Published in July 29, 2021

Get the Lowdown on Renters Insurance Premium

What is a renters insurance premium?

Insurance companies typically offer discounts with full annual payments. But people tend to pay it monthly as it’s inexpensive. If you decide to cancel your insurance, most companies will provide the reimbursement, but that depends on your provider. Renters insurance is straightforward in the sense that you only ever need to deal with two factors: maintaining your policy by paying your premium, and paying a deductible when filing a claim. There are a few factors that determine insurance premiums.

Although some factors that determine your premium are out of your control; Factors such as additional coverage (your choice) also contribute to your premium.

The amount of insurance coverage you want

The price of your premium is mainly determined by the amount of coverage you require. It’s always helpful to take inventory of your items to calculate how much you need to include in your policy.

If you own items with higher value, you might want to consider setting higher coverage limits or in some cases even purchase additional riders.

The limits of your coverage will affect the cost of your premium. Here’s an overview of the coverage basic policies include:

– Personal property damage coverage: Reimbursement of repairment of damaged or stolen belongings

– Personal liability coverage: Legal costs from damage or injury of yourself or others

– Medical payment coverage: Medical expenses of other parties injured on your property

– Loss of use coverage: Expenses of living elsewhere if your home is uninhabitable

Your rental location

The location of your rental property helps companies determine the likelihood of you filing a claim. The more likely you are of filing claims, the higher your premium gets.

Weather is also a major factor that affects insurance premiums. For this reason, your insurance company will always ask for your address.

Your rental building and history

Your building size and history act as factors that determine the price of your premium. Older building increases your premium as they are at a higher risk of damage.

Your renters insurance deductible

Your deductible is the amount of money you pay out-of-pocket prior to filing a claim. This is then followed by your insurance provider covering the rest of the costs, accordingly to your coverage limits. The higher your deductible, the lower your premium will be.

Actual cash value renters insurance vs. replacement cost renters insurance

There are two payment options to choose from that determine how you get paid from filing a claim. You can either receive actual cash value or replacement cost of damaged or lost belongings. The actual cash value policy will pay you the value of your belonging after depreciation. This means you will not be paid the price you initially paid for them.

Replacement cost covers the cost of repairing or replacing the damaged/lost item. Therefore, this type of payment pays out more as well as costs more.

Renters insurance discounts

You can lower your premium by installing safety features in your home. Features that could give you discounts include:

– Fire and smoke alarms (sound on)

– Carbon monoxide alarms

– Automatic sprinklers

– Burglar alarms

– Deadbolt locks

– Fire extinguisher

Additional riders and coverage

Renters insurance doesn’t always cover all personal property. Generally, items with a higher value aren’t covered due to them being higher than the covered limits. In order to protect valuable items, people tend to purchase additional coverage to cover damage or loss of valuable items.

You can also add more personal liability coverage to increase protection from damage you’d be responsible for.

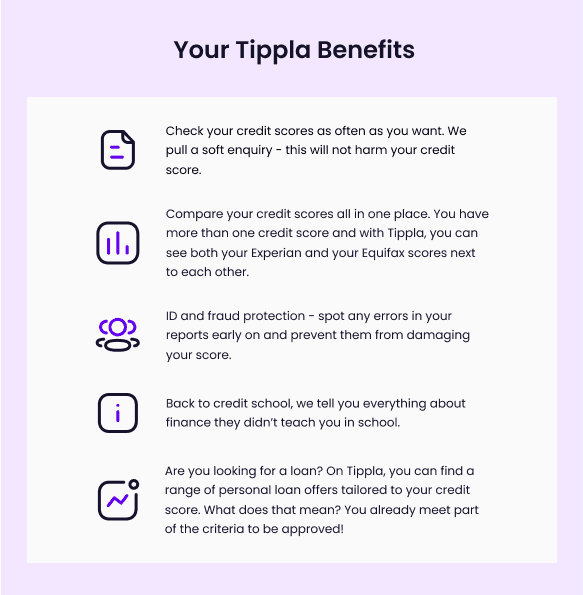

Your credit score

Insurance providers will assess your credit and debt history to determine your premium price. Satisfactory credit scores result in lower premiums as you would be at a lower risk to insure.

How to pay renters insurance premiums

You can either pay your premium in full or in increments. The different options include:

– Monthly

– Semi-annually

– Annually

The method by which you pay your premiums depends on your insurance provider. The most common form of payments includes bank transfers, credit cards or authorised checks.

What happens if I don’t pay my renters insurance premium?

Your insurance company is required to give you a 30-day grace period before cancelling your policy. If you don’t pay the premiums you owe within that 30-day grace period then you lose coverage. If that happens, you will have a lapse in coverage.

You should definitely try to avoid this as much as possible. If you have a lapse in coverage, then none of your belongings will be protected and you no longer have any liability coverage (you might also be in violation of your lease if your landlord requires renters insurance).

Hungry for more?

Did you enjoy reading this article? Tippla is here to give you all the advice you need on renters insurance! Read more here!

While we at Tippla will always do our best to provide you with the information you need to financially thrive, it’s important to note that we’re not debt counsellors, nor do we provide financial advice. Be sure to speak to your financial services professional before making any decisions.

Related articles

Why Is Your Credit Score Important? A Quick Overview

18/07/2023

Whilst your credit score is only a number, it...

What is a Car Insurance Broker?

28/07/2021

A car insurance broker helps users determine which policies...

New Year, New Credit Score: Take Control of Your Credit

07/09/2021

The new year is upon us. It’s time to...

Should I get a student bank account?

28/07/2021

Student bank accounts are essentially the same as any...

Subscribe to our newsletter

Stay up to date with Tippla's financial blog