Published in September 12, 2024

The Dos And Don’ts Of Credit: Protect Your Credit Score

Taking out credit, whether it be a credit card, loan, or mobile phone, can have more implications than you may realise. Unfortunately, these effects aren’t commonly talked about, so you could be harming your credit score without even realising it. We’ve put together a helpful guide to help you protect your credit score.

Your credit score plays a significant role in your financial health, impacting your ability to borrow money, secure a loan, or even rent a property. In Australia, credit scores range between 0 and 1,200 (depending on the credit reporting agency), and having a good score opens the door to better interest rates, higher credit limits, and more favourable loan terms.

While many services claim to help improve your score, there have been credit ninja review complaints about the effectiveness of their services. It’s essential to research thoroughly and focus on practical, proven steps to boost your credit score. In this article, we’ll explore key strategies and tips to help you achieve a healthier credit score.

What is credit?

Before we dive in, let’s go over one important bit of information – what is credit? As defined by MoneySmart, “Credit is money you borrow from a bank or financial institution. The amount you borrow is debt. You will need to pay back your debt, usually with interest and fees on top.”

Examples of credit include:

- Credit card;

- Loans – personal (secured and unsecured), car, mortgage, business, student and more;

- Buy Now Pay Later services;

- Mobile phone;

- Internet;

- Electricity or gas;

- Water.

Your credit score, or credit rating, is a number ranging from 0 – 1,200. The role of a credit score is to indicate to credit providers your creditworthiness, which essentially means how risky of a borrower you are.

A good credit score indicates that you are effective at managing your debt and likely won’t default on your credit. A bad credit score shows that providing you with credit will be more of a risk to the provider. The better your credit score, the more likely you will be approved for credit.

Dos

Taking out credit can be beneficial for your credit score. In fact, you need to have taken out some form of credit in order to have a credit score. So how can you use credit for good?

Make your repayments on time

Your repayment history is one of the ingredients which contributes to your credit score. According to Equifax, your repayment history makes up 30% of your credit score – the second-biggest contribution behind only credit enquiries.

Because of this, whether you make your repayments on time could make a big difference to your credit score. So how can you make this work in your favour? Well, you could ensure that you always make your repayments on time.

There are a number of ways to do this, such as streamlining all your repayments to come out at once, setting up direct debit repayments or adding notifications on your phone.

