Published in July 29, 2021

Will renters insurance cover a lost wedding ring?

You’ve just been popped the question, and you’ve excitedly said yes! You love your ring, but you want to make sure it’s covered. How can you do this? Will renters insurance cover lost wedding ring? We break this down.

Covering lost jewellery

When renting any sort of property, renters insurance commonly protects your personal property as well as liability. This includes your everyday items or belongings such as jewellery. When damaged by a covered hazard, you will get reimbursed to either fix or replace them.

Different types of coverage

Personal Property: This coverage protects and reimburses your belongings in the event of damage or theft. That coverage is regardless of whether it’s inside or outside your property.

Medical Expenses and Personal Liability: In the case of someone else being injured in your property, liability coverage aids with any legal expenses. Medical expenses are also covered in the case of another person being injured.

Loss-of-use coverage: In the case of your property becoming uninhabitable, your insurance may cover the costs of staying elsewhere.

Your policy limit determines how much coverage you get on expensive stolen items.

Will renters insurance cover lost wedding ring?

Insurance generally covers the majority and sometimes all the cost of reimbursement for your personal belongings. Even if your belongings were damaged or stolen not within your property, renters insurance will still cover the price of reimbursement. If your wedding rings get damaged or stolen whilst you’re on vacation, your insurance policy should still pay out your policy limit.

In the case of a covered peril, you should still be able to file a claim on your damaged ring, depending on its value and depreciation. It’s always a smart idea to get a professional appraisal on your pricier personal belongings, in order to ease your claim and help determine the replacement cost. This could also help you decide on whether you would want to add additional coverage.

What perils are covered?

When personal property is damaged by perils such fires, falling objects, theft or more, renters insurance will usually cover the cost. It’s important to mention that most insurance companies only cover expensive jewellery in the case of theft, as that’s the only covered peril with jewellery. Although, sometimes insurance providers will reimburse you for loss of jewellery, depending on additional riders or coverage.

What are the coverage limits for wedding rings?

Insurance usually includes a certain amount of coverage per loss, depending on your policy and provider. The insurer is liable to cover your coverage limit, which is the maximum amount. For example, if you purchase $10,000 in renters insurance, you will be covered up to $10,000 in total losses.

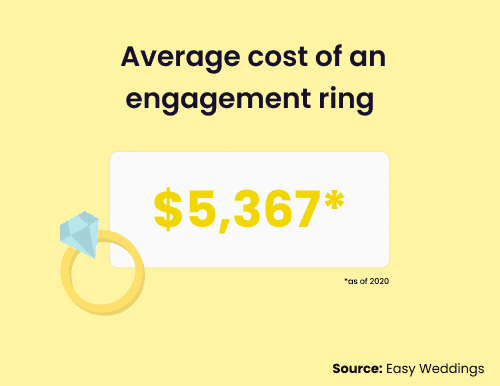

Value items like wedding or engagement rings have separate limits called sub-limits. Most insurers will offer sub-limits for jewellery within the $1,000 and $1,500 range. For example, if you have a jewellery sub-limit of $1,000 and your ring costs $8,000, you will only receive $1,000 for a covered reimbursement.

Most wedding rings are expensive and some people may want higher coverage, you could always purchase additional coverage.

