Published in July 29, 2021

Does renters insurance cover collectables?

Does renters insurance cover collectibles? Here’s a breakdown on the ins and outs of collectibles coverage.

What is collectibles coverage?

To answer the question “does renters insurance cover collectibles” there are a few things to consider. Mainly, with renters insurance, collectibles coverage will depend on your policy. The majority of renters insurance policy providers will cover your personal belongings, liability, and potential living expenses if your property is uninhabitable.

Most renters policies will cover perils such as fire, vandalism, theft, smoke damage, leakage and more. Although, it should be noted that peril coverage depends on your specific policy.

If your item is of high value, in the event of damage or theft, your insurance policy probably won’t be enough to cover the reimbursement. Therefore, if you’re an owner of expensive collectibles, you should consider purchasing collectibles coverage.

Plan a thorough budget with Moneysmart to understand your spending habits and how much you can afford for your monthly payments.

What is the difference between personal property and collectibles?

Your personal belongings are covered by your insurance provider, depending on your limit. Items include furniture, electronics, as well as clothing; they are the items that make up your home. For example, in the case of a leakage in your home, your insurance policy should reimburse you the cost of the belongings damaged, after you pay the deductible.

Collectibles, on the other hand, aren’t everyday items you depend on with your daily life. Collectible items could include things such as coins, paintings or stamp collections. Sometimes, valuables may exceed your coverage limits, meaning you would need to either customise your policy or consider additional coverage to protect your collection.

When does renters insurance cover collectibles?

Renters insurance coverage generally depends on your policy limits and the amount of additional coverage you would have purchased. As most insurance policies only offer coverage up to a certain limit, you should consider additional riders or coverage to ensure reimbursement for your highly valuable items.

Taking an inventory of your collection helps to determine its value and aids with determining its replacement cost in the case of damage or theft.

Additionally, getting a professional appraisal can help you receive physical evidence of your items’ value, in the event of damage or theft.

Different types of events covered under renters insurance?

Your renters insurance should cover the damage or loss of your items from these perils:

– Theft

– Loss

– Fire and lightning

– Explosions

– Smoke damage

– Vandalism

– Falling objects

– Damage from steam-heating/water-heating appliances

– Leakage or overflow of water or steam

– Windstorm and hail

– Riots

What is not covered by renters insurance

There are a few circumstances where renters insurance won’t cover or reimburse you, even if you’ve purchased additional coverage. Here are a few examples:

Wear and Tear: Your insurance provider will not reimburse you if your belongings are damaged from wear and tear over time.

Damage while on loan: If you loan your collectibles to an organisation of any sort, renters insurance will most likely not cover the cost of reimbursement in the event of loss or damage.

Extremely expensive items: Even with additional coverage, renters insurance companies will most likely not cover extremely expensive items as they’d exceed any limit. In this case, you’d have to purchase a completely separate policy that would specialise in expensive collectibles.

Hungry for more?

Want to learn more about renters insurance? Or find articles that cover similar topics such as “does renters insurance over collectibles”? You can read more on insurance claims and similar topics with Tippla!

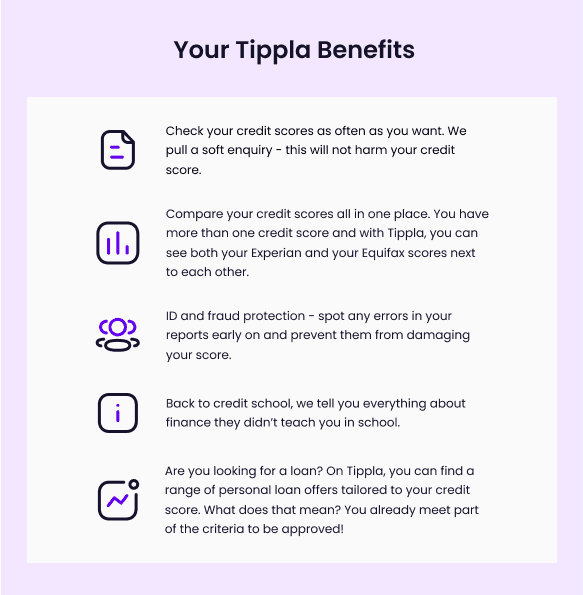

When you sign up to Tippla, you will be able to access your Equifax and Experian credit scores. You can check your credit scores online for free with Tippla, as well as view your Equifax and Experian credit reports. Below, we’ve outlined some other Tippla benefits.

While we at Tippla will always do our best to provide you with the information you need to financially thrive, it’s important to note that we’re not debt counsellors, nor do we provide financial advice. Be sure to speak to your financial services professional before making any decisions.

Related articles

Tips and Strategies to Minimise the Negative Effects of Credit Enquiries in Australia

11/10/2023

Managing your credit is crucial for getting loans or...

How To Check My Credit Report For Free

13/09/2021

Your credit report is an important document that gives...

How to Know if You’re Eligible for a Loan? Find Out with Tippla

16/08/2023

Tippla is a free online financial platform that enables...

Subscribe to our newsletter

Stay up to date with Tippla's financial blog