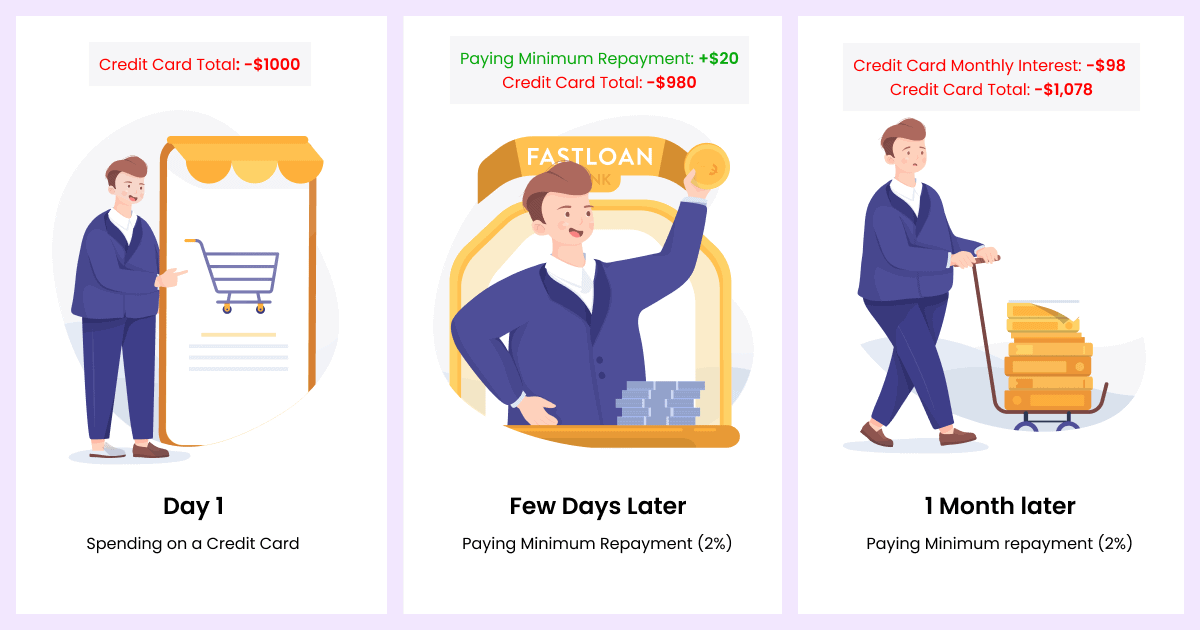

Make more than the minimum repayments

Did you know that if you only pay the minimum amount due on your credit card that carries interest, you’ll actually end up paying more money in the long term? It’s true!

When you take out a credit card, you’ll need to make a minimum payment each month, which is usually about 2 or 3% of the total amount you owe for the month.

However, when you only pay back the minimum amount, depending on how much you owe, you could end up having to pay back the outstanding balance for years. This means you could be stuck with credit card debt for years, even when you’re not using it anymore!

Think of it like this: your credit card charges you 10% interest per year and you spend $1,000 on your credit card in one month. Your minimum repayment is 2%, meaning you would have to pay a minimum of $20. This means that there’s still $980 that will be charged the interest rate, which will cost you an extra $98.

The next month, the interest you’ve been charged will be added onto your outstanding balance, and then you’ll have to pay interest on the new amount. Add on the fact that you’ll probably spend more in the next month, you can see how your credit card debt can quickly get out of hand!

Keep your line of credit open even when you’re not using it

Keeping your line of credit open, even when you’re not using it, might sound contradictory at first, but it could help boost your credit score. Why is this you may ask? The age of a credit account can contribute positively to your credit score.

Paying your credit bills from a specific account consistently showcases that you have been capable of dealing with this credit account for a long time. This serves as a good indication for a future credit provider that you are likely to handle credit well.

Whilst we’re not advocating that you keep multiple credit accounts open just for the sake of it, you might want to consider keeping some open and in use so credit reporting agencies have data to base your credit score on. You don’t have to go into debt to contribute to your credit history. Instead, you could make smaller purchases with your credit card and fully pay off your debt whenever needed.

In addition to keeping your line of credit open, having different types of credit can also be beneficial for your score. This is because it shows providers that you’re able to handle multiple credit accounts perfectly fine. At the end of the day, that’s what credit providers care about – that you can manage your debt well, and you’ll make your repayments on time.

Find the best interest rates

This might seem like a no brainer, but interest rates can really make a huge difference in terms of how much money you’ll end up paying overall across the duration of your credit. Even a 0.5% difference in an interest rate can cost you thousands over the course of a year.

Take this as an example, the average home loan in Australia is $388,100. If you borrow that amount at 5% interest over 25 years, you’ll pay $292,539 in interest over the life of the loan. But if you borrow the same amount at 5.5% instead, you’ll pay an extra $34,344 in interest!

Because of this, you might want to aim for credit with the lowest interest rates and fees when you apply for credit. If you’re not sure what’s the best option, you can seek the advice of a financial advisor, who can help you make the best decision for you.

Frequently check your credit score

Your credit score changes frequently. Credit providers report to credit bureaus once a month, but not necessarily at the same time. This means your score can change frequently.

If you check your credit score often you can see exactly what influences your score – both good and bad – and take steps to rectify the situation if something you have done has negatively impacted your score.

If you check your credit score, you’re more likely to catch any mistakes on your report early. 1 in 5 credit reports have some kind of mistake on them. Wrongly listed information could cost you valuable points. That’s why it’s important to check your information frequently to catch mistakes early on.

