Published in October 19, 2021

When Do Banks Do a Credit Check For Personal Loans?

If you’re applying for a personal loan with a bank - do they check your credit score, and if so, when do they do it? Tippla has all the answers in our helpful guide below.

If you’re in the market for a personal loan, you might be wondering when do banks do a credit check for personal loans? We have put together this helpful guide to take you through the process of credit checks when it comes to personal loans.

What are credit checks?

Before we get stuck in, let’s first cover what are credit checks. A credit check is when someone checks your credit score. In Australia, only companies you authorise can view your credit scores.

Typically, you provide your permission to conduct a credit check when you apply for credit, such as a personal loan. This is a requirement when applying for a personal loan unless you have sought out a personal loan that does not require a credit check.

Do personal loans require credit checks?

Yes, generally speaking – personal loans offered by banks, non-bank lenders, credit unions and other credit providers will require you to consent to a credit check when you apply for a personal loan.

When you apply for a personal loan, the company you are applying with will want to determine how big of a risk you pose. Basically, this means they want to know whether you will make your loan repayments.

Your credit score and credit report are some of the factors used to determine your creditworthiness (translation: how reliable of a borrower you are). They will often also ask to see your recent bank statements, employment status and other factors they can use to determine your risk profile.

No credit check personal loans

Whilst nearly all personal loans will require a credit check, there is a niche of personal loans that do not require a credit check. These are referred to as no credit check personal loans.

Although this is an option for you in Australia, no credit check personal loans are difficult to find and your options are limited. For this type of personal loan, instead of looking at your credit history, lenders will generally look at your income, employment status, existing debts and other criteria when assessing your risk profile.

What’s important to highlight here is that no credit check personal loans are riskier for lenders. Because of this, they will often come with higher interest rates and fees, which can cost you a lot in the long run.

What does a credit check do to my credit score?

When you apply for a loan, this is referred to as a credit enquiry and it will appear on your credit report for up to 5 years. There are two main types of credit enquiries – hard and soft.

The main difference is that a hard enquiry is made after you have applied for money in some form, such as a credit card, loan, post-paid phone plan, whereas a soft enquiry is unrelated to lending you money.

Hard enquiries harm your credit score. That means, each time you apply for a loan, you are damaging your credit score. Of course, sometimes this damage is unavoidable – and it won’t last forever, but it is a good idea to space out your credit applications and do your research before applying for a loan.

What credit score do I need for a personal loan?

If you’re thinking of applying for a personal loan, is there a perfect credit score you should try and have before you apply? When it comes to credit scores, generally, the higher your score, the better it will be for you.

In Australia, you have three credit scores, one with each of the three credit bureaus in Australia – Equifax, Experian and illion. Your credit score will range from either 0 – 1,000 for Experian and illion, or 0 – 1,200 with Equifax.

Your credit score is a representation of your creditworthiness. Therefore, the higher your score, the more reliable of a borrower you are perceived to be. Whilst your credit score isn’t the only factor lenders consider when reviewing your loan application, it is an important piece of the puzzle. In fact, your credit score could be the difference between being accepted or rejected for credit.

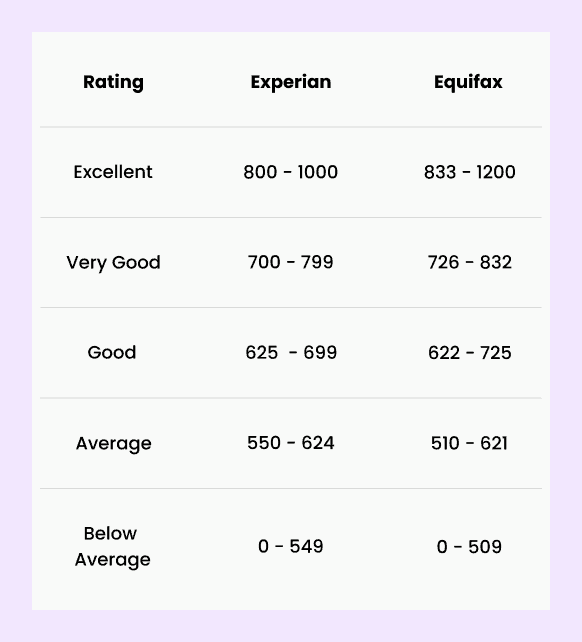

Therefore, if you’re wanting the perfect credit score when applying for a personal loan, you should be aiming for a credit score that’s good or higher. Here’s how Equifax and Experian categorise their credit scores:

Source: Experian and Equifax

If your credit score is average or below average, there are still options out there for you. If you’re not urgently in need of credit, you could try and improve your credit score before applying for a loan. Otherwise, you can do your research and see what bad credit loan options are available for you.

When do banks do a credit check for personal loans?

Now you know what a credit check is and why banks perform them when you apply for a personal loan, let’s take a look at when banks do a credit check for personal loans.

As we discussed above, banks need your consent to perform a credit check. You typically give this consent in the terms and conditions when you apply for a loan. Therefore, banks can only check your credit history once you have made an application with them.

So in answer to the question “when do banks do a credit check for personal loans”, the answer is – after you’ve applied for the loan, and before you’re either approved or rejected.

Where can I get a personal loan?

You can get a personal loan from a range of providers. Whilst banks are still one of the largest players in the game, you can also get personal loans from non-bank lenders and credit unions.

If you are looking for a personal loan, then Tippla has you covered! When you sign up for Tippla, you can access a range of personal loan offers that have been tailored to your credit score. When you fill out the application, you will be matched with a range of lenders who would be willing to lend to you based on your credit score.

Not sure what your credit score is?

If you’re not sure what your credit score is, then Tippla has you covered. When you sign up for Tippla, you can view your Equifax and Experian credit scores and reports. Not only that, but you can access our credit school – a short online course that will take you through the basics of your credit score.

While we at Tippla will always do our best to provide you with the information you need to financially thrive, it’s important to note that we’re not debt counsellors, nor do we provide financial advice. Be sure to speak to your financial services professional before making any decisions.

Related articles

How to get proof of renters insurance

28/07/2021

What is renters insurance? If you rent property, it’s...

Does renters insurance cover collectables?

29/07/2021

Does renters insurance cover collectibles? Here’s a breakdown on...

What is Credit Repair? How to Fix Your Credit Score

19/10/2021

Mistakes on your credit reports can be quite common....

Which is better: Personal loans or credit cards?

07/09/2021

Loan 101 – what’s better for me – personal...

Subscribe to our newsletter

Stay up to date with Tippla's financial blog