Published in October 22, 2021

How Is Interest Charged For Personal Loans?

When you take on a personal loan, you’re not only repaying the amount you’ve borrowed, often you will also have to pay interest on top of the loan.

It can be difficult to understand how interest works when it comes to your personal loan. A lot of people don’t realise how much interest can cost you over the life of your loan. That’s why Tippla is answering the question – how is interest charged for personal loans? Let’s get stuck in.

What is interest?

Before we get into the nitty-gritty details of how interest is charged for personal loans, let’s first cover what is interest. Putting it simply, interest is a fee that you pay in exchange for using someone else’s finances (such as a bank, non-bank lender, credit union, etc). You pay interest on top of repaying the amount you have borrowed (referred to as the principal amount).

You pay interest on top of repaying the amount you have borrowed (referred to as the principal amount). Generally speaking, when it comes to personal loans, the interest rate is noted on an annual basis. This is known as the annual percentage rate (APR). The APR does not use compound interest.

Why do you have to pay interest on personal loans?

Lenders don’t lend to people simply because they want to. Just like anything else, lenders such as banks, non-bank lenders and credit unions are businesses, and businesses need to make money. Charging you interest when they lend you money is one of the ways lenders achieve this.

Furthermore, interest rates are used by lenders to hedge against risk. As the Reserve Bank of Australia (RBA) outlines: “For each loan that it makes, a bank will assess the risk that a borrower does not repay their loan (that is, the credit risk). This will influence the revenue the bank expects to receive from a loan and, as a result, the lending rate it charges the borrower… A bank’s perception of these risks can change over time and influence their appetite for certain types of lending and, therefore, the interest rates they charge on them.”

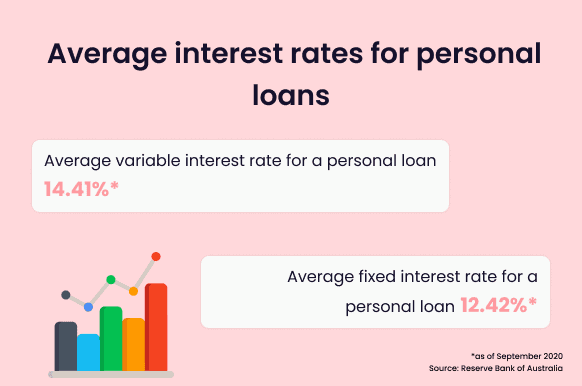

Personal loans and interest rates

There are a number of personal loan products, and the amount of interest you pay and how it is calculated will vary depending on which product you select. Namely, when you take out a personal loan you can get either a fixed-rate or variable-rate personal loan. In some instances, you can even get a no-interest-rate personal loan. We’ve broken down each product below.

Fixed-rate personal loans

A fixed-rate personal loan is when the interest rate of your loan won’t change for the duration of the loan’s term. With a fixed-rate personal loan means your payments should remain consistent over the life of your loan. Therefore, you can easily budget your repayments.

Furthermore, should interest rates increase, then you don’t need to worry about having to pay more each month. On the other side, if interest rates fall, then you won’t benefit from not having to pay as much in interest.

Variable-rate personal loans

The opposite to the fixed-rate personal loan, is a variable-rate personal loan. Instead of having the same interest rate for the duration of your loan term, with a variable-rate personal loan, your interest rate can fluctuate depending on the market.

A variable-rate personal loan can offer you more flexibility, as well as allow you to capitalise on lower interest rates when the market takes a dip. However, it can increase your risk of having to pay higher interest rates if interest rates increase.

No-interest personal loans

Another option you have when it comes to interest, are no-interest personal loans. Under the No Interest Loan Scheme (NILS), you can borrow up to $1,500 without needing a credit check. The repayments range from 12 to 18 months.

If you want to get a loan under the NILS, you must:

- Have an income less than $45,000 per year after tax and have either a Health Care Card or a Pensioner Concession Card;

- Have lived at your current address for more than three months;

- Prove that you can repay the loan.

Whilst you can get interest-free loans from NILS, the strict criteria might mean you’re not eligible. However, there are a couple of other schemes and routes you can take. This includes:

- Centrelink cash advance – if you currently receive Centrelink benefits, you can apply to have one of your payments made in advance.

