Published in September 19, 2024

The Pros and Cons of Pre-Approved Credit Offers

Pre-approved credit card offers are tempting, but it’s important to consider the advantages and disadvantages before accepting one. These offers usually provide a quick and easy approach to applying for new credit that has a good chance of being approved.

Keep in mind that preapproval does not equate to approval; It just means that you passed the lender’s initial screening. You also have to note that accepting a pre-approved offer may result in a hard credit enquiry, which might lower your score for a while. Aside from this, as compared to cards you actively look into, pre-approved cards may not always provide the greatest conditions or interest rates according to CreditCardCompare.com.au.

Ultimately, pre-approved offers should be carefully evaluated. Even while they might be handy, it’s a good idea to weigh your needs, evaluate your alternatives, and refrain from making rash decisions based on the status of your pre-approval.

Pros of Pre-Approved Credit Offers

- Convenience and Speed of Application: Pre-approved credit offers make the application process more efficient and hassle-free for applicants by streamlining the process. Those looking for quick financial solutions can especially benefit from this convenience.

- Access to Potentially Favorable Terms and Offers: Those who get pre-approved offers may be eligible for more favourable terms, such as competitive interest rates and other benefits. These terms are customised based on the person’s creditworthiness, which might lead to a better financial deal.

- Enhanced Negotiating Power: When finalising credit agreements, pre-approved applicants frequently have good negotiation power. Having this upper hand may result in a more favourable loan terms such as lower interest rates or a repayment period that’s ideal for your situation.

- Potential for Introductory Promotions and Rewards: Pre-approved credit offers might include tempting initial promotions and rewards. These may consist of advantages such as lower initial interest rates, sign-up bonuses, or exclusive rewards, providing additional value to the credit-seeking individual.

Cons of Pre-Approved Credit Offers

While pre-approved credit offers can be enticing, it’s essential to consider potential drawbacks that may impact individuals.

- Impact on Credit Report and Score: Accepting pre-approved credit offers could result in hard enquiries being made on your credit record, which might have an impact on your credit score.

- Risk of Overspending or Accumulating Debt: Having pre-approved credit might be convenient, but it also comes with a risk of overspending or debt accumulation. People can be enticed to use the available credit limit without giving it much thought, which could eventually cause financial difficulties.

- Potential for Deceptive or Unfavorable Terms: Pre-approved credit offers may have drawbacks, including high interest rates post-introductory periods and annual fees that can offset rewards programs. Being aware of hidden fees like late payments or balance transfer charges is crucial. The convenience of easily accessible credit may lead to overspending and debt accumulation.

Types of Financial Products with Pre-Approval Options

In the Australian financial context, various financial products offer the convenience of pre-approval options, catering to diverse needs and preferences.

- Online Loans: Before applying, borrowers may evaluate their eligibility and possible loan conditions with the help of online lenders’ pre-approval tools for personal loans. This streamlined process improves the efficiency of receiving financial assistance.

Fun Fact! 📢 Did you know you can check your pre-approved loan offers through Tippla? When you sign up with Tippla, you can access personalised loan offers from your dashboard. Isn’t that great?

Note: These offers do not affect your credit score unless you start applying for a loan

- Credit Cards: Credit card companies often give pre-approved credit card offers to those who qualify. This pre-approval expedites the application process by enabling customers to look over credit card alternatives with an understanding of the terms and perks.

- Auto Loans: Pre-approval for auto loans is provided by car financing organisations, giving potential car purchasers with an in-depth knowledge of their budget and lending terms. This makes the process of buying a car more efficient and helpful.

- Mortgages: Pre-approval for home loans is offered by some mortgage providers. This enables potential buyers to determine their borrowing capacity and explore properties within their budget with confidence. A mortgage pre-approval increases a homebuyer’s competitiveness in the real estate market.

What information do lenders use to determine pre-approval?

