Published in December 7, 2023

A Complete Guide to Home Loan Fees

Homeownership is a significant milestone, and many individuals opt for home loans to help with their financing. However, aside from the loan amount and interest rates, numerous fees can impact the overall cost of borrowing. Prospective homeowners must familiarise themselves with these fees to make informed decisions and ensure financial preparedness.

This guide aims to simplify the often-overlooked aspects of home loan fees, providing borrowers with a roadmap to fully understand the financial landscape of property ownership.

Application and Origination Fees

Two major up-front costs that prospective borrowers frequently face are application and origination fees. These fees are different, but they are both related to the initial phase of the loan process. Application and origination costs function as a deterrent to frivolous applications. By charging these costs, lenders make sure that applicants are interested in obtaining a loan, reducing the risk of processing applications that may not result in a finalised loan.

Application Fees

Application fees are one-time non-refundable charges imposed by lenders to cover the costs of processing a loan application and are payable when you submit your application for a home loan. These fees contribute to the administrative expenses incurred by the lender during the initial stages of assessing a borrower’s eligibility and processing the application.

Origination Fees

Origination fees are upfront costs levied by lenders to compensate for the work of creating a new loan. They are typically calculated as a percentage of the total loan amount and are meant to cover the lender’s expenses related to underwriting, document preparation, and other tasks involved in bringing the loan into existence.

Comparing Fees Across Lenders

Understanding how to compare application and origination fees from different lenders is crucial for borrowers seeking the most cost-effective loan options.

Here’s a guide on how to make informed comparisons:

- Consider the Total Cost: Instead of focusing solely on one fee, evaluate the overall cost of the loan, including interest rates and other charges. This provides a more comprehensive picture of the financial commitment.

- Negotiate Where Possible: Some lenders may be open to negotiation on fees, especially if you have a strong credit history. Don’t hesitate to discuss fees and terms to find a mutually beneficial arrangement.

- Evaluate Loan Packages: Some lenders may offer bundled packages. Bundled home loan packages combine various financial products like home loans, credit cards, savings accounts, insurance policies, share trading accounts, and financial planning services. Lenders offer these products collectively, potentially resulting in reduced interest rates or fees compared to individual products. This cost savings can lead to more favourable interest rates on home loans or lowered fees for affiliated credit cards and insurance policies.

- Research Lender Reputation: Consider the reputation and reviews of potential lenders. A lender with a transparent fee structure and a history of customer satisfaction may provide a more favourable borrowing experience.

Appraisal and Inspection Fees

Appraisal Fees

The costs incurred when a certified appraiser determines the worth of a piece of real estate are known as appraisal fees. To be sure that the property’s worth supports the loan amount, lenders need appraisals. This keeps the lender and the borrower from overestimating the value of the property.

A buyer’s agent normally charges a fixed fee for an appraisal and negotiating service, or a percentage of the purchase price of the property (often approximately 0.9%) + GST.

Inspection Fees

The price of a professional inspection of the property’s mechanical and structural elements is covered by the inspection fees. The purpose of this inspection is to find any possible problems or fixes that are needed. Buyers may make educated judgements and negotiate conditions based on the results of inspections, which provide them with an accurate depiction of the property’s condition.

Inspection reports are a useful instrument in negotiations. Buyers and sellers may bargain if serious problems are found, and repairs or price modifications may be made to ease worries. Inspection fees vary depending on factors such as property size, location, and the extent of the inspection. The cost range is generally between $259 and $930. However, it’s essential to note that fees may differ by state.

Factors Affecting the Cost of Appraisals and Inspections

- Property Type and Size: Larger or more complex properties may require more extensive appraisals and inspections, impacting the overall cost.

- Geographic Location: The cost of services can vary based on the location of the property. In areas with higher daily living expenses and costs, appraisal and inspection fees may be relatively higher.

- Property Condition: The condition of the property can influence both appraisal and inspection costs. Properties that are dilapidated or badly kept may need more extensive assessments, increasing the overall cost.

- Scope of Inspection: An inspection may or may not be very detailed. While some buyers could choose for a general inspection, others might ask for specialist evaluations for certain parts, like the electrical or plumbing systems.

- Appraiser/Inspector Experience: The appraiser or inspector’s experience and standing may affect the cost. Experts with more experience might charge more, which suggests their reliability and skill.