Don’t

We’ve given you a number of things you could do to protect or even boost your credit score, but what are some things you might want to avoid?

Make multiple credit enquiries in a short space of time

When you apply for some type of credit, such as a loan or credit card, before approving your application, the provider will take a look at your credit report to see how risky of a borrower you are. This request is recorded on your credit report as a hard enquiry and it will usually impact your credit score.

As outlined by Equifax, “Hard inquiries serve as a timeline of when you have applied for new credit and may stay on your credit report for two years, although they typically only affect your credit scores for one year.”

Hard enquiries on your credit report can symbolise different things to different lenders. For example, multiple hard enquiries might look like a number of financial institutions have rejected you. Therefore, they themselves may be more likely to reject your application. To be safe, know your options before you dive deep into the world of credit.

On the other side of the coin are soft enquiries. A soft enquiry is when you request a copy of your credit report or check your credit score. Soft enquiries don’t harm your credit score, and they’re not visible to potential lenders when they check your report after you make a credit application. A soft enquiry will stay on your credit report from 12 to 24 months.

Take on unnecessary credit

Your credit score is based on how effectively you can manage debt. One way to harm your credit score is to let your debt get out of your control. Therefore, one thing you could do to protect your credit score is to avoid taking out unnecessary credit.

If you’re taking out a loan to pay for something that you don’t necessarily need or you can’t really afford, then you might be living above your means. Before taking on credit, you should ask yourself if this is something you both need and can afford.

In a similar vein, maxing out your credit accounts can hurt your credit score. Just because you have an allocated credit limit, doesn’t mean you should use all of it. Using your full borrowing capacity may affect your credit score and indicate to credit providers that you may be at a higher risk to struggle financially in the future.

Lose track of your repayments

Repayments make up 30% of your Equifax credit score. That means, if you lose track of your repayments and miss, or even default on one of your bills, this could be bad news for your score.

Defaults can stay on your credit report for 5 years, which means any time you apply for credit, the provider will be able to see that you defaulted in the past and that might lead to them rejecting your application.

Prioritise long-term loans

If you’re looking for a loan, it can seem like a smart idea to take out a longer-term loan with a lower interest rate and an overall lower monthly repayment. However, this isn’t always the cheaper option.

Even if you end up paying less each month, because you’re having to make your repayments for longer, you might end up paying more overall. Ultimately, taking on a longer-term loan means that you are committed to making your monthly repayments for more time. If your financial situation was to change throughout the duration of the loan, this could make it difficult to make the repayments.

When taking out any form of credit, it’s important to do your research and calculate the total costs you’ll incur across the duration of the line of credit and not just the monthly repayments. If you’re ever in doubt, you can reach out to a financial adviser who can help you navigate your finances.

Protect your credit score by learning more

There’s a lot of mystery when it comes to credit scores and the nitty-gritty details can be confusing. However, following the above dos and don’ts could help you get started on improving, maintaining or even building your credit score!

If you want to learn more about how to protect your credit score, Tippla has you covered! Our Credit School is a free online resource which will guide you through all of the information you need to know about your credit scores and reports. So what are you waiting for? Let’s get credit-score savvy!

While we at Tippla will always do our best to provide you with the information you need to financially thrive, it’s important to note that we’re not debt counsellors, nor do we provide financial advice. Be sure to speak to your financial services professional before making any decisions.

Related articles

Can You Use a Personal Loan to Pay Off Credit Card Debt?

28/07/2021

As spending picks back up in Australia, more and...

Understanding The Differences: Credit Scores in Australia vs The US

19/06/2024

If you understand your credit score, then you can...

A Guide to Preventing Unauthorised Credit Enquiries

14/08/2024

In today’s digital age, safeguarding your financial identity is...

Bridging Loans for Property Purchase

09/12/2024

The Australian property market has been experiencing dynamic shifts,...

Subscribe to our newsletter

Stay up to date with Tippla's financial blog