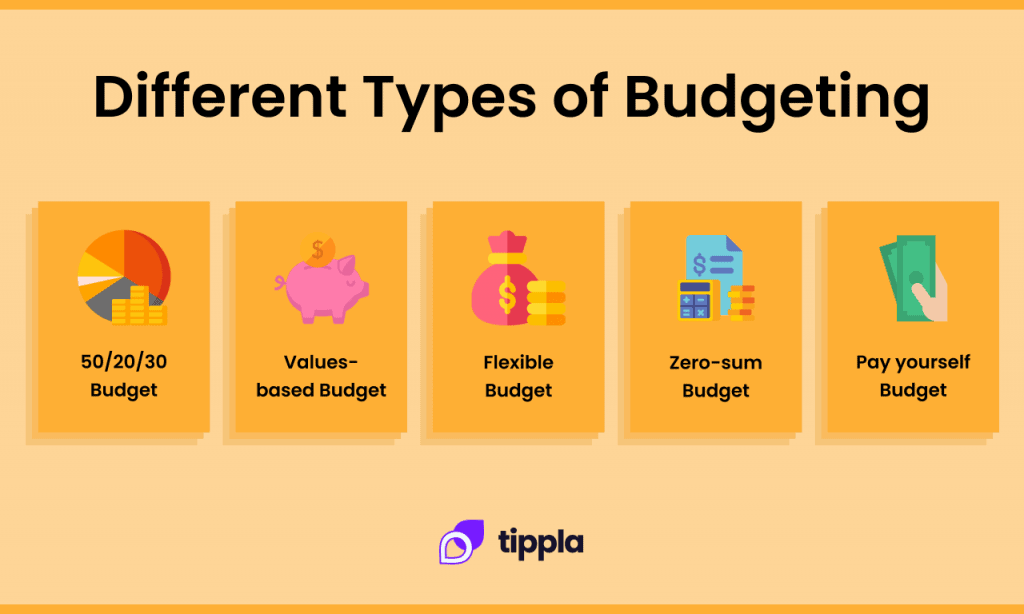

Plan a thorough budget with Moneysmart to understand your spending habits and how much you can afford for your monthly payments.

How to insure jewellery with renters insurance

The first step would be to put the renters’ insurance policy under the name of the ring owner, it can be in the purchaser of the rings name, but after you give the wedding or engagement ring to the recipient you must change the name on the policy.

– Add additional coverage and riders

Most insurance providers limit coverage at a range of $1,000 to $1,500 range. Meaning, if your jewellery exceeds that amount, you should consider additional coverage. There are a few ways to do this.

– Scheduled property coverage

This allows you to increase coverage for a specific item. With scheduled property coverage, you could also add additional coverage for a specific liability that is not covered by your policy. As mentioned before, jewellery is only covered in the case of theft; This allows you to cover it in the case of other perils.

– Increase your coverage limits of all your jewellery

You can purchase additional coverage that allows you to cover all jewellery. This means you could increase your total coverage to cover the majority of the value of your wedding rings, along with other jewellery items depending on each item’s value and your provider.

– Replacement cost coverage

Replacement cost policies tend to pay out the value of the item as if it were bought new. This means the depreciation is not a factor. However, you might have an agreed value policy, which will pay the depreciated amount of your item in the event of a covered claim. In this case, adding additional coverage can help you get paid out. Although additional coverage increases your premium, you’ll usually be reimbursed for your ring as if it were brand new, depending on your coverage limit.

– Purchase a separate jewellery insurance policy

A lot of insurance companies offer jewellery insurance, which would mean you’d have a completely separate policy from your renters’ insurance. It’s important to mention that you’d essentially be getting the same coverage from the separate policy as you would from additional coverage to your renters’ insurance policy, so that should be taken into consideration.

How to file a renters insurance claim on a wedding rings

In the event of filing a claim for stolen or damaged wedding rings, you’d need to start the process immediately. In the case of theft, you’d need to file a police report initially, as reports could provide your insurer with evidence of theft.

A lot of insurance companies have a deadline as to when you can file a claim to have your ring covered, therefore you should always file a claim immediately. This deadline is usually between 48 to 72 hours of the incident.

In order to ease filing your claim, always have these handy:

– Your policy number

Details about the incident (what happened, what it’s worth…etc.)

A police report in the case of theft

Contact details

– Documented photos or videos of the damage

After filing your claim, your insurance provider will start an investigation process which may take time depending on the incident. You could always ask for an estimated timeframe.

When does renters insurance not cover wedding rings?

Even after purchasing additional coverage, there are still some fractures that may not cover your wedding/ engagement ring.

Gradual deterioration: Your insurance provider will not reimburse or replace your ring from gradual wear and tear.

Insects or vermin: If pests damage your jewellery, your provider will most likely not cover your claim.

Destruction because of government quarantine or custom laws: Although this is rare, your insurance provider will still not cover or reimburse your rings in the case of government quarantine.

Mechanical breakdown: If any part of the jewellery itself causes the damage, your insurance provider will not cover it.

Learn more about how the accounts you hold can affect your credit score by signing up with Tippla for just $4.95 a month.

While we at Tippla will always do our best to provide you with the information you need to financially thrive, it’s important to note that we’re not debt counsellors, nor do we provide financial advice. Be sure to speak to your financial services professional before making any decisions.

Subscribe to our newsletter

Stay up to date with Tippla's financial blog