Credit Report and Credit Check Fees

Credit Report Fees

The cost of acquiring a record documenting a person’s credit history is known as a credit report fee. Credit bureaus generate this report, which contains information on public records, credit accounts, and payment histories.

To determine if a borrower is creditworthy, lenders review credit reports. These give lenders information about a person’s financial conduct to help them decide about loan interest rates and loan approvals.

Individuals can access their credit reports for free once every three months, as mandated by law. Credit reporting bodies are required to provide this service without charge. While the standard access is free, some services offer additional features for a fee.

Helpful Tip 💡But did you know that there is a way for you to access your credit score anytime you want to? And the best part, it’s completely FREE. Simply sign up with Tippla today and get full access to your credit score and MORE. Tippla also offers a range of financial tools that can help you improve your credit rating.

Credit Check Fees

Credit checks are usually initiated by lenders or other institutions when you apply for credit, such as a loan or credit card. Generally, you will not be charged a fee for a credit check unless it’s a “comprehensive” check, which includes additional information beyond your basic credit report. These can cost around $30 – $100.

Title Search and Title Insurance Fees

Title Search Fees

Title search fees are the costs of reviewing public documents to determine the legal ownership and status of a property’s title. The purpose of this is to verify if the seller is authorised by law to transfer ownership. In real estate transactions, title searches are essential for locating any liens, encumbrances, or legal matters that can impact the title of the property.

Each state and territory has its land registry and associated fees. For example, a title search in New South Wales might cost around $15.45, while in Victoria it could be as low as $20.

Title Insurance Fees

Title insurance costs cover the cost of getting a title insurance policy, which protects purchasers and lenders against financial loss due to errors in the property title. Title insurance adds another degree of security by limiting the financial risks associated with potential title issues, even when a comprehensive title search has been performed.

The Importance of Ensuring a Clear Title When Buying a Home

- Legal Ownership Confirmation: A clear title ensures that the seller has the legal right to transfer ownership. Without a clear title, the legitimacy of the transaction may be compromised.

- Avoiding Future Disputes: A thorough title search helps identify any outstanding liens, claims, or restrictions on the property. Resolving these issues before the purchase can prevent future legal disputes.

- Securing Financing: Lenders typically require a clear title before approving a mortgage. A clear title assures lenders that their investment is protected and that the property can serve as collateral.

How Title Insurance Protects Buyers and Lenders

- Protecting Against Undisclosed Issues: Title insurance provides coverage for undisclosed issues that may arise after the purchase, such as hidden defects in the title that were not identified during the title search.

- Safeguarding Against Fraud: Title insurance can protect against fraud or forgery that may affect the validity of the title. This includes situations where someone else claims ownership of the property.

- Covering Legal Costs: In the event of a title dispute, title insurance may cover legal fees and related expenses, saving buyers and lenders from significant financial burdens.

- Ensuring Marketability of Title: Title insurance enhances the marketability of the property by providing confidence to potential future buyers that the title is clear and that they, too, can obtain title insurance for their purchase.

Lenders Mortgage Insurance (LMI)

When talking about home loans or home financing, borrowers often encounter Lenders Mortgage Insurance (LMI). Lenders Mortgage Insurance is designed to protect lenders when borrowers secure a home loan with a deposit of less than 20% of the property’s value. It is a risk mitigation measure that facilitates access to homeownership for those with a smaller deposit.

Lenders Mortgage Insurance protects lenders from potential financial losses if a borrower defaults on their mortgage. Lenders may offer home loans to a wider range of borrowers and promote more inclusion in the real estate market by offering this insurance.

Factors Affecting the Cost of LMI:

- Loan-to-Value Ratio (LVR): LMI costs are tied to the Loan-to-Value Ratio, reflecting the proportion of the loan amount relative to the property’s value. A higher LVR results in higher LMI premiums, emphasising the importance of a substantial deposit.

- Deposit Amount: The size of the deposit significantly influences LMI costs. A larger deposit reduces the LVR but also correlates with lower insurance premiums, offering an incentive for borrowers to contribute a substantial upfront amount.

- Creditworthiness: Similar to global lending practices, the borrower’s credit history and financial standing play a role in determining LMI costs. A favourable credit score may contribute to reduced insurance premiums.

Closing Costs

Closing costs are the final phase of the homebuying experience, involving a variety of fees that assure a smooth and legally compliant property transfer.

Attorney Fees

Legal professionals ensure that all legal aspects of the property transaction are appropriately handled, from reviewing contracts to facilitating the transfer of ownership. Attorney fees contribute to the legal guidance and expertise necessary to safeguard the interests of both buyers and sellers during the closing process.

