Published in July 29, 2021

Rejected for a Loan? Use Your Credit Score To Help

If you’ve been rejected for a loan or denied credit, it could be because of your credit score.

Many Australians don’t realise just how important their credit scores are. While it may just be a number, your credit score can have far-reaching implications, especially if you are trying to apply for a loan. In fact, sometimes, the reason why you have been rejected for finance or denied credit is because of your credit score.

What is a credit score?

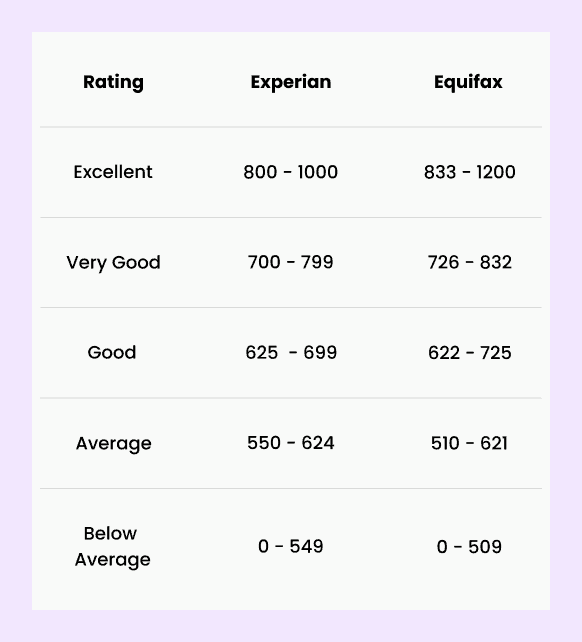

If you’re wondering how your credit score could have anything to do with your loan application, then it’s best if we start from the beginning. What is a credit score? Your credit score is a number ranging from 0 to 1,000 for your Experian and Illion credit score, or 0 to 1,200 for your Equifax credit score.

This number reflects your creditworthiness. It indicates to any credit providers or lenders how risky of a borrower you are. If you have a good credit score, then it shows that you’ve historically been good at managing your credit. If you have an average or below-average credit score, then it means you might be more of a risk to a lender.

In Australia, there are three credit reporting agencies – Equifax, Experian and Illion. Aussies have a unique credit score and credit report for each of these agencies. This means you actually have three credit scores and reports.

A common question we are asked here at Tippla – how is the credit score calculated? Each of the three agencies has their own formula for calculating your credit score. In fact, the specifics are a well-kept secret. But, most of them will use similar information such as your repayment history, credit accounts, credit enquiries, whether you have any defaults and bankruptcies, among other criteria.

How to check your credit score

If you’re not sure what your credit score is then never fear! You can check your credit score by signing up for Tippla. For no cost whatsoever, you can see your credit score, check your credit report, and have access to numerous resources to help you fix your credit score.

On Tippla, you can see two out of three of your credit scores and credit reports from Equifax and Experian. Alternatively, you can reach out to all three of the credit bureaus and request your credit score – but if you want your report in less than 10 days, you’ll likely have to pay.

What is a good credit score in Australia?

We often get asked the question – what is a good credit score in Australia? A good credit score ranges across the three credit reporting agencies – Equifax, Experian and Illion. Here’s a breakdown of what is a good credit score in Australia:

Source: Experian and Equifax

Every time you apply for a loan, credit card, or even sign up with an electricity provider, the company you’re applying to will check your credit score. If you have a below-average credit score, then you might be declined for credit, or rejected for a loan, as you’re deemed too high of a risk.

Another consequence of having a below-average credit rating is that when you apply for a loan or credit you might have to pay higher interest rates and fees than if you had a good credit score. This is because the provider is deeming you as a risk, and is compensating that with higher fees and interest.

This is why we say your credit score is an important number – it is used much more than you might think!

I’ve been rejected for a loan: what’s next?

If you’ve been rejected for a loan, the first thing you should do is find out why. There could be numerous reasons why you were denied finance, and your credit score is one of them. However, other reasons as to why you were rejected for finance might be:

- Insufficient income to make the repayments;

- Information on your credit reports such as bankruptcy, poor repayment history or multiple credit applications in quick succession;

- Your employment is not secure;

- You already have multiple loans.

If you’ve been rejected for a loan, you should ask the lender if it was due to information on your credit report. If it is your credit report, then you can ask the lender which credit report they used.

Once you know which credit report has led to your loan being rejected, you can take a look at your report on Tippla. On our platform, you can see your credit report for both Equifax and Experian. You can use Tippla to find out what is on your report that has caused the lender to reject your finance.

