Published in August 2, 2021

Renters Insurance Declarations Page?

What is a Renters Insurance Declarations Page?

A renters insurance declarations page is usually is the front page of a policy that identifies the basics of your policy as well as the costs and coverage included. When purchasing renters insurance, you are purchasing protection for your personal belongings as well as coverage of your liability. The declarations page contains coverage details of your policy.

Your renter’s insurance declarations page is essentially your policy’s overview and invoice containing every detail you’re paying for. It also includes details of the limits and what’s protected.

It’s an important page as it’s a source of reference for your policy coverage. It can also serve as proof of insurance if your landlord has required you to purchase one.

How to get your renters insurance declarations page

A declarations page is typically attached to the front of any insurance policy.

If you don’t have one attached, you should contact your policy provider and request one. Making any changes to your coverage limits will result in a new declarations page.

When will you need your declarations page?

There’s a range of reasons as to why you’d need to maintain a copy of your declarations page. Landlords typically require tenants to purchase insurance. In this case, your declarations page would work as your proof of purchase.

It can also come in handy in case you need to file a claim, as you can reference what is and isn’t covered in your policy.

What details does a renters insurance declarations page include?

Your policy number and policy dates

Your insurance policy reference number will be listed on your declarations page. This will be the number that aids with filing claims.

The declarations page will also state the duration of your policy. Although they’re usually outlined as day, month, year, some companies will mark it down to the minute.

All relevant parties: The declarations page will state all parties included in or relevant to the policy. These include:

The name insured: This would your name, the policyholder. This will also include your date of birth and address.

The name of any additional insured: Additional people included in your policy. Anyone listed means your coverage extends to them.

The names of additional interested parties: Landlords will sometimes ask to be added as additional interested parties. This doesn’t add them to the policy or cover them, it just notifies them of any changes made to the policy.

Agent name: The insurance representative who manages your policy. This would include the company address and phone number.

The carrier: This would be your renters insurance company. It will include their address and phone number.

Information about the rental and building

Your declarations page will contain an overview of information about your rental unit. The information would include:

– Address

– Building type

– Building history

– Additional building details

Total Premium

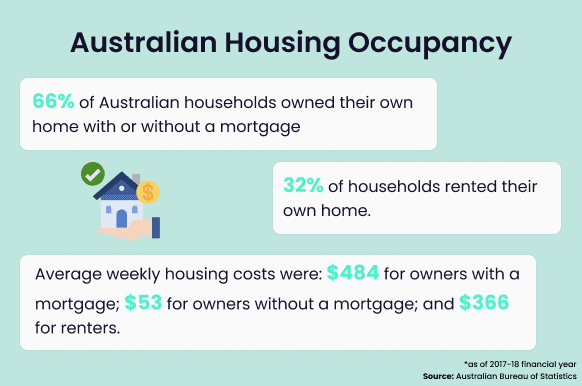

Your premium is the amount you have to pay to maintain an active insurance policy. Factors such as cost of rent, credit score, and cost of belongings help determine your premium.

The amount of coverage required helps determine your premium; More coverage results in higher premiums. This also includes personal liability coverage.

You can pay your premium either annually or monthly to pay it in small increments.

Coverage components, limits, and deductibles

When filing a claim, there’s an amount you need to pay out of pocket, this is the deductible. Although not all policies require you to pay a deductible, personal property coverage that aids with reimbursing your belongings usually requires you to pay.

Your insurance limit is the maximum amount of coverage paid by your insurance provider. As mentioned previously, having a higher limit tends to lead to increased premiums. You will be able to see different types of coverage as part of your policy, before purchase.

Additional coverage and riders

Renters insurance doesn’t always cover all personal property. Generally, items with a higher value aren’t covered due to them being higher than the covered limits. To protect valuable items, people tend to purchase additional coverage to cover damage or loss of valuable items.

Discounts

Having safety features in your home could result in your insurance company providing you with a discount. You will also find discounts on the declarations page. Things in your home that could give you a discount:

– Burglar alarms

– Fire alarms

– Automatic sprinklers

– Fire extinguisher

– Smoke alarms

– Deadbolt

What does renters insurance cover?

Basic insurance coverage generally protects personal property and liability. If the property is damaged, you will be reimbursed. Damage includes:

– Fire and lightning

– Windstorm and hail

– Explosions

– Damage by aircraft

– Damage by vehicle (not your own)

– Riots

– Smoke damage

– Vandalism

– Theft

– Leakage or overflow of water or steam

– Freezing of plumbing, heating, air conditioning

– Short-circuit damage caused by electrical appliances

– Damage from steam-heating or water-heating appliances/systems

– Falling objects

– Weight of snow

– Volcanic eruption

Renters insurance also covers a certain amount of personal liability. This is in the event of injury to someone else or damage to another person’s property.

How to renew your renter’s insurance

Renters insurance is typically either six months long, or a year. Renewal results in a new declarations page and a potential change to your premium for different reasons. This depends on whether you increase or decrease your coverage.

Hungry for more?

Like what you’re reading? Get the low down on secured loans vs unsecured loans!

Tippla could be the answer to harnessing your credit and getting your life back on track. Sign up today!

While we at Tippla will always do our best to provide you with the information you need to financially thrive, it’s important to note that we’re not debt counsellors, nor do we provide financial advice. Be sure to speak to your financial services professional before making any decisions.

Related articles

Christmas Is Coming: What To Avoid To Protect Your Credit Score

07/09/2021

It’s beginning to feel a lot like Christmas! With...

Are Term Deposit accounts worth it?

28/07/2021

Although a term deposit account tends to earn high...

Tips and Strategies to Minimise the Negative Effects of Credit Enquiries in Australia

11/10/2023

Managing your credit is crucial for getting loans or...

Subscribe to our newsletter

Stay up to date with Tippla's financial blog