Notary Fees

Notaries validate the authenticity of signatures on legal documents, adding a layer of authentication to the closing process. Notary fees are essential for certifying the legality of documents, and ensuring that the transaction adheres to legal standards.

Escrow Fees

Escrow agents act as neutral third parties, holding funds and documents until all conditions of the sale are met. Escrow fees cover the services provided by these agents, fostering a secure and organised exchange of funds and documents between buyers and sellers.

How to Estimate and Negotiate Closing Costs

To estimate closing costs based on your location and property value, you can use reputable online tools and calculators, such as those provided by savings.com.au and savvy.com.au. Engage with potential lenders who can provide detailed loan estimates, breaking down anticipated closing costs early in the home buying process.

To negotiate, you can solicit quotes from various service providers, including attorneys and escrow agents, to compare costs and potentially negotiate for more favourable terms. In some cases, buyers may negotiate with sellers to share or cover certain closing costs as part of the overall transaction.

The Importance of a Loan Estimate and Closing Disclosure

Loan Estimate

A Loan Estimate is a document provided detailing the estimated costs of a mortgage, including closing costs. It allows borrowers to compare offers from different lenders and understand the breakdown of potential expenses associated with the loan.

Closing Disclosure

A Closing Disclosure is a document provided to borrowers at least three days before closing, outlining the final terms and costs of the loan. It confirms the accuracy of previously estimated costs and enables borrowers to identify any discrepancies or issues before finalising the transaction.

