Published in October 27, 2021

How Do Variable Rate Personal Loans Work?

With so many personal loan options out there, it’s important to understand the difference. Here’s a guide on variable rate personal loans.

Are you currently thinking about getting a personal loan? You might have realised just how many options there are for you – short-term, long-term, fixed-rate, variable-rate, the options can sometimes seem endless. To help you sort through the clutter, we’ll take you through how variable rate personal loans work and why you might consider one.

What is a personal loan?

A personal loan is a line of credit. Put simply, it’s when you borrow money under the agreement that you will repay the amount you borrowed, often with interest and fees on top.

People take out personal loans to cover something “personal”. Unlike business loans, student loans and home loans which can only be used for specific purposes, personal loans offer more flexibility.

You could use a personal loan to cover the following expenses:

- Medical expenses;

- Weddings;

- Vacations;

- Funerals;

- Large purchases, such as a television;

- Emergency expenses;

- Home renovations.

The different types of personal loans

There are seemingly endless different types of personal loans. We have outlined some of the most common types below:

- Secured personal loans – A personal loan that has been secured with collateral.

- Unsecured loans – Unsecured personal loans do not have an asset attached to the loan.

- Fixed-rate personal loans – A fixed-rate personal loan is when the interest rate doesn’t change for the duration of your loan.

- Variable-rate personal loans – A variable-rate personal loan is where the interest rate can change during the term of your loan.

- Overdraft loans – A personal overdraft is kind of like a line of credit, which has been linked to your transaction account.

- Debt consolidation loans – If you have multiple debts, and you want to pay them off, you can take out a debt consolidation loan.

What are variable rate personal loans?

Now let’s get stuck into what exactly variable rate personal loans are. As we covered above, when you take on a personal loan, you don’t just have to repay the amount you borrowed, but in most cases, you’ll also have to pay interest on top.

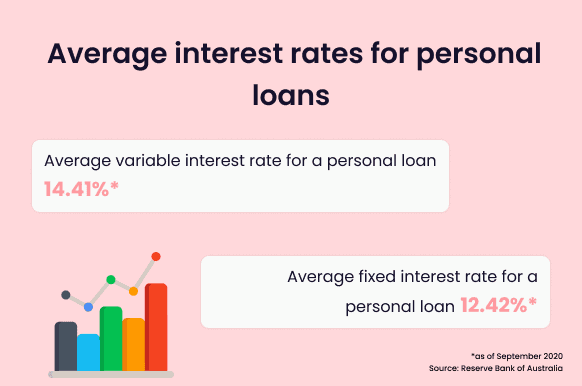

When it comes to personal loans, the interest you repay can either be a fixed interest rate, or a variable interest rate. With a variable interest rate personal loan, the interest can change – either up or down, throughout the life of the loan.

Generally speaking, variable rate personal loans offer more flexibility than fixed-rate personal loans. However, with that increased flexibility also comes an element of uncertainty. We’ll cover this a bit more below.

Why does the interest rate change?

The interest rate can be adjusted by the company you took the loan out with (bank, non-bank lender, credit union, etc). The interest rate can fluctuate for a range of reasons – changes in the official cash rate by the Reserve Bank of Australia (RBA), regulatory changes and other factors such as changes in costs, shareholder interests, etc.

What are the benefits of variable rate personal loans?

One of the key benefits of taking out a personal loan with a variable interest rate is that you can typically make extra repayments on your loan. This can allow you to pay off your loan faster and reduce how much interest you’ll pay on your personal loan overall.

Furthermore, with a variable interest rate, if interest rates fall, then your payments will reduce. If you have a fixed interest rate personal loan, then you won’t get to benefit from drops in the interest rate.

Things to consider

Whilst there are some advantages to variable rate personal loans, there are some things to consider. Just as your repayments can fall if the interest rate decreases, so can your repayments increase should the interest rate rise.

With a changing interest rate, it can be harder to budget around your repayments. Instead of needing to factor a consistent monthly amount into your budget, with a variable interest rate, you will need to consider how future interest rate movements might alter your repayments.

Variable-rate vs fixed rate personal loans

Whilst a variable rate can offer you more flexibility, a fixed-rate personal loan can provide you with consistency and certainty. With a fixed-rate personal loan, the terms of the loan are typically locked in. This means you can plan your budget knowing that your interest rate and minimum repayment amounts will remain the same for the life of your loan.

The key advantages of a fixed interest rate include:

- Consistency – Set and forget. You’ll know what your repayments are for the life of your loan.

- Security – You don’t have to worry about your interest rate rising if the market changes.

Some things to consider with a fixed interest rate are:

- Less flexibility – With this type of personal loan, you are often charged a fee for making additional repayments.

- Missing out – You won’t benefit from any interest rate decreases.

Why should I choose a variable rate personal loan?

You might be wondering which option is the right one for you – a fixed or variable interest rate. Ultimately, the option that’s best for you will depend on your individual circumstances and what you can afford to repay and how you want to repay it.

Before taking on a personal loan, it’s a good idea to check what will suit your financial situation best and outline your priorities. With so many personal loan options available, there will likely be a product that suits your needs best.

While we at Tippla will always do our best to provide you with the information you need to financially thrive, it’s important to note that we’re not debt counsellors, nor do we provide financial advice. Be sure to speak to your financial services professional before making any decisions.

Related articles

The Economics of Buying vs. Renting a Home

09/12/2024

Australia’s housing market has long been a topic of...

How to Choose the Best Australian Centralised Exchange

17/11/2025

If you’re new to the world of digital currency,...

Credit Scores and Mortgage Applications: What Australians Need to Know

15/09/2023

Many Australians dream of owning their own home, but...

Subscribe to our newsletter

Stay up to date with Tippla's financial blog