Published in September 7, 2021

How to Use Credit Cards Effectively: A Guide

Millions of Australians have some kind of credit card. But there’s a difference between having a credit card and utilising a credit card. To help with this, Tippla has put together a helpful guide on how to use credit cards effectively.

As of November 2020, there were 13,668,490 credit cards in circulation, according to comparison site Finder. These credit cards netted a national debt accruing interest of $20.9 billion. At the same time, the number of debit cards in circulation was more than double, at 34,861,747.

With this in mind, it’s clear that a lot of Aussies are using credit cards to help with their finances. So let’s dive into the ins and outs of credit cards.

What is a credit card?

When you take on a credit card, you are getting a line of credit that you can use to make purchases, balance transfers and cash advantages. Where a debit card limits you to the money you have in your bank account, credit cards are like a loan. This is because they provide you with extra finance which is set at a predetermined amount.

Like a loan, you have to pay back your credit card. At the very least, you will need to make the minimum repayment every month by the due date of the balance.

As highlighted by Investopedia: “Credit cards impose the condition that cardholders pay back the borrowed money, plus any applicable interest, as well as any additional agreed-upon charges, either in full by the billing date or over time.”

Who offers credit cards?

In Australia, there are a lot of options when it comes to credit cards. In fact, there are hundreds of options available. Nowadays, banks don’t offer one type of credit card. They often offer multiple different types of cards all serving different purposes. You can get access to low-interest credit cards, no annual fee credit cards, balance transfer credit cards, and rewards credit cards.

Rewards cards can vary. A common one is credit cards tied to the frequent flyer points of main airlines such as Virgin and QANTAS.

The benefits of credit cards

With anything in life, there are both pros and cons to having a credit card. Let’s start first with the benefits of credit cards.

Access to extra finance

One of the main reasons people get a credit card is because they want access to a line of credit. A credit card allows you to spend money you might not have in your bank account at that very moment. It gives you the freedom to buy what you want and need without restricting you to your bank account.

This extra line of credit can become especially useful in emergency situations. You can deal with the problem right away and not have to wait until payday. It is very important to highlight that a credit card isn’t free money. You have to pay back everything you spend. So it’s good to be careful that you don’t fall into the trap of overspending and putting yourself into further debt.

Build up your credit score

One benefit of having a credit card is that you could use it to create a good credit history and boost your score. If you make your monthly repayments on time and don’t max out your credit card, then it could boost your credit score.

Rewards

A lot of credit cards have some kind of rewards programs where you can earn bonuses. This can range from frequent flyer points, bonuses tailored to specific stores, cashback and extras such as travel insurance.

Security

Another benefit credit cards can offer is the added security when shopping online. As we recently highlighted, online financial fraud and credit card fraud in Australia is a real threat. This is when scammers will somehow access your card details and use them to shop online.

If you use your credit card to shop online, if scammers do get access to your credit card details, then it’s not connected to the money in your bank account. However, if fraudsters get your debit card details, then they will be draining your personal money.

If you are a victim of credit card fraud, you will most likely not be liable for the money stolen. Generally, once you alert your bank or financial institution about the fraudulent transaction(s), they will freeze your card and reimburse you the funds.

However, there are some situations where you could be liable for the lost funds. For example, if you display your pin obviously on your credit card for all to see, or you took too long to notify the bank, then you might be liable for the fraudulent charges.

In Australia, most credit cards now come with a chip on them, in addition to the magnetic strip. The encryption of chip cards helps to prevent fraudsters from stealing your card information during point-of-sale transactions.

The downside of credit cards

Whilst there can be numerous benefits to having a credit card, there are also a few things to watch out for. Whilst credit cards give you access to extra cash, you do have to pay that money back.

Fees and interest

When you take on a credit card, depending on which one you select, you might have to pay credit card fees and interest. This means, when you spend money on your credit card, you might end up having to pay back more than you anticipated.

When you apply for a credit card, you should read the conditions of the card carefully and make sure you can afford the repayments. It’s also important to be aware of what actions trigger fees and interests on your repayment.