- Pension Loans Scheme – the government scheme allows Australian seniors to supplement their income by borrowing against the equity in their property. Whilst these loans aren’t interest-free, they do have a significantly lower interest rate.

- Buy Now Pay Later (BNPL) – if you need to make a purchase, but you can’t afford to make the payment in one go, then BNPL platforms could be an option for you. With BNPL, you can split your payments into smaller instalments. You don’t have to pay interest on the purchase, but you can be charged fees including late fees, overdraft fees from your bank, and interest if your account is connected to a credit card.

If you are in need of financial assistance and you’re not sure of your options, you can reach out to a free financial counsellor with the National Debt Hotline to discuss your options.

How is interest charged for personal loans?

In Australia, the interest calculated for personal loans, car loans and home loans, is usually based on the unpaid daily balance of your loan and is charged to the loan on a monthly basis.

As outlined by Australia and New Zealand Banking Group Limited (ANZ): “The interest rate applied each day is equal to your annual interest rate at the time, divided by 365. Please note: Interest charged to your loan may differ each month, as it is dependent on the number of days in the month, the applicable annual interest rate and the unpaid balance of your loan.”

Here’s an example of what that might look like. Say you have a personal loan of $10,000 and a 2.5% interest rate p.a. You can calculate your interest by first finding the daily interest rate:

$10,000 x 0.025/365 = $0.68 daily interest.

Now, to work out how much in interest you’ll pay for the month (let’s choose October), you need to multiply the daily interest by the amount of the days in the month:

$0.68 x 31 = $21.23 monthly interest for October

Your repayments will then be calculated based on the following factors – the amount of your loan, the loan term, the annual interest rate and any applicable fees.

The impact of interest

Whilst interest is a necessary evil when it comes to taking on finance, interest can really cost you a lot in the long run. So how can you reduce the interest rate on your personal loan? We’ve outlined a couple of things you could do below

Pay off your personal loan quickly

Because your interest is calculated on a yearly basis and charged monthly, the quicker you can repay your loan, the less interest you should have to pay. You can pay off your loan faster by:

- Rounding up your repayments – say your monthly repayment is $235 a month, you could instead try and put $250 towards your loan each month, which will see the loan paid off faster.

- Paying fortnightly instead of monthly – there are 12 months in a year or 26 fortnights. If you pay $200 a month, then you’ll pay $2,400 for the year. But if you pay $100 a fortnight, you’ll end up paying $2,600 a year. This could help you pay off your loan faster.

- Make additional repayments – if you can afford it, instead of making your repayments once a month, you could try and make extra repayments to pay off your loan faster.

Before you make any changes to your repayment schedule, you should check the terms and conditions of your loan to ensure you won’t be charged any fees for paying off your loan faster.

Do your research

One of the best ways to save yourself money when it comes to interest is to do your research before you take on a personal loan. If you compare your options on the market and find a loan with a low interest rate and other agreeable terms, you could save yourself a lot in the long run.

A simple google search can show the many personal loan options that are available for you. There are a number of comparison websites that can allow you to see your options in one place. However, it is important to keep in mind that they won’t show all the options available.

Opt for shorter-term loans if possible

Long-term loans might seem appealing with their smaller monthly repayments and lower interest rates, but long-term loans aren’t always the best option.

As an example, say you borrow $1,000. If you take out a short-term loan with a 3-month repayment period and a 14% interest rate p.a. Throughout the loan, you’ve paid $35.7 in interest (assuming every month is 31 days).

On the other side, imagine you take out a longer-term loan of the same amount, with a 2% interest rate over 2 years. That 2% interest rate is dramatically smaller than 14%. However, over the 2 years, you’ll end up paying $40 worth of interest, which is more than the higher-interest short-term loan.

While we at Tippla will always do our best to provide you with the information you need to financially thrive, it’s important to note that we’re not debt counsellors, nor do we provide financial advice. Be sure to speak to your financial services professional before making any decisions.

Related articles

What Is a Joint Personal Loan?

28/07/2021

Understand what joint personal loans are, how they work,...

Credit Score FAQs: You Asked, We Answered

26/07/2021

There is a lot of uncertainty surrounding credit scores...

Do Investments affect your credit score?

22/01/2025

Whether in property, the stock market, cryptocurrency, or a...

Subscribe to our newsletter

Stay up to date with Tippla's financial blog