Published in July 28, 2021

Can You Use a Personal Loan to Pay Off Credit Card Debt?

As spending picks back up in Australia, more and more Aussies will be accruing a credit card debt. This has led to many asking the question – can you use a personal loan to pay off credit card debt? We’ve put together this handy guide outlining the pros and cons, as well as explore other options.

Credit card debt in Australia

Credit card debt in Australia fell during 2020, hitting its lowest level in more than 15 years. There were a few factors contributing to this – reduced spending during the pandemic, and Aussies switching to other lending services such as Buy Now Pay Later (BNPL).

According to figures from the Reserve Bank of Australia (RBA), throughout the pandemic in 2020 $6.3 billion in credit card debt was removed. This is a reduction of 23.5%.

Whilst these figures were reassuring, it appears that Aussies have been making up for lost time towards the end of the year, and so far into 2021. Across the Christmas period, Australians generated $24 billion in credit card debt.

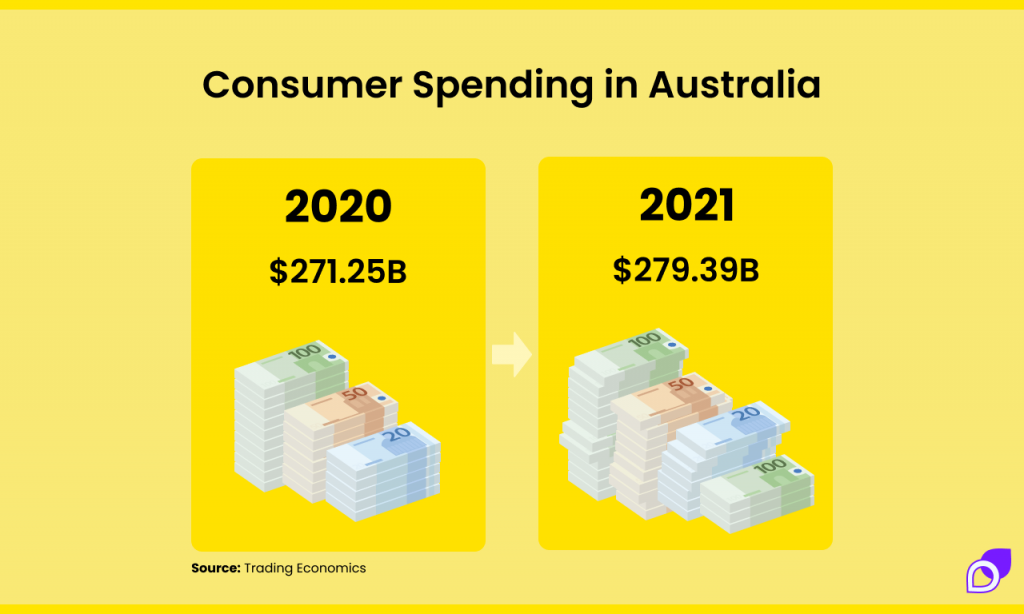

Forecasts for this year expect consumer spending to increase in 2021 and again in 2022. According to Trading Economics, consumer spending in Australia is expected to be $271.25 billion in 2021 and $279.39 billion in 2022.

Loosely translated, increased consumer spending this year and in 2022 could see credit card debt back on the rise. That’s why it’s good to know your options.

Paying off credit card debt

A credit card is a line of credit that you can use to make purchases – both online and in person. You can also make balance transfers and cash advances. Unlike debit cards, you’re not limited to the money in your bank account. Credit cards are similar to personal loans in that they provide you with extra finance set at a predetermined amount, which resets each month.

The extra finance provided by credit cards isn’t free money. You have to pay back what you spend. At the very least, you will need to make the minimum repayment every month by the due date of the balance if you want to avoid late fees.

With a credit card, you have a few options.

Pay off your credit card debt in full

Each month you will receive a credit card statement. This outlines all of your transactions and the amount you owe. The most cost-effective way to pay off your credit card is to pay it off in full each month. This means you pay back the full amount that you spent during the month.

Paying off your credit card debt in full is the most cost-effective way because this way you don’t carry over any debt into the next month, which will generally incur extra interest. However, it’s not always possible to pay off your credit card bill in full each month. If you have an unexpectedly expensive month, you might not have enough to settle the debt. That’s why there are other options.