When you apply for pre-approval, lenders want to get a sense of your financial health and ability to handle a loan. They do this by scrutinising several key factors, which we can broadly categorise into the following:

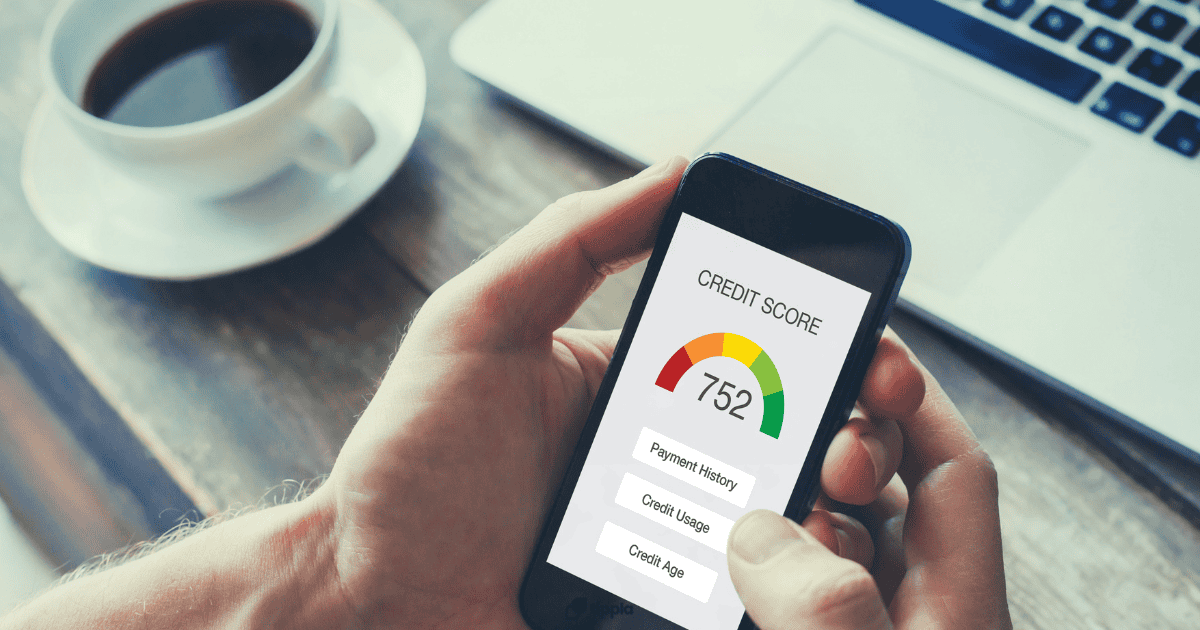

- Credit Score: Lenders frequently check your credit score first since it is a numerical representation of your previous borrowing and repayment patterns. A high credit score increases your chances of being pre-approved by assuring lenders that you are a reliable borrower.

- Income and Employment: Your ability to repay the loan must be proven to the lender by having a regular source of income. Pay stubs, tax records, and proof of employment help them determine how stable your income is and how likely it is to continue.

- Debts and Liabilities: Existing debts, such as car loans or school loans, influence your total financial capabilities. Lenders use your debt-to-income ratio, which indicates how much of your income is used to pay off current debt, to determine how much more you can afford.

- Savings and Assets: Having a strong savings cushion or large assets shows careful spending and the capacity to withstand financial crises. This can help your pre-approval case, particularly if your income or credit score isn’t the best.

- Loan Type and Purpose: The type of loan you’re looking for, as well as its intended purpose, can both have an impact on the pre-approval process. For example, because mortgages carry a larger risk than personal loans, lenders may be more stringent.

Remember, pre-approval is based on a snapshot of your finances at a specific time. It’s important to keep the lender updated if your income, debts, or employment status changes significantly.

Opting Out of Pre-Approved Credit Offers

Tired of overflowing mailboxes and spam emails filled with tempting credit card offers? You’re not alone. Thankfully, Australia empowers you to control this influx with two readily available options:

- Opt-Out Prescreen: This national, government-run service allows you to opt out of pre-screening for credit and insurance offers for five years. Visit the website or call 1800 5 OPTOUT (1800 567 8688). Remember, this applies to your credit report information being shared with credit providers, not to offers based on publicly available information like your address.

