Why Are My Credit Scores Different? Here Are 3 Reasons

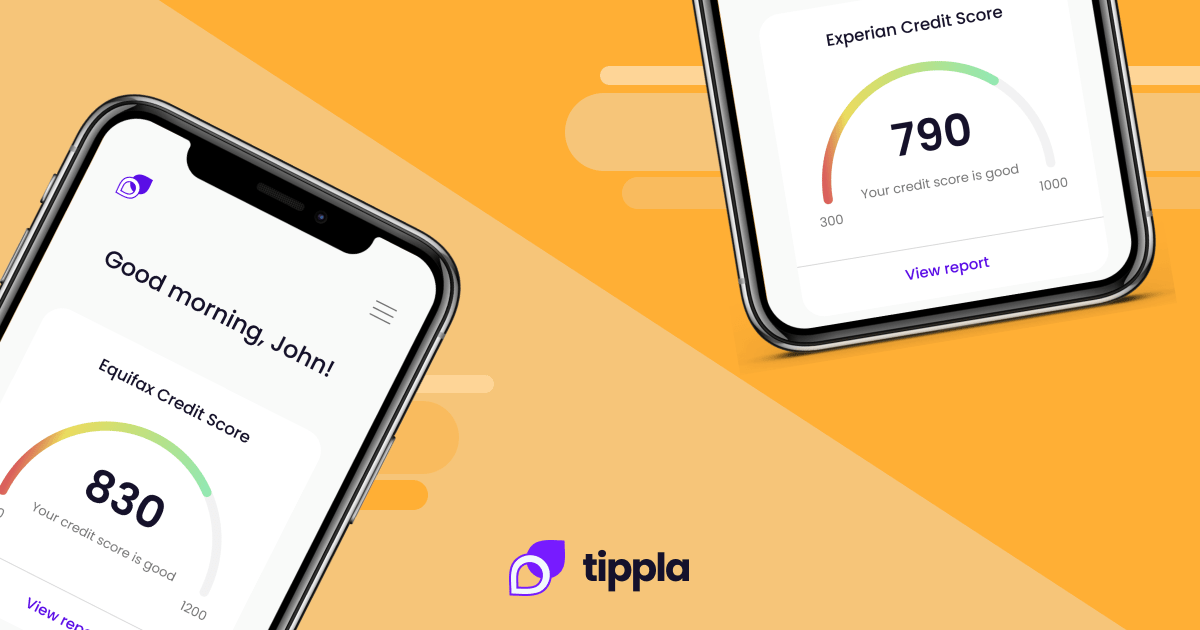

We get asked the question “why are my credit scores different” a lot here at Tippla. There’s a lot of concern that having two different scores is a bad thing, but we’re here to shine a light on why your credit ratings might be different and what it means.

What is a credit score?

A credit score is a numerical representation of your creditworthiness and how reliable of a borrower you are. Your credit score falls on a scale ranging from 0 – 1,200. Your credit score will generally fall on a five-point scale – below average, average, good, very good and excellent.

The higher your credit score, the better. This is because a high credit score indicates that you are a reliable borrower and likely to repay your debt. This is what credit providers care about the most when reviewing your application – can you pay them back?

In Australia, your credit rating is calculated by three credit reporting agencies – Equifax, Experian and illion. This means you have not one, but three credit scores in Australia. Your credit score is based on your credit report.

What goes onto your credit report? Here’s a breakdown. Your credit report outlines your credit history, including all of your credit accounts, your repayment history, any credit applications you’ve made recently, and more.

Sometimes your credit scores and credit reports might be different across the three bureaus. This isn’t necessarily a bad thing. Let’s find out why.

Why are my credit scores different?

There are three main reasons why your credit scores might be different.

Equifax, Experian and illion use different scales

As we mentioned above, your credit score is a number ranging from 0 – 1,200. However, they don’t all use the same scale. Your Equifax credit score will be a number falling somewhere between 0 – 1,200.

The higher your credit rating, the better. Your Experian and illion credit score, however, is based on a scale ranging from 0 – 1,000. Because your Equifax credit score is based on a different scale, then it’s more likely that your Equifax credit score will be different from your Experian and illion credit scores.

In addition, Equifax, Experian and illion all classify your credit scores differently. For example, a good credit score for Equifax is 622 – 725. Anything less than this is either average or below average. Experian, on the other hand, classifies 625 – 699 as a good credit score, and illion categorises a score falling between 700 – 799 as good.

They use different algorithms to calculate your credit score

As Tippla recently covered, the different credit bureaus all use different algorithms to calculate your credit score. Exactly how they do that is a well-kept secret, but we do know a few things.

Namely, Equifax, Experian and illion all place an emphasis on your repayment history. Do you make your credit repayments on time, have you ever defaulted on a repayment? This is what the credit bureaus particularly look out for.

Other things the credit bureaus look out for are:

- How many credit accounts you have;

- How many credit applications you’ve made in the past five years;

- Court judgements;

- Bankruptcies;

- Serious credit infringements.

The credit bureaus determine what counts the most towards your score, and how much weight each of these items have. This is why you might have a different score across the three bureaus.

Not all lenders and banks report to all credit bureaus

Your credit score is based on your credit history outlined in your credit reports with the three reporting agencies. Each month, credit providers such as banks, lenders and utility providers, report to the credit reporting agencies. However, they don’t necessarily report to each one.

Say you have a credit card with a bank. Each month that bank might only send information on your repayment and credit activity for the month to Equifax and not the other two bureaus. Therefore, when Equifax is calculating your score, it is considering all of the information provided to it by your bank, alongside any other information it might get from other companies you have credit accounts with.

However, because Experian and illion aren’t getting this information each month, it isn’t being factored into your score. If you have good credit behaviour, then this might not be contributing to all your credit scores. On the other side, if you have a bad credit history, it might not affect all your credit scores.

Did you know: sometimes you might only have one or two credit scores

If you have a credit history, then you’ll likely have three separate credit scores with each of the credit reporting agencies. However, this isn’t always the case. If you only have one type of credit or minimal credit activity, then you might actually not have a credit score with all three.

Think of it like this. Let’s go back to the same situation as earlier – you have a credit card with a bank. That bank only reports your credit information to Equifax. That means Experian and illion aren’t getting that credit information.

Now, say that’s the only credit you have – you’ve never taken out a loan, and you don’t have any utilities in your name. Besides this credit card, you don’t have any credit information, and Experian and illion aren’t getting that information. To these two credit reporting agencies – you don’t have any credit history.

Your credit report would be blank and, therefore, you don’t have a credit score. This is why sometimes you can have a credit score with one of the reporting agencies, but not with all three.

Why are my credit scores different?

To sum this up, there are three main reasons why your credit score might be different across Equifax, Experian and illion. These are:

- Equifax uses a different scale than Experian and illion;

- They all use different algorithms to calculate your score;

- Not all credit providers report your information to all three credit reporting agencies.

Whilst these are the three main reasons why your credit scores are different across the three agencies, that doesn’t mean they are the only reason. Another reason, and one you should really look out for, is mistakes on your credit report.

1 in 5 credit reports has some kind of mistake on them. This could include the wrong address, incorrect or outdated personal information, or sometimes it could be a larger mistake such as a credit account that you don’t actually have. Mistakes can harm your credit score, so it’s important to check your report frequently to make sure all of the information is up to date and correct.