Minimum repayments

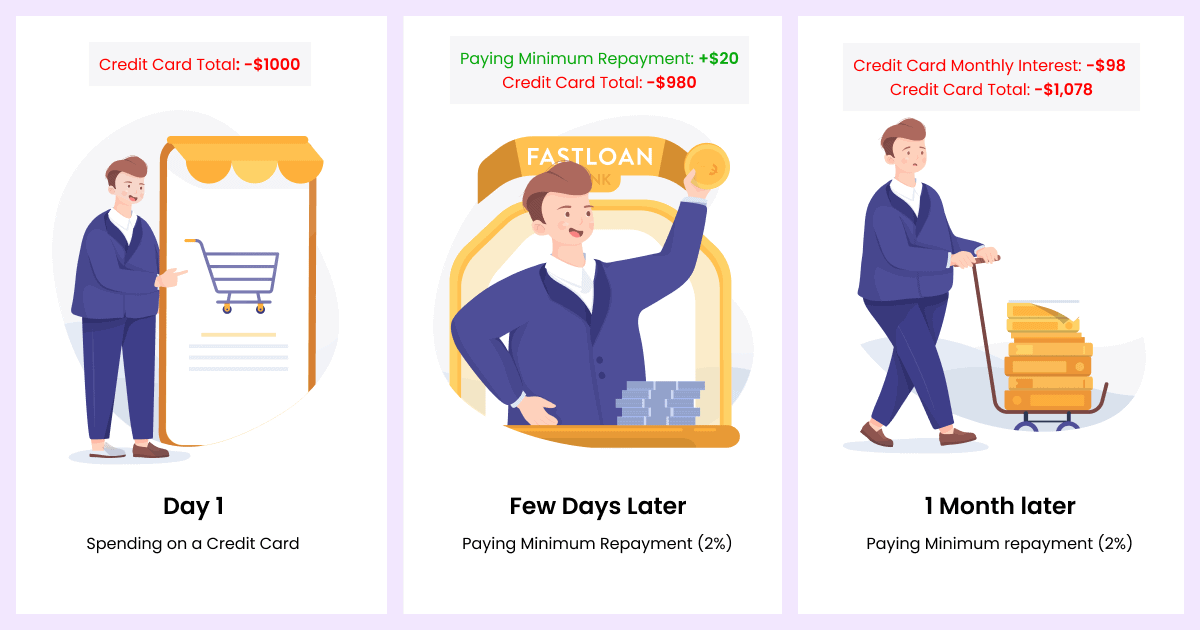

Most credit cards have a minimum monthly repayment. This is the lowest amount you have to pay in order to meet your credit agreement. The minimum monthly repayment is usually about 2 or 3% of the total amount you owe for the month.

This means that you don’t actually have to pay your whole bill when you have a credit card, you only have to pay the minimum repayment by the due date to avoid paying late fees. However, you will still accrue interest on the remaining amount owing, which could cost you more in the long run.

Here’s an example of how the minimum monthly repayment works. Say your credit card charges you 10% interest per year and you spend $1,000 on your credit card in one month. If your minimum repayment is 2%, then you would have to pay at least $20 by the due date to avoid late fees. However, the remaining $980 that you haven’t paid will be charged the interest rate, which will cost you an extra $98.

This $98 in interest will be added to your outstanding balance for the next amount. Then you’ll have to pay interest on the new amount. Taking into account that you’ll probably spend more in the next month, you can see how your credit card debt can quickly get out of hand!

Maxing out your card

Maxing out your credit card is when you reach your credit card limit. Say your credit card limit is $8,000, then maxing out your credit card would be when you spend all of that $8,000 in one month.

When you max out your credit card, you can’t make any more purchases until you make a repayment. Depending on your card conditions, you might incur fees and charges when you max out your card, which means you’ll have to pay even more back.

When you max out your credit card, it means you have a lot more to repay. Even the minimum repayment amount is higher. 2% of $1,000 ($20) is a lot less than 2% of $8,000 ($160). And 10% interest on $980 ($98) is a lot less than 10% on $7,840 ($784).