Perhaps you’ve defaulted on your repayments in the past, and that is showing on your report, or perhaps you have multiple credit accounts and loans. Whatever it is, you’ll be able to see it on Tippla.

Check your credit report for mistakes

You might be surprised to hear that 1 in 5 credit reports have some kind of mistake on them. Oftentimes, this mistake can damage your credit score. In a worst-case scenario, a mistake on your credit report could lead to you being rejected for a loan. This is why it’s so important to check your credit reports frequently, to make sure everything is correct.

Once you’re sure that everything is correct on your credit report, the next step you could take is improving your credit score.

Improve your credit score

Having a good credit score can be the difference between being approved or rejected for a loan. More than that, if you have a good credit score, then you might get access to better finance conditions.

As we mentioned earlier, a good credit score indicates to a lender that you are effective at managing your debt and are a low-risk borrower. This means that the lender doesn’t need to provide you with higher interest rates and fees to protect themselves if you should default. Of course, the lender will mostly always have some kind of interest rates and fees, but they could be much lower than if you had a below-average credit score.

This might seem like a no brainer, but interest rates can really make a huge difference in terms of how much money you’ll end up paying overall across the duration of your credit. Even a 0.5% difference in an interest rate can cost you thousands over the course of a year.

Take this as an example, the average home loan in Australia is $388,100. If you borrow that amount at 5% interest over 25 years, you’ll pay $292,539 in interest over the life of the loan. But if you borrow the same amount at 5.5% instead, you’ll pay an extra $34,344 in interest!

With this in mind, how can you improve your credit score? Tippla recently put together a guide on how you can fix your credit score. But here’s a quick breakdown on all the things you can do.

How to fix your credit score

There are numerous ways you can improve your credit score and decrease your chances of being rejected for a loan. It’s important to point out here that fixing your credit score can’t be done overnight. It will take time and consistent behaviour, but it definitely can be done!

Space out your credit applications

Every time you apply for credit – which includes any time you apply for a loan, the company you have applied to will check your credit report to see how risky of a borrower you are. This check registers as a hard enquiry on your credit report and can harm your credit score for a period of time.

The more applications you make, the more damage you’ll do to your credit rating. Additionally, lenders can see how many hard enquiries have been made, generally over the last two years. If a lender sees that you’ve recently made multiple applications, they might think you’re in a difficult financial position and desperately in need of cash. If they don’t want to take that risk, this could lead to them rejecting your application.

Make your repayments on time

Your credit score is based on how well you have managed your debt in the past. As part of this, your repayment history is an important factor when calculating your score. If you want to improve your credit score, then making sure you consistently make your credit and loan repayments could make a big difference.

Keep your credit accounts open

The age of your credit account can contribute positively to your credit score. The older the account, the better it is for your rating, as it demonstrates that you can consistently handle a line of credit.

Another way you can improve your credit score is by keeping your credit accounts open. Whilst we’re not advocating that you keep multiple credit accounts open just for the sake of it, you might want to consider keeping some open and in use so credit reporting agencies have data to base your credit score on.

What looks bad on a credit report

Whilst there are many things that can look good on your report, such as mature credit accounts, consistently positive repayment history and diversified credit, there are also things that can look bad on your credit report.

So what exactly might this be? Well, it could be anything that suggests that you haven’t effectively managed your debt. This could include too many credit applications, defaults, poor repayment history, bankruptcy and other serious credit infringements.

If you’re struggling with your debt, in Australia, you can contact a financial counsellor for advice on how to approve your situation. You can also reach out to the National Debt Hotline, which will help you with where to start.

Furthermore, credit providers are required to have hardship policies in place to help you if you are in a bad financial situation. If you are experiencing hardship, it could be worthwhile to reach out to your credit provider first and try to come to an agreement.

Use your credit score to get a loan

Your credit score can impact multiple areas of your life, including your ability to be approved for a loan. The better your credit score, the more likely you are to be approved for a loan. Not only that, but a good credit score could give you access to better loan terms and save you serious dollars in the long run.

If you want to take control of your credit score, sign up for Tippla here. Alternatively, if you want to learn more, check out Tippla’s Credit School – a free online short course which will guide you through the ins and outs of your credit score.

While we at Tippla will always do our best to provide you with the information you need to financially thrive, it’s important to note that we’re not debt counsellors, nor do we provide financial advice. Be sure to speak to your financial services professional before making any decisions.

Subscribe to our newsletter

Stay up to date with Tippla's financial blog