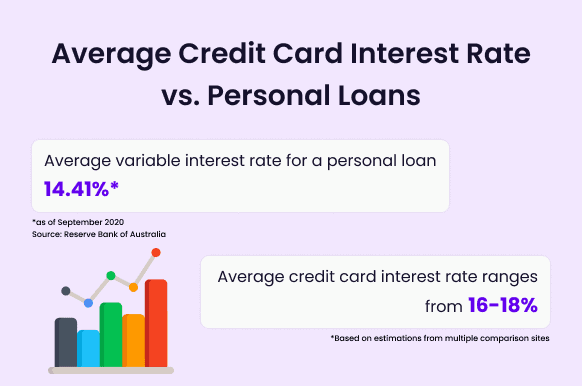

Credit cards in Australia

As Tippla recently covered, a lot of Aussies have credit cards. There were 13,668,490 credit cards in circulation as of November 2020, according to Finder. Credit cards are similar to personal loans – they are a line of credit that you have to repay. Like personal loans, they often come with interest and extra fees.

How to reduce the interest on your credit card

There are several ways you could reduce the interest on your credit card. For example, you could opt for a low-interest credit card.

Another thing you could do is pay off your credit card each month in full. With credit cards, you don’t have to repay everything that you spend each month. Most credit cards come with a minimum monthly repayment.

This is the minimum amount you have to pay each month to meet your credit agreement and avoid late fees. This is usually around 2 or 3% of the total amount you owe for the month.

However, as we explained in our previous article when you only repay the minimum amount, your remaining balance is charged interest. Head to our article to see why doing this can quickly increase your credit card debt.

With this in mind, to avoid paying extra interest, you could pay off your credit card in full each month. To achieve this, you could set up a budget and be careful with the purchases made on your credit card. You could try to only spend what you’re sure you can afford to repay each month.

An overview of how to reduce the interest on your personal loan

There are a number of ways to reduce the interest on your personal loan. These include:

- Comparing multiple loans to get the best deal;

- Paying off your loan quickly;

- Opting for loans with shorter terms;

- Refinancing your loan.

If you’re unsure of what’s the best option for you, you can reach out to a free financial counsellor. They can explain your options and help you make the best decision for you.

While we at Tippla will always do our best to provide you with the information you need to financially thrive, it’s important to note that we’re not debt counsellors, nor do we provide financial advice. Be sure to speak to your financial services professional before making any decisions.

Related articles

Does renters insurance cover collectables?

29/07/2021

Does renters insurance cover collectibles? Here’s a breakdown on...

How to Know if You’re Eligible for a Loan? Find Out with Tippla

16/08/2023

Tippla is a free online financial platform that enables...

Credit Repair Companies: Are They Worth It?

19/10/2021

In life, there’s rarely a quick fix. The same...

The Benefits of High-Interest Savings Accounts

22/02/2024

Disclaimer: This content does not constitute financial advice. The...

Subscribe to our newsletter

Stay up to date with Tippla's financial blog