If you prefer to pay off your credit card in full each month, then you might struggle to fully repay your credit card bill if you max out your card. Like with anything, it’s important to only spend within your means so you don’t put yourself into a difficult situation.

Rewards programs

Although credit card rewards programs can be a great way to increase your frequent flyer points simply by spending money, it is important to carefully read and understand the conditions of the cards.

Often, cards with rewards programs come with higher interest rates and additional fees. Sometimes these extras can actually offset the benefits that you get through the rewards program. That’s why it’s a good idea to carefully examine the rewards programs and see if it will work out better for you in the long run.

How to use credit cards effectively

With the pros and cons for credit cards outlined, now it’s time to get into how to use credit cards effectively. When it comes to your credit card, you shouldn’t be over-reliant on it. It is a tool that when wielded properly, could greatly benefit your life. However, credit card debt can be a slippery slope.

So how could you use credit cards effectively? You could start off by finding a credit card that meets your needs, whatever they might be. You should read the terms and conditions carefully. It’s important to always keep in mind that whatever you spend, you need to repay.

Keep an eye on your balance

One way to use your credit card effectively is to avoid maxing out your card. You could do this by keeping an eye on your balance. Investopedia outlines that it’s better to keep your card balance low relative to your credit limit. This is because maxing out your credit card can harm your credit score and indicate to lenders that you’re a risky borrower.

As we mentioned above, there are numerous drawbacks to reaching your limit. These include extra fees and charges, the inability to use your card until you make a repayment and higher risk of defaults.

Make more than the minimum repayments

Although you don’t have to pay more than the minimum repayments by the deadline each month, it could work out a lot better if you do. This is because it could save you from being charged extra interest.

In fact, the best thing you could do is to pay off your credit card in full each month. That way you won’t be charged interest on the remaining debt, and you won’t carry credit card debt into the next month.

Pay your credit card bill on time

Each month, you will receive your credit card bill, outlining all of the transactions you’ve made during the month. Once you receive your statement, you will have a fixed time to pay off your credit card, or at the very least, make the minimum monthly payment to avoid late fees.

When it comes to your credit card, it’s important to pay your credit card bill on time. If you don’t you’ll most likely have to pay late fees and in some cases, extra interest. Not only that, but it could be good for your credit score. Even if you have a credit card that has 0% interest or 0% balance transfer terms, these will likely become void if you are late making your repayments.

Your repayment history is one of the most important factors when it comes to your credit score. If you don’t pay your bills on time or miss them altogether, it could harm your credit score. Therefore, one way to use your credit card effectively is by paying your bill on time.

Be on the lookout for credit card fees

You can incur credit card fees for a number of different reasons and they can add up over time. That’s why it’s important to know what fees you can be charged with your particular card and what triggers them.

Credit cards and your credit score

Your credit score is based on your credit history. Good credit behaviour can improve your rating, as can bad credit behaviour. If you are to miss a credit card payment, then this will show up as a default on your credit report and negatively affect your credit score.

How to use your credit card effectively

There are a lot more aspects to credit cards than meets the eye. There are many things you could do to make sure you’re getting the most out of your credit card. You could repay your credit card in full each month, avoid over-relying on your card, make sure to pay off your bill each month on time and more.

While we at Tippla will always do our best to provide you with the information you need to financially thrive, it’s important to note that we’re not debt counsellors, nor do we provide financial advice. Be sure to speak to your financial services professional before making any decisions.

Related articles

What Do Lenders See When They Look At My Credit Report?

26/07/2021

If you’re wondering what lenders see when they look...

Credit Scores for International Students in Australia: Building Credit History

06/09/2023

In Australia, as in many other countries, a good...

How To Provide 100 Points Of ID For An Identity Check

28/07/2021

100 points of ID – Why you need it...

Are Term Deposit accounts worth it?

28/07/2021

Although a term deposit account tends to earn high...

Subscribe to our newsletter

Stay up to date with Tippla's financial blog