Repay the minimum monthly repayment

Most credit cards have a minimum monthly repayment option if you can’t repay your full credit card bill. The minimum monthly repayment is the lowest amount you can pay in order to meet your credit agreement and avoid late fees. The minimum monthly repayment is usually about 2 or 3% of the total amount you owe for the month.

So what does this mean? Well, you don’t actually have to pay off your whole credit card bill each month. You only have to pay the minimum repayment if that’s all you can afford. But there’s a catch. You will still accrue interest on the remaining amount owing, which could cost you more in the long run.

Want to know how quickly credit card debt can get out of hand? Tippla recently covered why only making the minimum repayment can cost you in the long run.

Consequences of not paying off your credit card debt

If you don’t repay your credit card debt, or make the minimum repayment at the very least, there can be quite a few consequences. Whilst each credit card issuer has a different approach to late payments and defaults, we’ve put together a general overview of some of the consequences.

| Consequences | |

|---|---|

| Fees and interest |

|

| Impact on your credit score |

|

| Default notice |

|

| Impact on your reward points |

|

| Debt collectors |

|

Personal loans in Australia

A personal loan is a type of instalment loan where you borrow a fixed amount of money. With a personal loan, you generally repay it on a monthly or fortnightly basis with interest. When you’ve paid back the loan your account is closed.

A lot of Australians rely on personal loans. Data from the RBA showed that the total amount of outstanding personal loans in Australia was more than $145.5 billion as of September 2020.

Can you use a personal loan to pay off credit card debt?

If you’re struggling to repay your credit card debt, you might be thinking about taking out a personal loan. But is this a good idea? We’ve outlined some of the pros and cons of doing this.

If you’re not sure what’s the best option, you can seek the advice of a financial advisor, who can help you make the best decision for you.

Pros of using a personal loan to pay off credit card debt

1. You might be able to get a better interest rate with a personal loan

If you’re considering using a personal loan to pay off your credit card debt, it could be a good idea to look at the interest rates. If you carry a credit card balance then you could be getting charged high-interest rates.

The RBA reports that the average variable interest rate for a personal loan is 14.41% and 12.42% for a fixed personal loan. With this in mind, you might want to weigh the interest you’d have to pay for a personal loan vs the interest you’ll incur if you don’t pay off your credit card bill. If a personal loan turns out to be the most cost-effective way, then it could be worth considering.

2. You could save your credit score

As we mentioned above, defaulting on your credit card bill can hurt your credit score. Not only that, but it could remain on your credit report for 2-5 years, depending on how long it takes you to repay the debt.

Whilst taking on a personal loan will result in a hard enquiry on your credit report, the damage would be less than having a default on your credit report, which can stay on your report for 5 years.

Equifax explains it like this: “Hard inquiries serve as a timeline of when you have applied for new credit and may stay on your credit report for two years, although they typically only affect your credit scores for one year.”

Again, it’s important to weigh your options. Will a personal loan stop you from being issued an official default notice? If so, then it could be worth your while to take out a personal loan.

3. You could pay off your debt quicker

When you only make the minimum repayment of your credit card bill, your debt can quickly accumulate. Before you know it, you could have a large credit card debt that could take years to pay off.

This is where a personal loan could help. It could allow you to pay off your credit card debt instantly. Then, you’d need to set up a payment plan to repay your loan. But then you wouldn’t have to worry about your outstanding debt growing each month with interest.

Cons of using a personal loan to pay off your credit card debt

1. It could lead to more debt

Although a personal loan could help you remove your credit card debt, it could also put you in even more debt. You’re merely transferring the debt from your credit card to the personal loan.

If you continue to use your credit card after you have removed the debt with the personal loan, then you could end up having both a credit card debt and a personal loan debt. If you choose to go down this route, you’ll need to be careful and keep an eye on your spending.

There are a range of other options you could try first before using a personal loan to pay off your credit card debt, which we’ll cover later in this article.

2. You’re not guaranteed to get a lower interest rate

Whilst personal loans might on average have lower interest rates, it’s not a guarantee. If you have a below-average credit score, then you might only be offered high-interest personal loans. If this is the case, then there might not be any benefit to using a personal loan to pay off your credit card debt. In fact, you could end up paying more in interest and fees on the personal loan than your credit card. This is something to keep an eye out for.