- Contact the Credit Reporting Bodies: Australia has three credit reporting bodies: Equifax, Experian, and Illion. You can contact them directly to opt out of pre-screening. Each has its process:

- Equifax: Submit a request online or by mail. You’ll find details on their website under “Products & Services” > “Credit Reports and Scores” > “Opt Out”.

- Experian: Similar to Equifax, you can opt-out online or by mail. Visit their website https://www.experian.com.au/ and search for “Opt Out”.

- Illion: You can opt out through their website or by calling 1300 734 670.

Remember, opting out is specific to each credit reporting body, so you’ll need to do it for all three if you want comprehensive coverage. Consider registering for a Do Not Mail list service like the Australian Mailing List Association’s suppression list. This can help reduce unsolicited marketing mail in general.

Using Pre-Approved Loans Wisely

When considering pre-approved credit offers, it’s crucial to navigate them wisely by evaluating and comparing offers effectively. Here’s a guide to making informed decisions and leverage favourable terms:

- Understand the Offer: Carefully review the terms, interest rates, fees, and repayment terms of the pre-approved loan offer. Clarify any unclear aspects by contacting the lender for additional information.

- Compare Multiple Offers: Don’t settle for the first offer. Seek pre-approval from multiple lenders to compare interest rates, fees, and overall terms. Use online tools and calculators to assess the total cost of each offer.

- Check for Hidden Costs: Read the fine print carefully for hidden costs such as application fees, origination fees, or prepayment penalties. Factor in all potential expenses to get a comprehensive view of the loan.

- Evaluate Repayment Flexibility: Assess the flexibility of repayment terms. Look for options like customisable repayment schedules or the ability to make extra payments without penalties.

- Consider the Impact on Credit Score: Understand that multiple credit enquiries can impact your credit score. Limit your rate-shopping to a specific timeframe (typically 14–45 days) to minimise the impact.

- Negotiate Terms: Don’t hesitate to negotiate with the lender for better terms, especially if you have a strong credit history. Negotiation may lead to reduced interest rates or more favourable repayment terms.

Common Misconceptions About Pre-Approval

- Pre-Approval Guarantees Loan Approval

Pre-approval is a preliminary assessment based on your financial information. It doesn’t guarantee final approval, as the property’s appraisal and additional checks are required before closing the deal.

- Pre-Approval Covers Any Property Type for Mortgage Loans

Your pre-approval is often specific to a particular property price. It may not apply universally, and changes in property type or price range might necessitate a reevaluation of your pre-approval.

- Pre-Approval is a Lengthy Process

While pre-approval involves a thorough review, it’s not as extensive as the final approval process. Final approval includes property-specific assessments and may take longer than pre-approval.

- Pre-Approval and Pre-Qualification Are Interchangeable

Pre-approval and pre-qualification differ. Pre-qualification is a preliminary assessment, while pre-approval involves a more in-depth analysis of your financial situation and creditworthiness.

Conclusion

In summary, pre-approved loans—whether for credit card, mortgage, or personal use—have advantages as well as misconceptions. Secured pre-approved loans provide a range of financial possibilities, whilst unsecured pre-approved loans include credit cards and personal loans. Despite popular belief, pre-approval enquiries—like those for credit cards—do not immediately affect a person’s credit score; rather, they just indicate that the person may be a candidate for credit. Using pre-approved credit offers strategically necessitates knowing the specifics of each kind, including the loan’s characteristics and possible impact on one’s credit score.

As customers navigate various financial landscapes, knowing the myths and reality of pre-approved loans allows them to make more educated and favourable financial decisions.

While we at Tippla will always do our best to provide you with the information you need to financially thrive, it’s important to note that we’re not debt counsellors, nor do we provide financial advice. Be sure to speak to your financial services professional before making any decisions.

Related articles

The Impact of Student Loans on Long-term Financial Planning

01/07/2024

Student loans, particularly through Australia’s Higher Education Loan Program...

How To Check My Credit Report For Free

13/09/2021

Your credit report is an important document that gives...

What happens at the end of a car lease?

28/07/2021

Car lease coming to an end? Here’s what happens...

How AI is Changing Credit Score Management

12/03/2025

Managing your credit score has always felt like a...

Subscribe to our newsletter

Stay up to date with Tippla's financial blog