Prepayment Penalties and Exit Fees

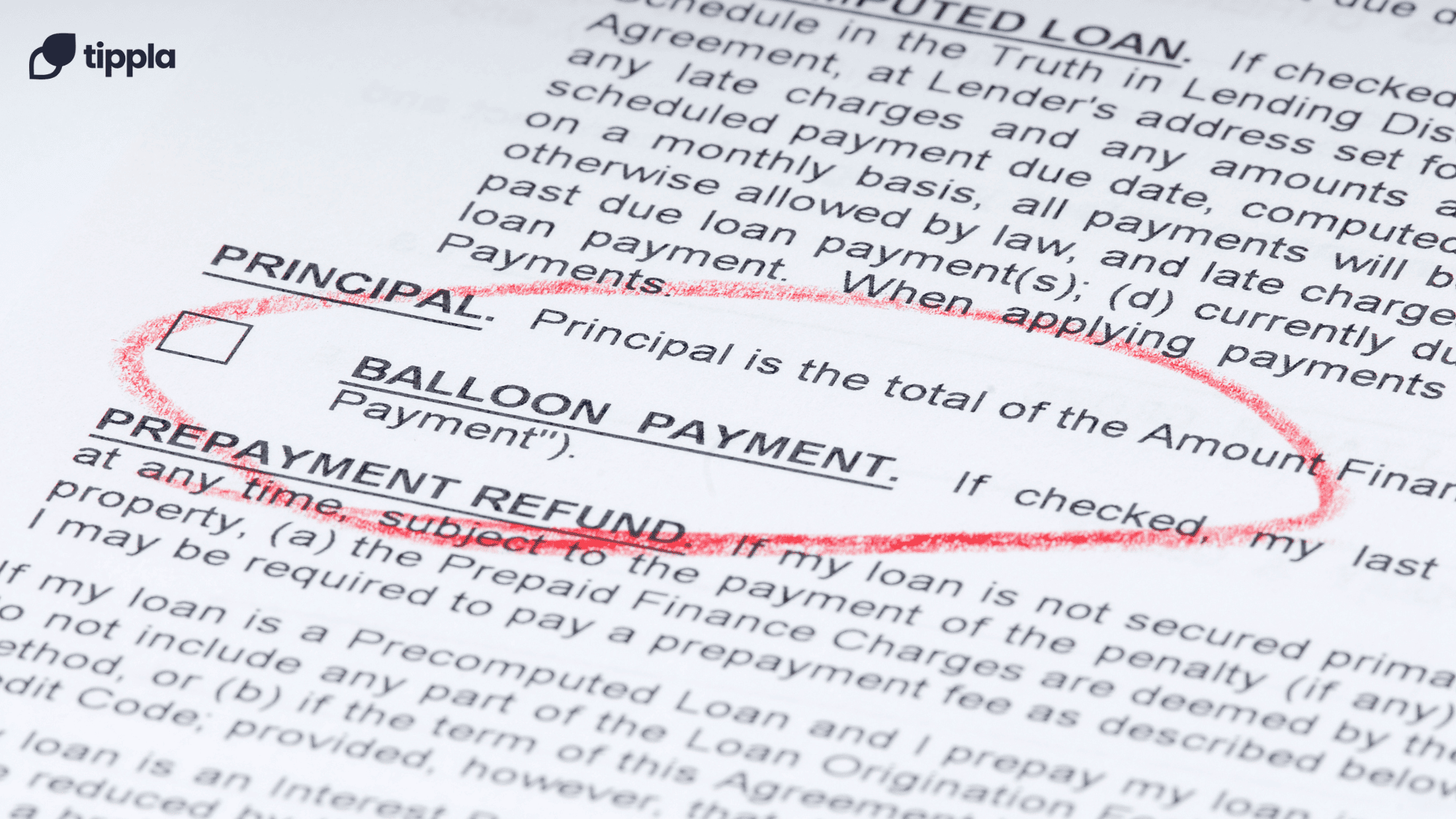

Prepayment Penalties

Prepayment penalties are charges imposed by lenders when borrowers repay their loan amount before the agreed-upon schedule. These penalties are designed to compensate the lender for potential lost interest. Their primary purpose is to discourage borrowers from paying off their loans early, ensuring lenders receive the expected interest income over the agreed-upon loan term.

Exit Fees

Exit fees are charges incurred when borrowers conclude or exit their loan agreement before the specified term ends. These fees may include various costs associated with the premature termination of the loan product. Exit fees are intended to offset administrative costs and potential financial repercussions for the lender when a borrower exits a loan arrangement ahead of schedule.

How to Determine if Your Loan Has These Fees

- Review Loan Agreement Terms: Carefully scrutinise your loan agreement for clauses related to prepayment penalties and exit fees. These details are typically outlined in the terms and conditions section.

- Consult with Lender: Directly enquire with your lender about any potential prepayment penalties or exit fees associated with your loan. Lenders are obligated to provide transparent information about the terms of your borrowing arrangement.

- Examine Loan Documentation: Thoroughly examine the loan documentation, including the Loan Estimate and Closing Disclosure provided by the lender. These documents often highlight any potential penalties or fees associated with early loan repayment.

Loan Servicing Fees

A mortgage’s ongoing management and administration costs are represented by loan servicing fees. Loan servicers, who are in charge of overseeing borrower accounts, collecting payments, and making sure that loan terms are followed, are the ones who impose these costs. Loan servicing costs pay for a variety of services and back-end work that keep a mortgage running smoothly for the duration of its term.

Role of Loan Servicing Fees in Mortgage Servicing:

- Payment Processing: Loan servicing fees contribute to the processing of monthly repayments. This includes the collection, allocation, and recording of payments made by borrowers.

- Account Management: Loan servicers use these fees to manage borrower accounts, keeping detailed records of payments, outstanding balances, and any relevant changes to loan terms.

- Customer Support: Fees associated with loan servicing help fund customer support services provided by loan servicers. This includes addressing borrower enquiries, providing assistance during financial difficulties, and offering information about loan terms.

- Escrow Management: For mortgages with escrow accounts, loan servicing fees support the management of funds earmarked for property taxes, homeowners insurance, and other related expenses. Servicers ensure these payments are made on time.

- Compliance and Reporting: Loan servicing fees contribute to the implementation of compliance measures, ensuring that the loan adheres to relevant regulations. Servicers are responsible for generating and providing required reports to both borrowers and regulatory authorities.

Conclusion

An in-depth understanding of the various home loan charges is crucial for people starting their homeownership. The application and origination fees, appraisal and inspection costs, as well as the specifics of a credit report, title search, and insurance costs, present a challenging financial environment for borrowers.

When it comes to closing costs—which usually include escrow, attorney, and notary fees—finalising the buying of a home requires careful consideration and discussion. Borrowers who are well-informed and aware of these fees may comfortably navigate the complicated world of home loans, allowing a more seamless transition to the joys of homeownership and helping them to make sensible financial decisions at every turn.

While we at Tippla will always do our best to provide you with the information you need to financially thrive, it’s important to note that we’re not debt counsellors, nor do we provide financial advice. Be sure to speak to your financial services professional before making any decisions.

Subscribe to our newsletter

Stay up to date with Tippla's financial blog