3. Like credit cards, personal loans have fees

Like credit cards, most personal loans have fees, including late payment fees. Some common personal loan fees include:

- Establishment fees;

- Ongoing monthly fees;

- Late payment fees;

- Early repayment fees.

It’s important to read the terms and conditions of your personal loan carefully before taking on a loan. Be sure to weigh the pros and cons, or speak with a financial advisor if you’re uncertain.

Other ways to pay off credit card debt

Can you use a personal loan to pay off credit card debt? The short answer is yes. But there are also a few things you could try first before resorting to that option.

Pay as much as you can each month

If you have a credit card and you’re not able to pay off your whole monthly bill, instead of just paying the minimum monthly repayment, you could try and pay off as much of the bill as you can. That way, you’ll have less debt carrying over into the next month, and less being charged interest. This is one way you could try and minimise your credit card debt.

MoneySmart also outlines: “If you’re finding it hard to pay the minimum amount, contact your bank or credit provider straight away or talk to a free financial counsellor. Taking action early stops a small money problem from getting bigger.”

Reduce your debt

If you find yourself in a difficult situation. You could try and reduce your debt. If you want to do this, the first thing you need to know is how much you owe. Once you know that, then you can try and move forward.

MoneySmart recommends taking the following steps:

- Work out what you can afford to pay;

- Prioritise your debts;

- Build a savings buffer;

- Get help if you need it.

When it comes to reducing your debt, there are two main methods – the snowball system and the avalanche system.

Snowball system

The snowball system is where you look at your list of debts and organise them from the biggest to the smallest amount. Once you’ve done that, you make the minimum payments towards all other debts and increase the amount for your smallest. Your goal is to pay off this one as quickly as comfortably possible. Once it is paid off, move the remaining amount from your debt budget towards the second smallest debt.

Avalanche system

The avalanche system has the same initial approach. You need to look at the list of debts but organise them from highest to lowest interest instead. If you mean to save money, this method could do the trick.

Choose the debt with the highest interest rate. The longer you keep high-interest debt, the more it will cost you. Make the minimum repayments towards all other debts and increase the amount for your highest interest debt. While this may take a little longer, it will be very rewarding in the long run. Once this debt is paid off, your freed budget could be much bigger and can be put towards the second highest interest-debt.

Credit card balance transfer

Another method you could try is a credit card balance transfer. This is when you transfer your debt, AKA the balance, to another credit card. This could help you get on top of your debt, as you might be able to get a new interest rate of either 0% at a special low rate for a limited amount of time. This usually ranges from six months to 2 years.

A credit card balance transfer could allow you to pay off your debt faster and save you money, especially if you get a low or no interest rate deal. However, if you can’t pay off your debt quickly, then it could end up costing you more.

Is it smart to use a personal loan to pay off credit card debt?

To answer the question “can you use a personal loan to pay off credit card debt” – whilst you can use a personal loan to pay off your credit card debt, that doesn’t mean you should. There are a number of things you could do before you resort to using a personal loan to pay off your credit card debt.

To summarise, you could:

- Reduce your debt;

- Pay off as much of your credit card debt as you can each month;

- Opt for a credit card balance transfer.

If you’re ever unsure of what’s the best decision for you, you can talk to a free financial counsellor. They’ll be able to explain your options and help you make the best decision for your financial situation.

While we at Tippla will always do our best to provide you with the information you need to financially thrive, it’s important to note that we’re not debt counsellors, nor do we provide financial advice. Be sure to speak to your financial services professional before making any decisions.

Related articles

Credit Unions vs. Banks: Which is better for my money?

28/07/2021

Credit unions and banks are both financial institutions that...

How To Check My Credit Report For Free

13/09/2021

Your credit report is an important document that gives...

Which is better: Personal loans or credit cards?

07/09/2021

Loan 101 – what’s better for me – personal...

The Dos And Don’ts Of Credit: Protect Your Credit Score

12/09/2024

Taking out credit, whether it be a credit card,...

Subscribe to our newsletter

Stay up to date with Tippla's financial blog