Published in July 29, 2021

Will my car insurance go up after a claim?

Even though your premium will increase after filing an at-fault claim, there are some things you can do to lower the costs.

Filing a claim is never fun, especially knowing you’ll have to pay more for your insurance. But accidents happen and that’s why insurance is there in the first place. With comprehensive insurance, the cost of damage and medical bills will be covered.

You may wonder, will my car insurance go up after an accident? Generally, filing an at-fault claim will very likely increase your insurance premium, significantly. An exact price would be hard to predict and it would depend on multiple factors such as the severity of the accident. However, here’s what you should know about the effect of claims on your car insurance rates.

How much does your insurance go up after an accident?

Hypothetically, say you’re driving and you accidentally rear-end someone. Regardless of how it happened, you will be at fault for being the car to rear-end the other. This, unfortunately, means your car insurance will have to cover the costs and your premium will be increased.

If you get in an accident, make sure to follow all the right steps to make sure everyone is safe. Additionally, make sure you exchange all the necessary information for the claims to be resolved smoothly and quickly.

Here’s a summary of what your insurance coverage does:

| Compulsory Third Party (CTP) insurance | Protects you if you injure (or kill) someone in a car accident |

| Third-party property damage | Covers you if you cause damage to someone’s else’s property |

| Third-party fire and theft | Covers you if your car is damaged by theft or fire |

| Comprehensive car insurance | The most advanced type of coverage (also the most expensive) |

If you get in an accident, your insurance will cover all the repair costs you or the other driver needs, depending on your coverage limits.

Additionally, medical costs are also covered for both parties, depending on your coverage limits. In saying that, if you exceed your coverage limits, you are fully responsible for the expenses. That’s why people usually go for comprehensive insurance, as it provides the most coverage out of all the other options. Once your policy is due for renewal after you’ve filed a claim, your provider will notify you of any increases to your rates. Your insurance rate increase depends on a few factors.

How long does an accident stay on my record?

The severity of the accident, whether you’re at fault, as well as your driving record, contribute to your insurance rate. If this is your first accident, don’t worry! It will most likely stay on your record for 3-5 years. The way insurance calculates the cost of your premium is based on how much of a risk they see you as. That’s why drivers under the age of 25 have much higher premiums.

If you’re on your learner’s license or are a guardian of a learner, read more on Learner drivers and car insurance.

Accidents tend to stay on your record for 5 years. So, that’s good news! Your premium rates won’t stay high forever! Your car insurance provider will only take the past three to five years when calculating your rates.

How does car insurance work if you’re not at fault?

If you’re in an accident where you’re not at fault, your insurance can still step in. For example, if your car gets hit while it’s parked, you may want to file a claim to get your losses covered.

There’s also the scenario where your car gets damaged by natural causes. That’s when comprehensive coverage does its job and covers the damage when you file a claim.

Moneysmart can help you find the right car insurance for you.

Hungry for more?

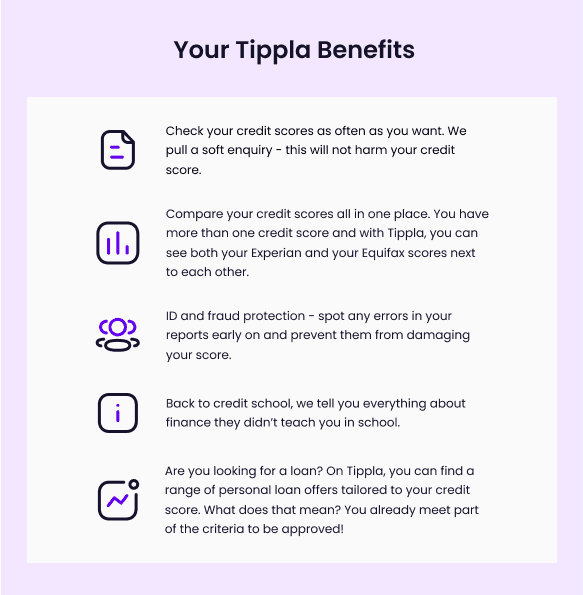

If you would like to read more on insurance, or other financial topics, head to Tippla’s blog. Or, you can sign up to Tippla for a whole heap of benefits!

While we at Tippla will always do our best to provide you with the information you need to financially thrive, it’s important to note that we’re not debt counsellors, nor do we provide financial advice. Be sure to speak to your financial services professional before making any decisions.

Subscribe to our newsletter

Stay up to date with Tippla's financial blog