Published in September 7, 2021

Should You Pay Off Your Credit Card or Personal Loan First?

Do you currently have credit card debt as well as a personal loan? You might be wondering what’s the right course of action: should you pay off your credit card or personal loan first? Tippla has put together this helpful guide to allow you to make an informed decision.

Learning the differences between debt

When you’re trying to decide which debt you should pay off first, it’s important to understand the differences between debt. Your credit card debt and personal loan will likely have different interest rates, terms and conditions.

With this in mind, it’s important to understand the differences between the two.

Interest rates

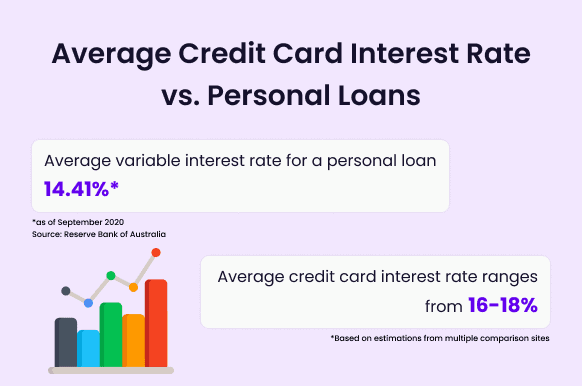

When it comes to deciding what debt to pay off first, it’s a good idea to compare the interest rates between the two. Typically, credit cards charge higher interest rates than personal loans do.

Annual Percentage Rate

The Annual Percentage Rate (APR) is the total amount of interest you will pay each year, before compound interest. The APR is represented as a percentage of the balance. The APR doesn’t include fees, such as account opening and maintenance fees.

For a credit card, say you have an APR of 10%, you will pay approximately $100 annually for each $1,000 borrowed. However, credit cards can have more than one APR. They can have one for purchases, one for cash advances and one that is charged when you make late payments.

Fees

Both credit cards and personal loans have fees associated with them. When considering which debt to pay off first, you should also consider the different fees you could be charged if you don’t pay off your debt.

Credit card fees

For credit cards, the most common fees include:

- Annual fees – the majority of credit cards come with an annual fee which you’ll be charged each year. The cost of this fee will vary depending on which credit card you have.

- Interest – You will be charged interest when you carry a balance, ie. when you don’t pay off your credit card debt for the month. The amount of interest you’ll be charged will depend on your card.

- Cash advance fee – When it comes to credit cards, a cash advance is when you withdraw money from an ATM with your credit card or buy foreign currency. When you do this you will generally be charged a cash advance fee.

- Late payment fee – At the end of each month you’ll receive your bill for how much you’ve spent on your credit card. If you don’t pay at least the minimum amount by the due date you’ll likely be charged a late payment fee.

- International transaction fee – If you use your card overseas or make a purchase online with an international merchant, you will likely be charged a fee.

Personal loan fees

For personal loans, the most common fees include:

- Establishment fees – This fee is charged when you take out a personal loan. It is charged to the borrower to cover the establishment of the loan.

- Ongoing monthly fees – Some lenders might charge ongoing monthly fees, such as account management fees.

- Late payment fees – Similar to credit cards, if you miss a loan payment, then you could be charged a late payment fee.

- Early repayment fee – Some personal loans don’t allow you to repay them earlier than the set term. This is because, if you pay off your loan earlier, then you save money in interest. To offset this potential loss, lenders might charge an early repayment fee.

Comparison rate

When you look for personal loans, you will likely see two rates attached to the loan – the interest rate and the comparison rate. The comparison rate is the combination of the interest rate and most of the fees and charges that you will incur if you take on this loan. The comparison rate is a more accurate representation of how much extra you’ll be paying on top of the loan.

How to pay off your debt

When it comes to paying off your debt, there are two main methods people tend to use. These are the snowball and the avalanche system. Let’s take a look at them both.

Snowball system

The snowball system is when you organise all of your debts from the largest to the smallest amount. Once you have organised your debts like this, the snowball method dictates that you make the minimum repayments for all of your larger debts, and focus your attention on your smallest debt.

As part of the snowball method, you aim to pay off your smallest debt as quickly and comfortably as possible. To achieve this, you could pay more than the minimum amount. If you have spare cash, then you could put it straight into repaying this loan.

Once your smallest debt is repaid, then you will move onto the second smallest debt. This cycle would continue until your largest debt is paid off.

Avalanche system

Similar to the snowball system, you approach the avalanche system by organising all of your debts. However, with this method, you rank them from the highest interest rate to the lowest.

Once you have ranked your debts, the avalanche method dictates that you make the minimum repayments towards your debts with the lowest interest rate, and increase the amount you pay for your highest-interest debt.

This method is particularly beneficial if you want to save money because paying off interest can add up quickly.

You could also try debt consolidation to get on top of your credit card debt and personal loan.

Should You Pay Off Your Credit Card or Personal Loan First?

Let’s sum up all of the information and points we’ve discussed in this article. Should you pay off your credit card or personal loan first? Here are the main things you should consider:

- The interest rate – which one is costing you the most in interest?

- Fees – which one is costing you the most in fees. Do the fees outweigh the interest you are paying?

- What can you afford to pay off?

- Which method best suits your lifestyle – the snowball or avalanche method

Most publications recommend that you pay off the debt which is charging you the most in interest. However, this might not be the best approach for every situation. If you are unsure of what’s the best course of action for you contact a free financial counsellor. They can provide you with advice based on your circumstances.

While we at Tippla will always do our best to provide you with the information you need to financially thrive, it’s important to note that we’re not debt counsellors, nor do we provide financial advice. Be sure to speak to your financial services professional before making any decisions.

Subscribe to our newsletter

Stay up to date with Tippla's financial blog