Published in July 28, 2021

What Credit Score Do I Need for a Home Loan?

Your credit score is an important number when it comes to applying for different types of credit and loans. It can be the difference between being accepted or rejected for a loan. This has prompted many Aussies to ask “what credit score do I need for a home loan?”. We’ve gathered all the information you need to know in our quick guide below.

If you’re wanting to get into the property market, you’ll likely need to take on a mortgage. To get a mortgage, you’ll need to be approved by a lender. During this process, they’ll check your financial history, as well as your credit history, among several other factors. Having an above-average credit score can make a big difference when it comes to your application success rate, and the terms and conditions you’ll get.

How do credit scores relate to home loans?

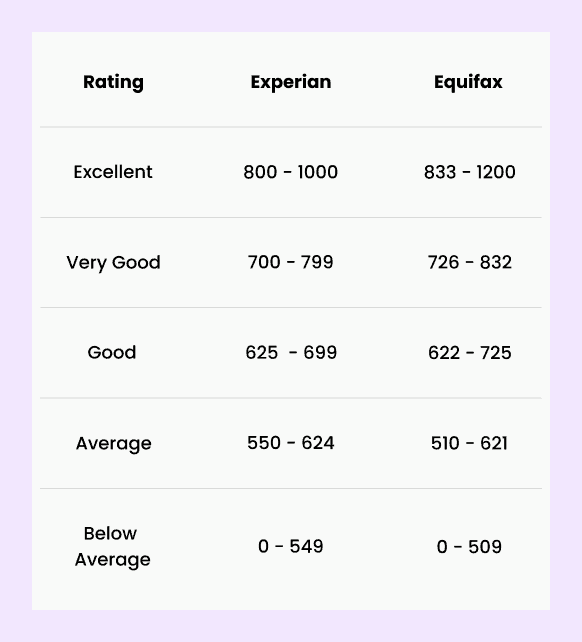

Your credit score is a numerical representation of your creditworthiness. In Australia, you have three credit scores, one from Equifax, Experian and illion. Your credit rating will fall somewhere on a scale ranging between 0 – 1,200.

Depending on your number, your score will be categorised somewhere on a 5-point scale – below average, average, good, very good and excellent.

So how does your credit score relate to home loans? If you have a below-average credit score, then it signals to lenders that you have a history of not effectively managing your debt. Therefore, you are a riskier borrower and more likely to default on your mortgage repayments.

Having a good credit score, on the other hand, shows lenders that you are responsible with your debt and, as a result, more likely to make your monthly repayments. This will provide you with a boost on your application, whereas a bad credit score, can be a setback.

What is a good credit score?

The determination of a good credit score differs between the credit reporting agencies. Here’s how Equifax and Experian categorise your credit score.

Source: Experian and Equifax

illion determines a good credit score between the range of 500 – 699.

How does your credit score influence your interest rate?

If you have an average or a below-average credit score, then a lender will assume that you are a risky borrower and more likely to default on your mortgage repayments, as opposed to someone who has a good credit score.

Not only could a bad credit score result in a lender rejecting your home loan application, but it could result in higher fees. Why is this? If you’re deemed as a riskier borrower, then a lender might try and offset this risk with higher interest rates and fees.

Therefore, if you have a good or higher credit score, then you’re deemed as a more reliable borrower and likely to be approved for a home loan with a lower interest rate.

There are many ways you can reduce the interest rate on your mortgage. This includes shopping around for the best deal you can find. If you start your search with a good credit score, then you’ve already done some of the leg work of saving yourself big time.

What credit score do I need for a home loan?

Unfortunately, there’s not one clear cut answer to the question “what credit score do I need for a home loan?”. Not only do the credit bureaus have different standards for a good credit score, but lenders also have different determinations of what a good credit score is.

Nonetheless, as MoneySmart highlights, a low credit score will affect your ability to get a loan or credit. Moreover, the options available to you will likely have worse conditions such as higher interest rates, more fees and stricter conditions.

Because of this, as a general rule of thumb – the higher your credit score, the better. You can also rely on the bureaus’ rankings, and aim for a score that is good or higher. This could put you in a much better position when applying for a home loan.

How are credit scores calculated?

If you’re thinking of getting a mortgage, then it’s a good idea to check in with your credit score and credit report and see where you’re at. You can get your credit report for free from any of the three credit bureaus. However, you’ll have to wait around 10 business days to receive the report. If you want to see your score and report within minutes, you can sign up to Tippla for no cost whatsoever.

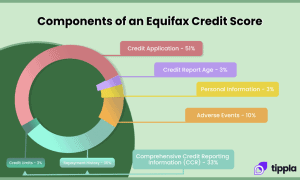

If you want to improve your credit rating or maintain a good score, then it’s important to understand how credit scores are calculated in Australia. Although the exact algorithms each of the bureaus use to calculate your score are a well-kept secret, we do know that the following factors all contribute to your score:

- The number of accounts you have;

- The types of accounts;

- The length of your credit history;

- Your payment history.

Source: Equifax

Therefore, if you want to improve or maintain your score, it is worth keeping an eye on the above items and make sure you demonstrate good credit behaviour in these areas. If you want a full breakdown, here’s an article on how to improve your credit score.

Can I apply for a home loan with a bad credit score?

The short answer is yes, you can apply for a home loan with a bad credit score. There are some lenders in Australia that specialise in lending to people with bad credit scores who can’t get approval from mainstream lenders.

However, whilst you can still get a home loan with a bad credit score, the options you’ll have will be limited and they will often come with higher interest rates. As we covered above, high interest rates can cost you.

One thing you could do if you have a bad credit score is to ask a family member with a good credit score to act as a guarantor for the loan. Another option you have is waiting a bit longer to buy a house and focus on improving your credit score first.

How to check home loan eligibility

There are many online resources that you can use to get an idea of how much you can borrow, and estimations on how much your mortgage repayments will be. MoneySmart’s mortgage calculator provides estimates on your expected interest rate, how much your mortgage repayments will be and how much you can borrow.

However, if you’re wanting to get into the property market, then you might want to reach out to a professional. A financial counsellor would be able to help you decide whether taking on a mortgage is a good idea for you financially, and a mortgage broker could guide you through the process and help you determine how much you can borrow and how expensive the whole process will be.

While we at Tippla will always do our best to provide you with the information you need to financially thrive, it’s important to note that we’re not debt counsellors, nor do we provide financial advice. Be sure to speak to your financial services professional before making any decisions.

Related articles

How Credit Scores and Credit Limits Are Determined in Australia

06/10/2023

Your credit score and credit limit are the keys...

How Long Does Bankruptcy Stay On Credit Report?

29/07/2021

There are a number of reasons why someone might...

How Are Credit Scores Calculated in Australia?

28/07/2021

There’s a lot of uncertainty when it comes to...

Checking accounts vs. Savings accounts

28/07/2021

There are a lot of similarities between checking and...

Subscribe to our newsletter

Stay up to date with Tippla's financial blog